- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Spotlighting Three Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it remains up by 9.1% over the past year with earnings forecasted to grow by 14% annually. In this fluctuating environment, stocks with high insider ownership can signal strong confidence from those closest to the company's operations, making them intriguing considerations for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.3% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 102.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

Let's review some notable picks from our screened stocks.

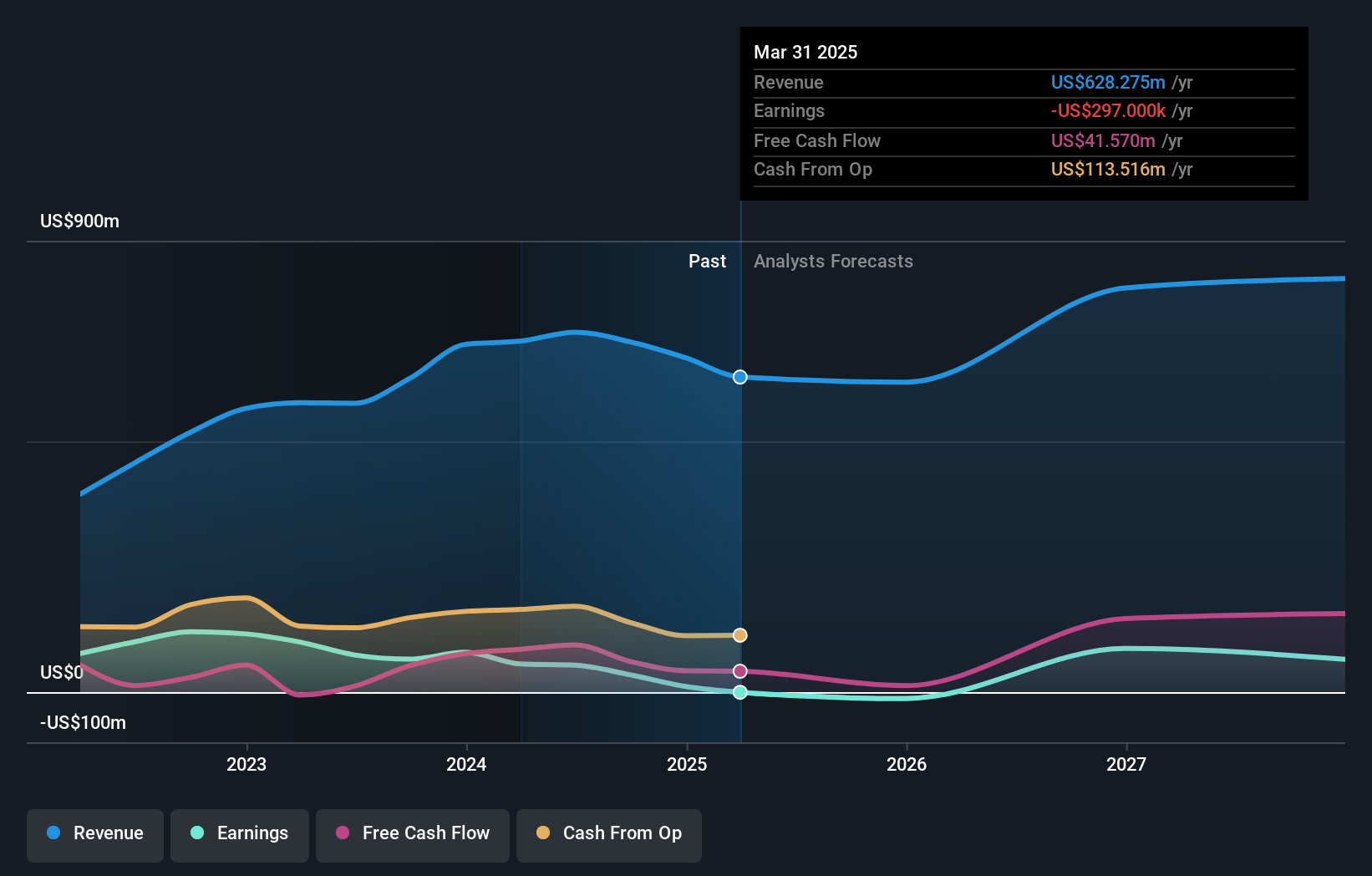

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. is involved in the development, operation, and sale of metallurgical coal with a market cap of $487.21 million.

Operations: The company generates revenue of $628.28 million from its metals and mining segment, specifically through the sale of metallurgical coal.

Insider Ownership: 10.8%

Earnings Growth Forecast: 78.5% p.a.

Ramaco Resources is expected to become profitable within three years, with earnings forecasted to grow significantly at 78.47% per year. Despite trading well below its estimated fair value, the stock has experienced high volatility recently. Revenue growth is projected at 11.7% annually, surpassing the US market average but not reaching 20%. Recent strategic hires and board appointments aim to bolster its rare earth mineral operations in Wyoming, enhancing long-term growth potential amidst current financial challenges.

- Dive into the specifics of Ramaco Resources here with our thorough growth forecast report.

- Our valuation report unveils the possibility Ramaco Resources' shares may be trading at a discount.

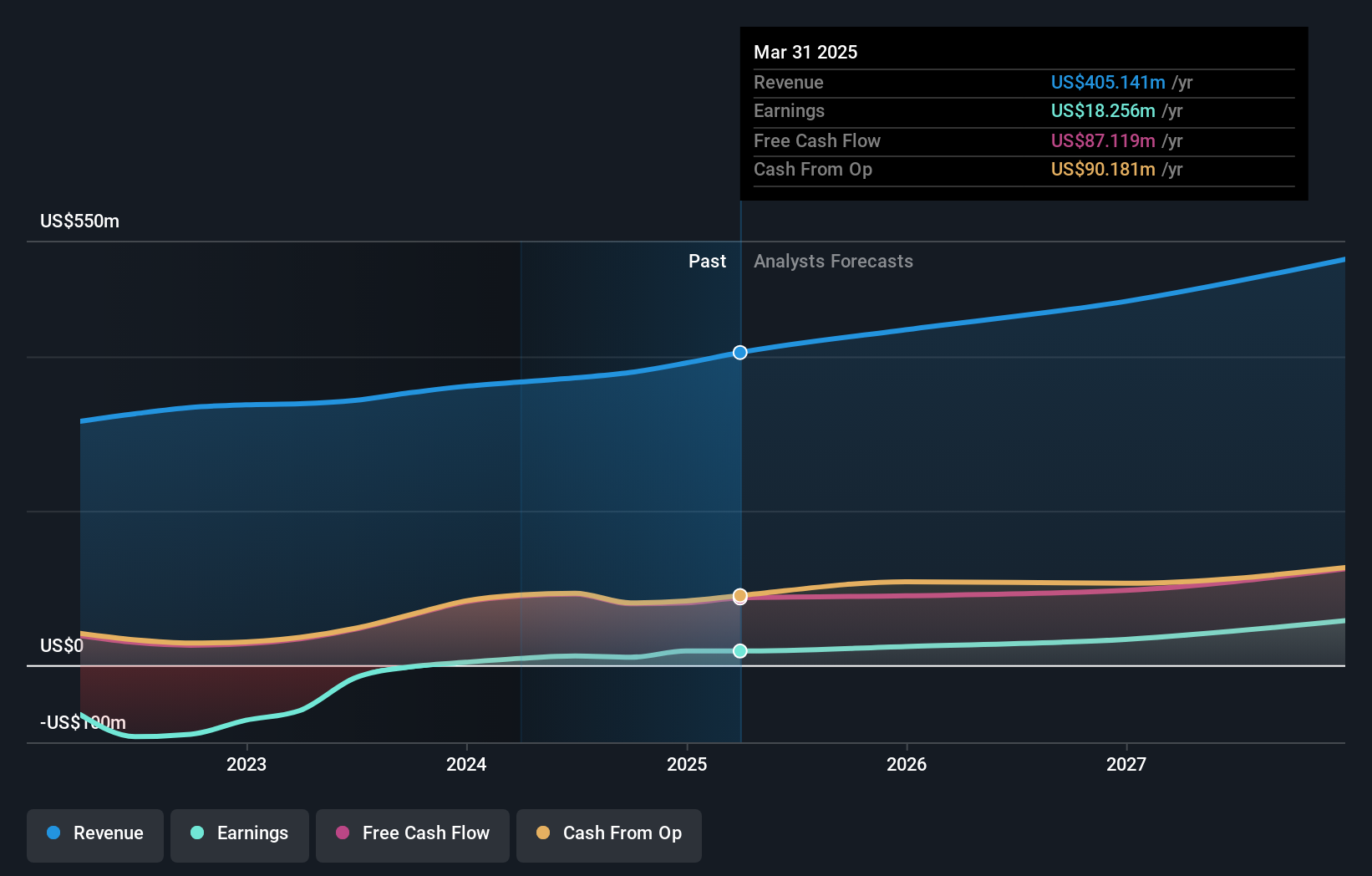

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $1.21 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $405.14 million.

Insider Ownership: 13.5%

Earnings Growth Forecast: 38.4% p.a.

Fiverr International is experiencing robust earnings growth, projected at 38.4% annually, outpacing the US market's average. Despite a slower revenue growth forecast of 9.1%, it exceeds the broader market rate and benefits from high insider ownership, aligning leadership interests with shareholders. The company recently raised its revenue guidance for 2025 to US$425 million-US$438 million, reflecting confidence in performance. Additionally, a US$100 million share repurchase program highlights management's commitment to enhancing shareholder value.

- Get an in-depth perspective on Fiverr International's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Fiverr International's share price might be too optimistic.

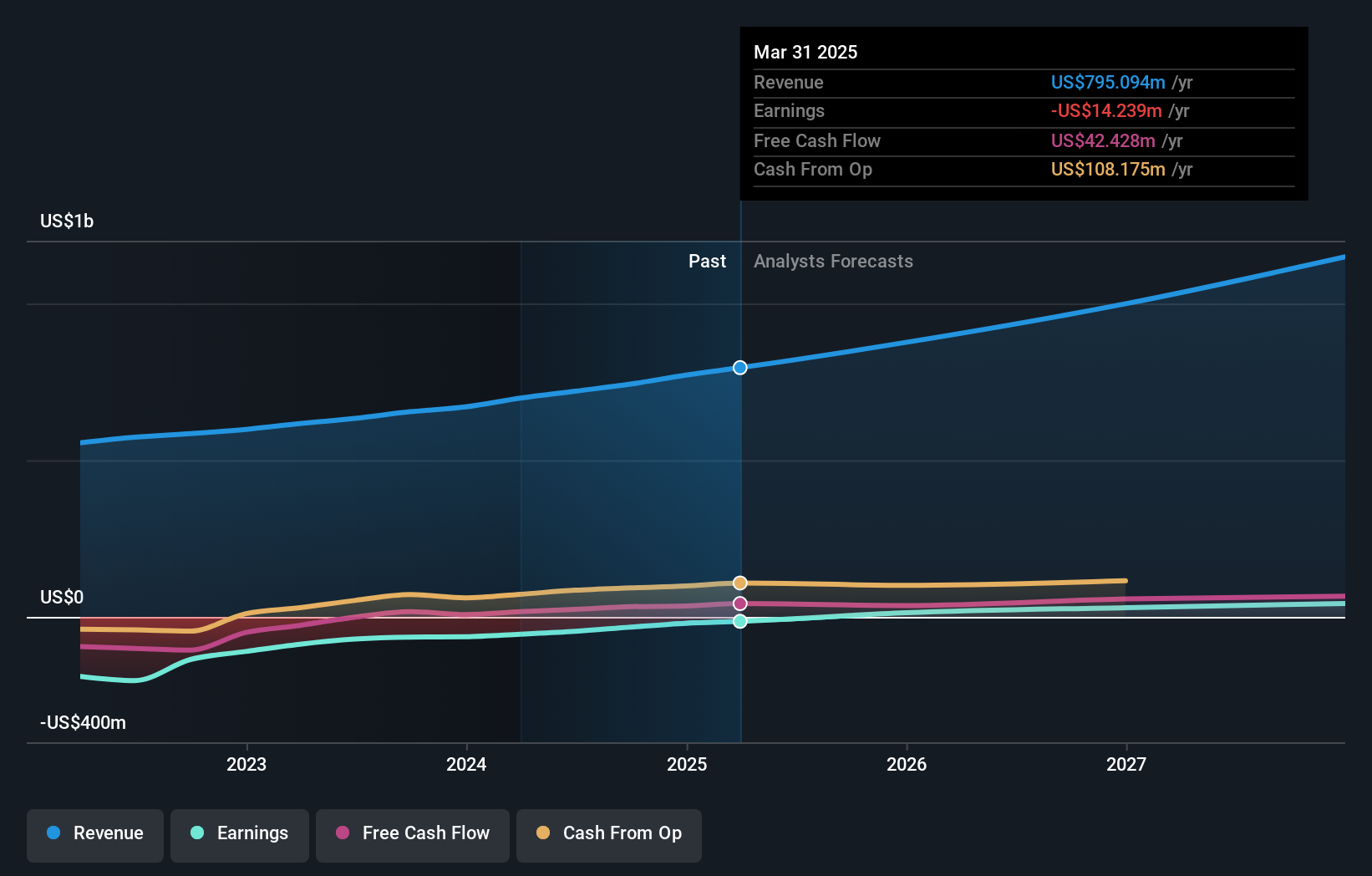

Warby Parker (NYSE:WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products, with a market capitalization of approximately $2.41 billion.

Operations: The company's revenue is primarily derived from its Medical - Optical Supplies segment, totaling $795.09 million.

Insider Ownership: 16.9%

Earnings Growth Forecast: 88.4% p.a.

Warby Parker's strategic partnership with Google to develop AI-powered glasses marks a significant step in innovation, supported by Google's US$75 million commitment for product development. Despite recent insider selling, the company is trading 14.1% below estimated fair value and has shown strong revenue growth of 24.7% annually over five years. While earnings are expected to grow significantly at 88.39% annually, the stock remains volatile with a forecasted return on equity of only 11.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Warby Parker.

- Our comprehensive valuation report raises the possibility that Warby Parker is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 193 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives