- United States

- /

- IT

- /

- NYSE:NET

3 Growth Companies With Insider Ownership Up To 15%

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight downturn, with major indices like the S&P 500 and Nasdaq Composite closing lower amid concerns about economic policies and inflation, investors are keeping a close eye on companies that can still offer growth potential. In this fluctuating environment, stocks with high insider ownership often attract attention due to their alignment of interests between company insiders and shareholders, suggesting confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Coastal Financial (NasdaqGS:CCB) | 14.5% | 46.3% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's uncover some gems from our specialized screener.

Celsius Holdings (NasdaqCM:CELH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Celsius Holdings, Inc. is involved in the development, manufacturing, marketing, and distribution of functional energy drinks across the United States and internationally, with a market cap of approximately $7.50 billion.

Operations: The company's revenue segment primarily consists of non-alcoholic beverages, generating approximately $1.36 billion.

Insider Ownership: 14.5%

Celsius Holdings is experiencing significant growth opportunities in the functional beverage sector, bolstered by the appointment of Eric Hanson as President and COO. Despite a recent decline in profit margins, the company forecasts robust earnings growth of 25.1% annually, outpacing market expectations. Revenue is also expected to grow faster than the US market at 15.2% per year. The company's share price has been highly volatile recently, with more insider purchases than sales but not in substantial volumes.

- Dive into the specifics of Celsius Holdings here with our thorough growth forecast report.

- Our expertly prepared valuation report Celsius Holdings implies its share price may be too high.

Astera Labs (NasdaqGS:ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $11.17 billion.

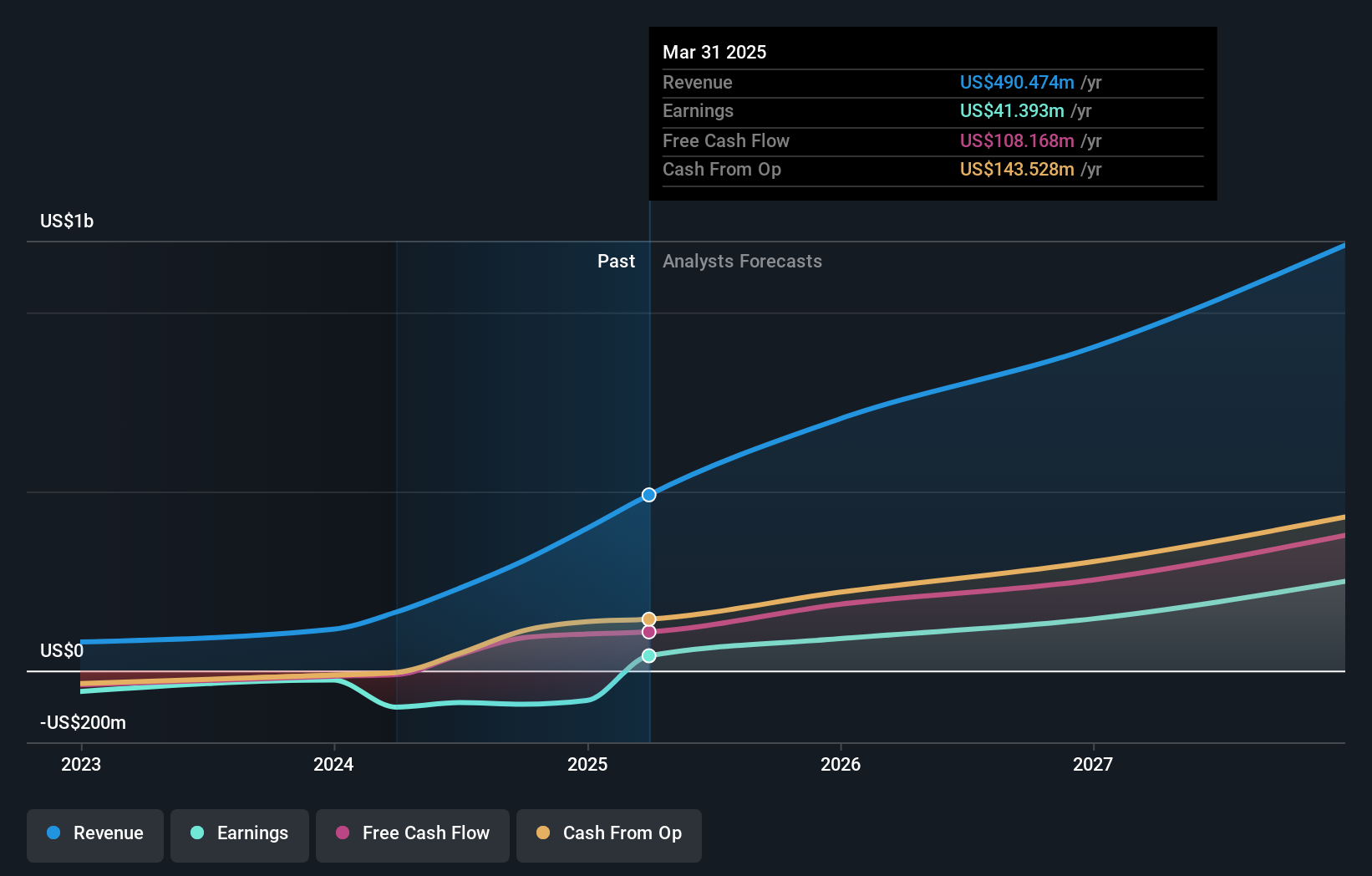

Operations: The company generates revenue from its semiconductor segment, which amounts to $396.29 million.

Insider Ownership: 15.9%

Astera Labs is poised for significant growth, with revenue expected to increase by 24.8% annually, outpacing the US market. Recent product announcements enhance its position in AI and cloud infrastructure, leveraging PCIe 6 technology for improved performance and efficiency. Despite a volatile share price and no substantial insider buying recently, insiders have bought more shares than sold in the past quarter. The company trades below its estimated fair value and aims to achieve profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Astera Labs.

- Our valuation report here indicates Astera Labs may be overvalued.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $40.55 billion.

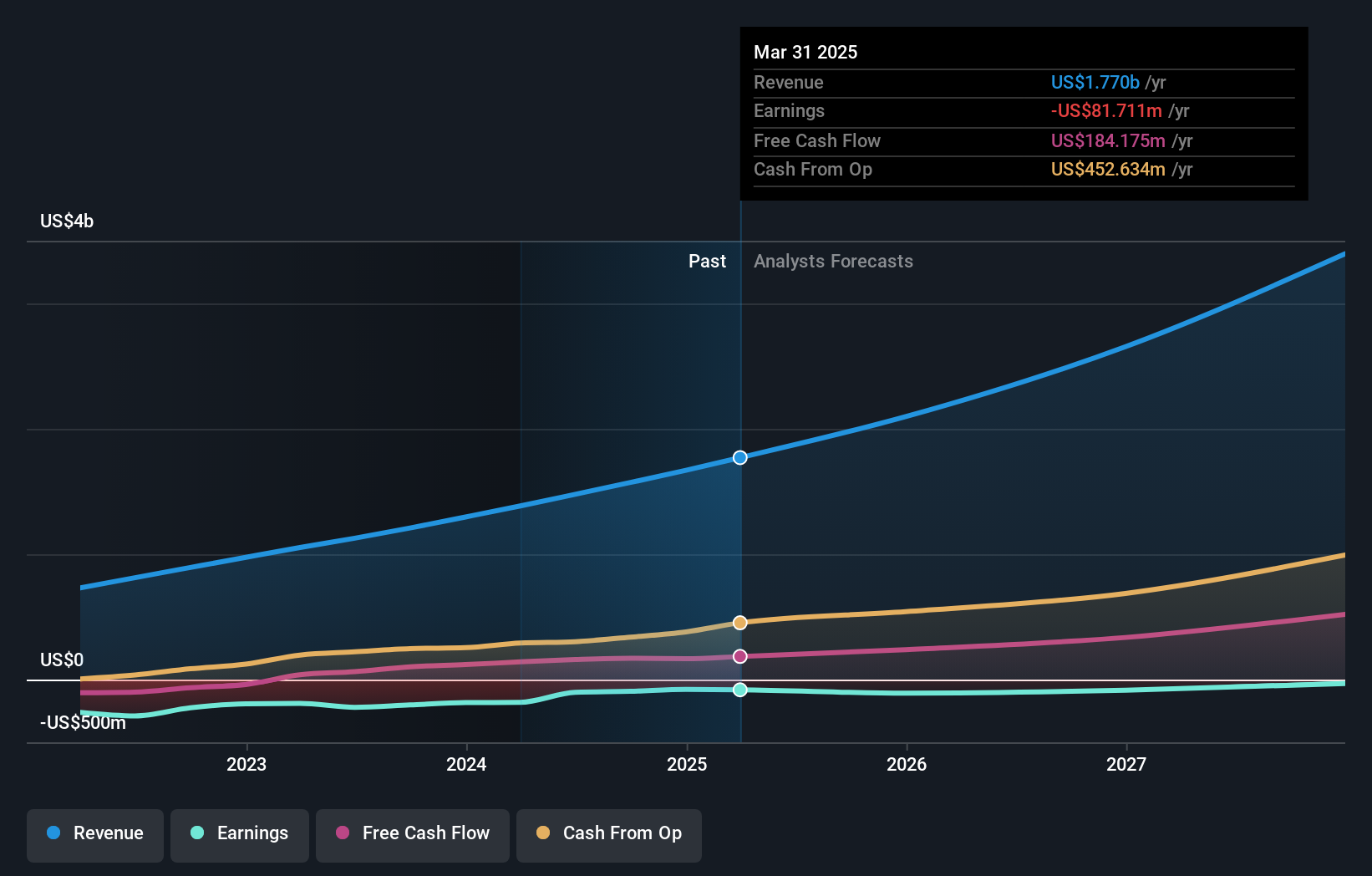

Operations: Cloudflare generates revenue through its Internet Telephone segment, which reported earnings of $1.67 billion.

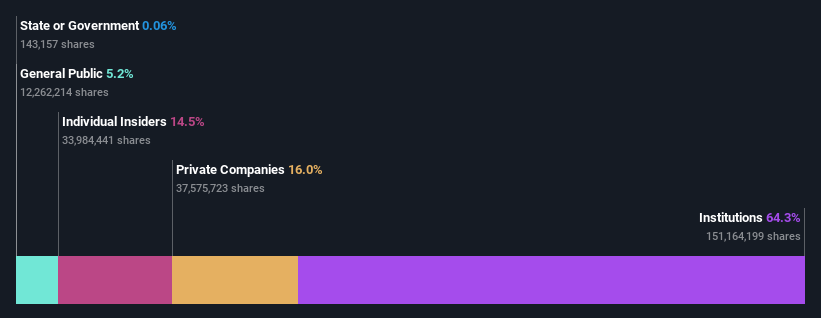

Insider Ownership: 10.9%

Cloudflare's growth prospects are strong, with revenue expected to grow at 18.8% annually, surpassing the US market average. Recent product launches like Cloudforce One and Security Posture Management enhance its cybersecurity offerings, positioning it well in a rapidly evolving threat landscape. Despite significant insider selling over the past quarter, no substantial buying was observed. The company aims for profitability within three years and has expanded support for post-quantum cryptography to bolster security measures further.

- Get an in-depth perspective on Cloudflare's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Cloudflare's current price could be inflated.

Make It Happen

- Embark on your investment journey to our 205 Fast Growing US Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives