- United States

- /

- Software

- /

- NasdaqGS:PEGA

3 US Stocks Estimated To Trade At Discounts Of Up To 46.9%

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape, with the S&P 500 and Dow Jones Industrial Average recently snapping their six-week winning streaks, investors are keenly observing economic data and earnings reports for signs of stability. In such an environment, identifying undervalued stocks can present opportunities for investors seeking potential value plays amidst fluctuating indices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlanticus Holdings (NasdaqGS:ATLC) | $36.44 | $72.49 | 49.7% |

| California Resources (NYSE:CRC) | $52.44 | $103.84 | 49.5% |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $28.26 | $55.88 | 49.4% |

| DiDi Global (OTCPK:DIDI.Y) | $4.80 | $9.45 | 49.2% |

| HealthEquity (NasdaqGS:HQY) | $88.07 | $175.93 | 49.9% |

| UFP Technologies (NasdaqCM:UFPT) | $275.20 | $537.30 | 48.8% |

| Vitesse Energy (NYSE:VTS) | $25.09 | $49.19 | 49% |

| Reddit (NYSE:RDDT) | $81.36 | $161.23 | 49.5% |

| Snap (NYSE:SNAP) | $10.45 | $20.65 | 49.4% |

| Nabors Industries (NYSE:NBR) | $75.62 | $149.50 | 49.4% |

Let's uncover some gems from our specialized screener.

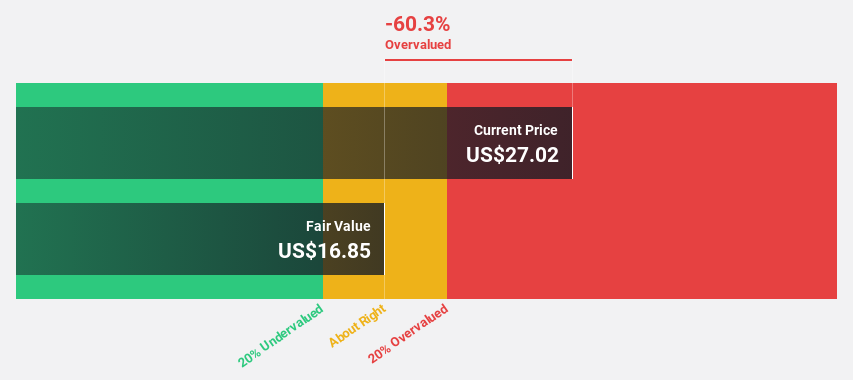

Allegro MicroSystems (NasdaqGS:ALGM)

Overview: Allegro MicroSystems, Inc. designs, develops, manufactures, and markets sensor integrated circuits and application-specific analog power ICs for motion control and energy-efficient systems with a market cap of approximately $5.04 billion.

Operations: The company's revenue primarily comes from the design, development, production, and distribution of various integrated circuits, amounting to $937.99 million.

Estimated Discount To Fair Value: 16.3%

Allegro MicroSystems is trading at US$23.04, below its estimated fair value of US$27.52, suggesting it may be undervalued based on cash flows. Despite a drop in profit margins and removal from the PHLX Semiconductor Sector Index, the company forecasts significant earnings growth of 42.3% annually over the next three years and completed a substantial share buyback worth $853.46 million (20% of shares), which could enhance shareholder value amidst current challenges.

- According our earnings growth report, there's an indication that Allegro MicroSystems might be ready to expand.

- Navigate through the intricacies of Allegro MicroSystems with our comprehensive financial health report here.

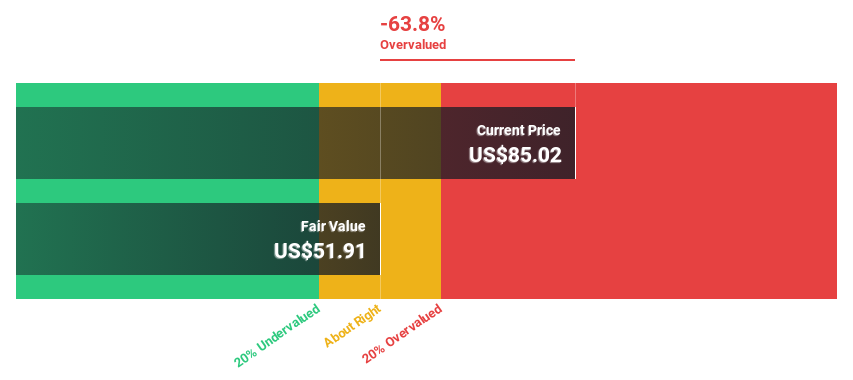

Pegasystems (NasdaqGS:PEGA)

Overview: Pegasystems Inc. is a global enterprise software company that develops, markets, licenses, hosts, and supports its products across various regions including the Americas, Europe, the Middle East, Africa, and Asia-Pacific with a market cap of $6.86 billion.

Operations: The company's revenue segment is primarily from Software & Programming, amounting to $1.48 billion.

Estimated Discount To Fair Value: 42.7%

Pegasystems, trading at US$80.03, is valued below its estimated fair value of US$139.64, indicating potential undervaluation based on cash flows. Despite a recent increase in net loss to US$14.39 million for Q3 2024 and ongoing legal challenges, Pegasystems forecasts substantial earnings growth of 23.9% annually over the next three years. The company continues share buybacks and strategic cloud expansion under new leadership to drive future performance improvements amidst these hurdles.

- Insights from our recent growth report point to a promising forecast for Pegasystems' business outlook.

- Take a closer look at Pegasystems' balance sheet health here in our report.

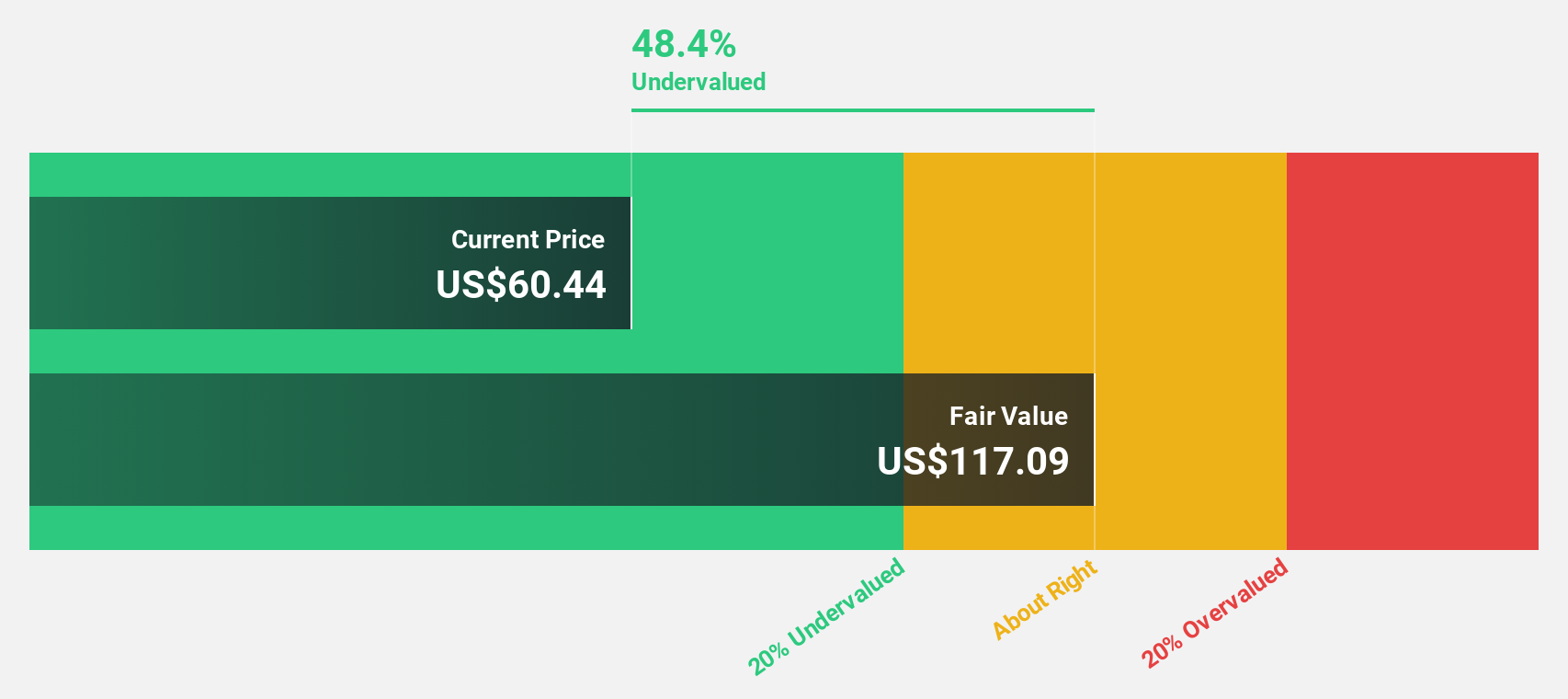

EQT (NYSE:EQT)

Overview: EQT Corporation is a natural gas production company in the United States with a market cap of $22.26 billion.

Operations: The company generates revenue from its Oil & Gas - Integrated segment, amounting to $4.43 billion.

Estimated Discount To Fair Value: 46.9%

EQT, trading at US$37.48, is significantly undervalued against its fair value estimate of US$70.63, suggesting substantial potential based on cash flows. Despite a decline in profit margins from 40.1% to 15.7%, EQT's earnings are expected to grow significantly by 36.4% annually over the next three years, outpacing the US market average growth rate of 15.1%. Recent strategic initiatives include advancing clean hydrogen and low carbon aviation fuel projects with initial funding commitments from the U.S Department of Energy.

- Our expertly prepared growth report on EQT implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on EQT's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 187 more companies for you to explore.Click here to unveil our expertly curated list of 190 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives