- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB) Valuation Check After AI Connectivity Wins, Revenue Beat, and Upgraded Analyst Outlook

Reviewed by Simply Wall St

Astera Labs (ALAB) just doubled down on its AI data center ambitions by rolling out plans for custom connectivity solutions on top of its NVLink Fusion work with Nvidia and the aiXscale photonics acquisition.

See our latest analysis for Astera Labs.

That backdrop helps explain why the stock has been volatile lately: despite a sharp 1 day share price return of minus 14.31% and a 90 day share price return of minus 35.14%, the year to date share price return is still positive, and the 1 year total shareholder return of 12.65% suggests long term momentum is holding up as investors weigh near term AI sentiment against Astera Labs latest wins in data center connectivity.

If you are watching how AI infrastructure names are repricing after big news swings like this, it is a good moment to explore other high growth tech ideas with high growth tech and AI stocks.

With revenue more than doubling, analysts lifting price targets, and new custom connectivity bets on NVLink and photonics, is Astera Labs quietly trading at a discount, or is the market already paying up for all that future AI growth?

Most Popular Narrative Narrative: 24.9% Undervalued

Compared with the last close at $148.85, the most widely followed narrative places Astera Labs fair value materially higher, framing a sizable upside debate.

Strong early engagement with hyperscalers and AI platform providers on open, interoperable standards like UALink (which are still in the early adoption phase with projected ramp in 2027 and beyond) enables Astera Labs to capture the industry's shift toward open, multi-vendor AI Infrastructure 2.0, ensuring exposure to significant long-term market expansion and incrementally larger addressable markets, positively impacting revenue growth rates and future margin potential as adoption accelerates.

Want to see how this growth story turns into a specific valuation target? The narrative leans on aggressive revenue expansion and rising margins to justify that upside. Curious which assumptions really move the model? Read on to uncover the numbers behind that conviction.

Result: Fair Value of $198.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI capex slowdown or faster hyperscaler adoption of integrated alternatives could undermine Astera Labs projected growth and compress multiples despite today’s perceived discount.

Find out about the key risks to this Astera Labs narrative.

Another Take on Valuation

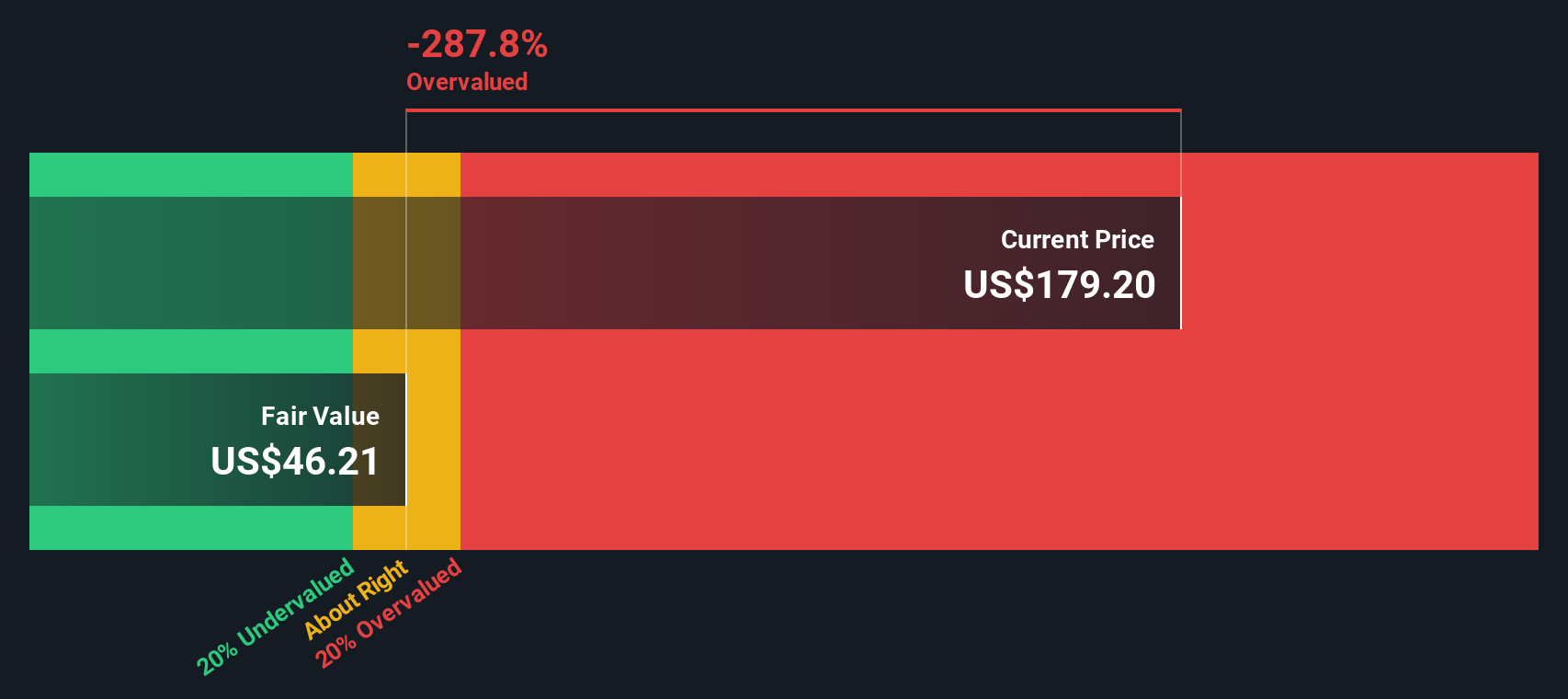

Our DCF model paints a different picture, suggesting Astera Labs is actually overvalued at around $148.85 versus an estimated fair value near $119.60. If growth or margins fail to meet the ambitious narrative, today’s optimism could turn into downside risk.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Astera Labs Narrative

If you see the numbers differently or want to stress test your own thesis using the same data, you can build a personalized view in just a few minutes, Do it your way.

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single AI opportunity, use the Simply Wall Street Screener to uncover fresh stocks that match your strategy before the market catches on.

- Capture potential multi-bagger upside by scanning these 3606 penny stocks with strong financials that already show the financial strength many speculative names lack.

- Target the next wave of innovation in automation and machine learning through these 26 AI penny stocks that are shaping the future of digital infrastructure.

- Explore value-focused opportunities by reviewing these 907 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)