- United States

- /

- Capital Markets

- /

- NYSE:BRDG

US Growth Companies With High Insider Ownership Boasting 70% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market attempts to rebound from a recent Fed-induced downturn, investors are closely monitoring growth companies with strong insider ownership, which can indicate confidence in their future potential. In this environment, stocks that demonstrate significant earnings growth alongside high insider stakes may present compelling opportunities for those looking to navigate market volatility effectively.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Loop Industries (NasdaqGM:LOOP) | 33% | 65.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

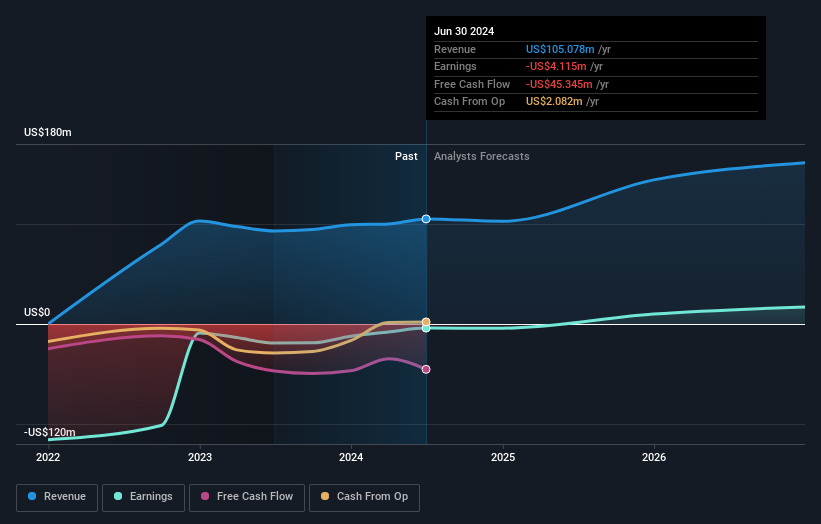

Arq (NasdaqGM:ARQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arq, Inc. is a North American company that produces activated carbon products and has a market cap of $294.64 million.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to $110.02 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 66.1% p.a.

Arq has demonstrated strong insider confidence with substantial insider buying over the past three months and no significant selling. The company is forecast to grow its revenue faster than the US market, at 18.4% per year, and is expected to become profitable within three years. Recent earnings reports show a turnaround, with net income of US$1.62 million in Q3 2024 compared to a loss last year, despite shareholder dilution from a recent equity offering of US$25 million.

- Unlock comprehensive insights into our analysis of Arq stock in this growth report.

- The valuation report we've compiled suggests that Arq's current price could be inflated.

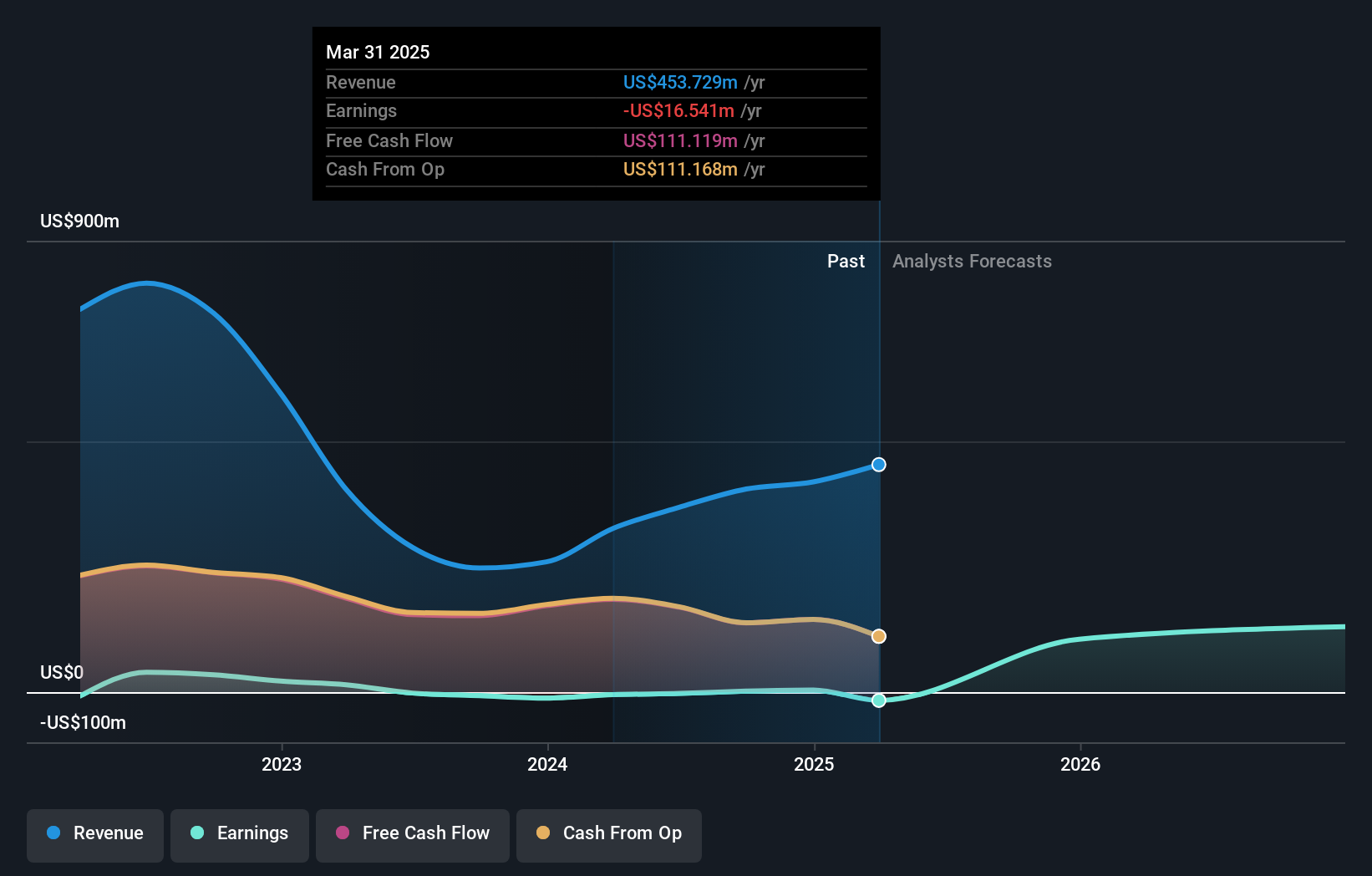

Astera Labs (NasdaqGS:ALAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure, with a market cap of $20.29 billion.

Operations: The company generates revenue of $305.71 million from its semiconductor-based connectivity solutions segment.

Insider Ownership: 16.1%

Earnings Growth Forecast: 70.2% p.a.

Astera Labs has shown significant revenue growth, with a 186.4% increase over the past year, and is expected to continue growing at 32.5% annually, outpacing the US market. Despite high volatility in share price and substantial insider selling recently, insiders have bought more shares than sold in the last quarter. The company anticipates becoming profitable within three years and recently expanded its product line with innovative AI-focused solutions like the Scorpio Smart Fabric Switch portfolio.

- Dive into the specifics of Astera Labs here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Astera Labs shares in the market.

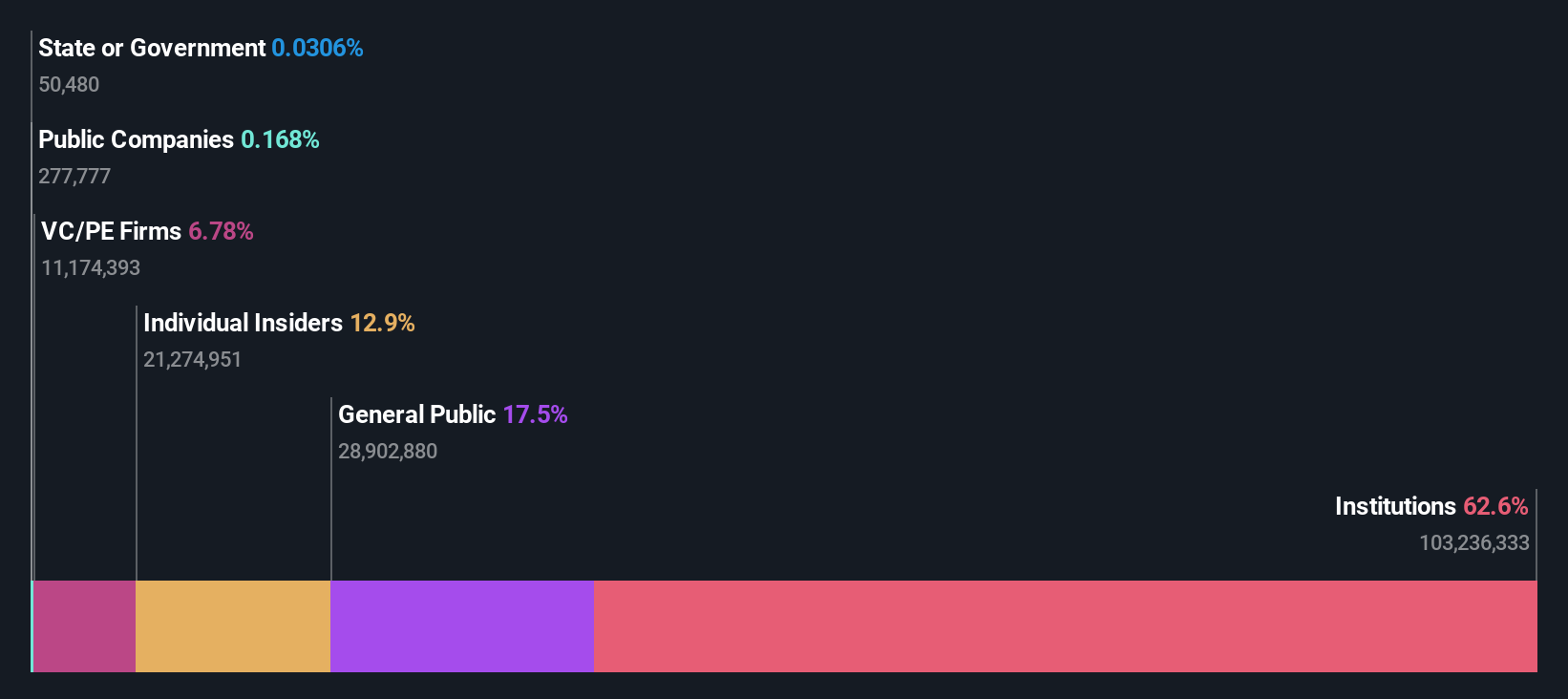

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector within the United States, with a market capitalization of approximately $1.08 billion.

Operations: The company generates revenue of $404.93 million as a fully integrated real estate investment manager in the United States.

Insider Ownership: 11.3%

Earnings Growth Forecast: 51.4% p.a.

Bridge Investment Group Holdings has demonstrated strong earnings growth, with net income rising to US$29.62 million for the first nine months of 2024, compared to a loss last year. Despite high debt levels and shareholder dilution, its earnings are forecasted to grow significantly at 51.4% annually, surpassing the US market average. Revenue is also expected to grow faster than the market rate but remains below 20% per year. The company recently engaged in affordable housing initiatives with Ethos Real Estate.

- Take a closer look at Bridge Investment Group Holdings' potential here in our earnings growth report.

- The analysis detailed in our Bridge Investment Group Holdings valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Navigate through the entire inventory of 200 Fast Growing US Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRDG

Bridge Investment Group Holdings

Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager..

High growth potential slight.