- United States

- /

- Machinery

- /

- NYSE:REVG

Freshpet And 2 Other Stocks That Might Be Priced Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause following a nine-session winning streak, investors are closely watching developments around tariffs and Federal Reserve decisions, which have introduced uncertainty into economic forecasts. In this environment, identifying stocks that might be priced below their fair value can offer potential opportunities for investors seeking to navigate the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| FB Financial (NYSE:FBK) | $44.62 | $89.12 | 49.9% |

| MINISO Group Holding (NYSE:MNSO) | $18.53 | $36.62 | 49.4% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.33 | $55.11 | 48.6% |

| Owens Corning (NYSE:OC) | $144.46 | $284.31 | 49.2% |

| German American Bancorp (NasdaqGS:GABC) | $38.57 | $74.67 | 48.3% |

| Pure Storage (NYSE:PSTG) | $47.58 | $93.52 | 49.1% |

| Ready Capital (NYSE:RC) | $4.44 | $8.67 | 48.8% |

| HealthEquity (NasdaqGS:HQY) | $91.42 | $179.14 | 49% |

| Live Oak Bancshares (NYSE:LOB) | $26.93 | $52.48 | 48.7% |

| Coeur Mining (NYSE:CDE) | $5.45 | $10.87 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Freshpet (NasdaqGM:FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe with a market cap of approximately $3.72 billion.

Operations: Freshpet generates revenue through the production and sale of natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe.

Estimated Discount To Fair Value: 13.9%

Freshpet's recent earnings report showed a net loss of US$12.7 million for Q1 2025, contrasting with a net income of US$18.6 million the previous year, yet it remains undervalued based on discounted cash flow analysis. Trading at US$79.09, below its fair value estimate of US$91.81, Freshpet is expected to see significant annual profit growth of 36.5% over the next three years despite slower revenue growth projections compared to market expectations.

- Insights from our recent growth report point to a promising forecast for Freshpet's business outlook.

- Click to explore a detailed breakdown of our findings in Freshpet's balance sheet health report.

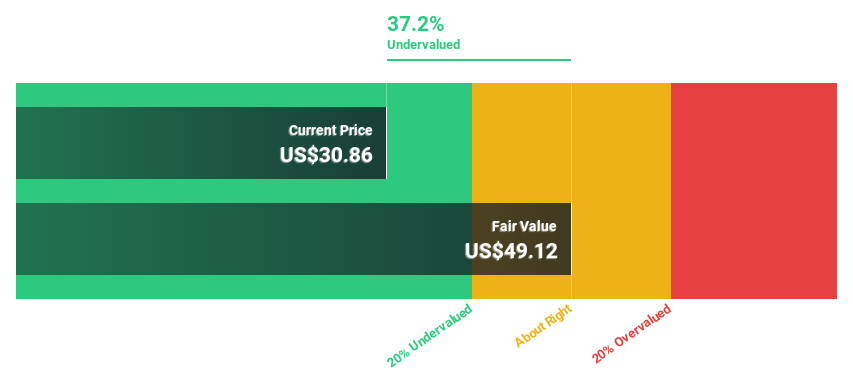

REV Group (NYSE:REVG)

Overview: REV Group, Inc. designs, manufactures, and distributes specialty vehicles and related aftermarket parts and services in North America and internationally, with a market cap of approximately $1.81 billion.

Operations: The company's revenue segments include Specialty Vehicles, generating $1.68 billion, and Recreational Vehicles, contributing $640.20 million.

Estimated Discount To Fair Value: 27.3%

REV Group is trading at US$35.64, significantly below its estimated fair value of US$48.99, indicating undervaluation based on discounted cash flow analysis. Despite a decrease in first-quarter sales to US$525.1 million and net income dropping to US$18.2 million, earnings are projected to grow substantially by 23.76% annually over the next three years, outpacing the broader U.S. market's growth expectations while maintaining strong operational execution and shareholder returns through dividends and buybacks.

- Upon reviewing our latest growth report, REV Group's projected financial performance appears quite optimistic.

- Get an in-depth perspective on REV Group's balance sheet by reading our health report here.

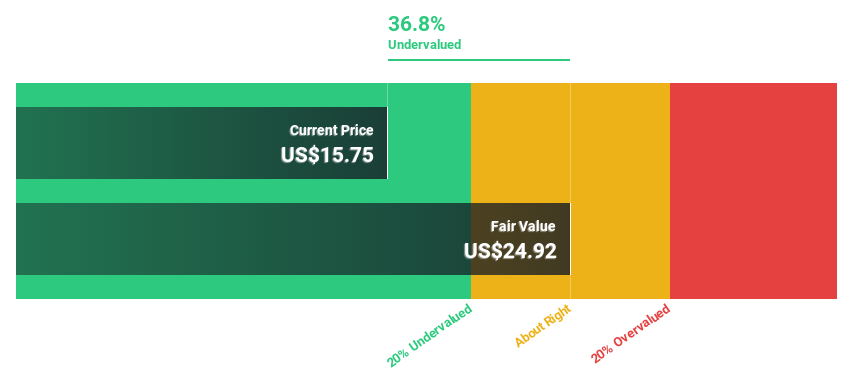

Warby Parker (NYSE:WRBY)

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products, with a market capitalization of approximately $2.05 billion.

Operations: The company's revenue is primarily derived from its Medical - Optical Supplies segment, totaling $771.32 million.

Estimated Discount To Fair Value: 28.9%

Warby Parker, trading at US$16.96, is significantly undervalued with a fair value estimate of US$23.87 according to discounted cash flow analysis. Despite a net loss reduction to US$20.39 million for 2024, the company anticipates robust revenue growth between 14% and 16% in 2025, bolstered by strategic partnerships like the Target collaboration. Earnings are projected to grow substantially by 76.4% annually over three years as profitability improves beyond market averages.

- The growth report we've compiled suggests that Warby Parker's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Warby Parker.

Seize The Opportunity

- Unlock our comprehensive list of 176 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives