- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Assessing Ambarella (AMBA) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Ambarella (AMBA) shares climbed nearly 5% in the last trading session, catching attention as investors responded to fresh momentum in the stock. Performance over the past month remains under pressure. However, recent gains are drawing renewed interest in its valuation.

See our latest analysis for Ambarella.

Even with the recent jump to $83.45 per share, Ambarella’s 1-year total shareholder return stands at an impressive 45.61%. This easily outpaces the broad market and suggests momentum is picking up after a patchy stretch earlier this year. Gains over the past 90 days have helped revive sentiment, and investors are starting to reconsider Ambarella's valuation in light of its stronger long-term track record.

If Ambarella's rebound has you looking for the next opportunity, broaden your watchlist and discover fast growing stocks with high insider ownership

With Ambarella’s shares rebounding and long-term returns far outpacing the market, the key question now is whether there is still value to unlock in the stock or if the market has already priced in all future growth.

Most Popular Narrative: 11% Undervalued

Ambarella's fair value, according to the most widely followed narrative, stands at $93.73 compared to the last close of $83.45. This assessment points to untapped upside as a result of several powerful structural drivers and bullish analyst upgrades.

Sharply increasing demand for AI-powered edge devices including portable video, robotics (notably aerial drones), and edge infrastructure has led to a rapid expansion of Ambarella's addressable markets. This is evidenced by record edge AI revenue and multiple recent, diversified design wins. The trend is catalyzing strong, sustained revenue growth and positions Ambarella to benefit further as additional vertical applications for edge AI proliferate.

Want to see the case behind this valuation? Deep within this narrative are bold calls on margin expansion and revenue surges that might surprise you. Wondering what core metrics underpin these projections? Find out what transforms expectations into such a high fair value.

Result: Fair Value of $93.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future returns could be challenged if Ambarella’s IoT segment softens or if margin pressures from rising costs exceed revenue growth.

Find out about the key risks to this Ambarella narrative.

Another View: Price Tag Risks Loom Large

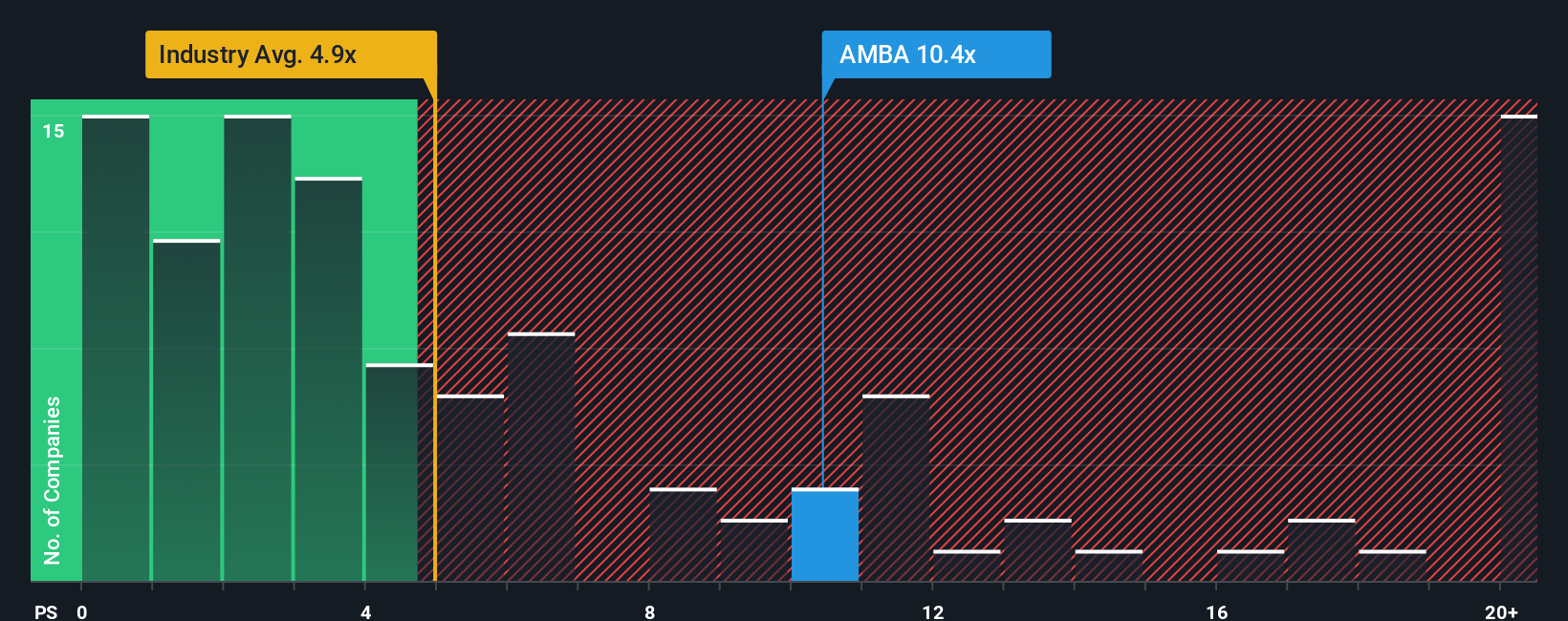

While analyst narratives suggest Ambarella is undervalued, a look at its price-to-sales ratio tells a different story. The stock trades at 10.2 times sales, which is double the US semiconductor industry average of 5.1 and well above its fair ratio of 5.6. This premium could add valuation risk, especially if growth expectations slip. Could enthusiasm be stretching the price too far beyond fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambarella Narrative

If you prefer independent analysis or want to chart your own take, you can build a custom valuation story yourself in just a few minutes, Do it your way

A great starting point for your Ambarella research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the curve by uncovering handpicked stocks that match your interests. Don’t miss a potential gem while waiting for the next move in Ambarella.

- Explore opportunities in cutting-edge medicine by checking out these 33 healthcare AI stocks which is driving innovations in healthcare and transforming patient care.

- Enhance your income strategy with these 17 dividend stocks with yields > 3% offering attractive yields and a consistent record of steady payouts.

- Spot trends early by targeting these 3573 penny stocks with strong financials that are positioned for growth and supported by robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)