- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Ambarella, Inc. (NASDAQ:AMBA) Analysts Are Reducing Their Forecasts For Next Year

One thing we could say about the analysts on Ambarella, Inc. (NASDAQ:AMBA) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business. The stock price has risen 7.1% to US$74.05 over the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

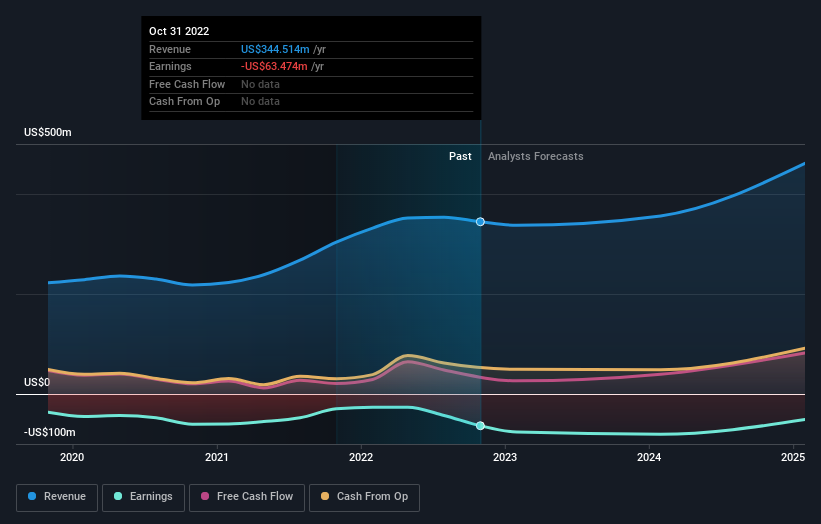

Following the downgrade, the latest consensus from Ambarella's 19 analysts is for revenues of US$356m in 2024, which would reflect a reasonable 3.4% improvement in sales compared to the last 12 months. Per-share losses are expected to explode, reaching US$1.99 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$406m and losses of US$1.17 per share in 2024. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Our analysis indicates that AMBA is potentially overvalued!

The consensus price target fell 8.2% to US$94.38, implicitly signalling that lower earnings per share are a leading indicator for Ambarella's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Ambarella analyst has a price target of US$150 per share, while the most pessimistic values it at US$60.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Ambarella's revenue growth is expected to slow, with the forecast 2.7% annualised growth rate until the end of 2024 being well below the historical 4.6% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 6.9% annually. Factoring in the forecast slowdown in growth, it seems obvious that Ambarella is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for next year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Ambarella's revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Ambarella.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Ambarella going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable high-definition (HD) and ultra HD compression, image signal processing, and artificial intelligence processing worldwide.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives