- United States

- /

- Specialty Stores

- /

- NYSE:W

Why Investors Shouldn't Be Surprised By Wayfair Inc.'s (NYSE:W) P/S

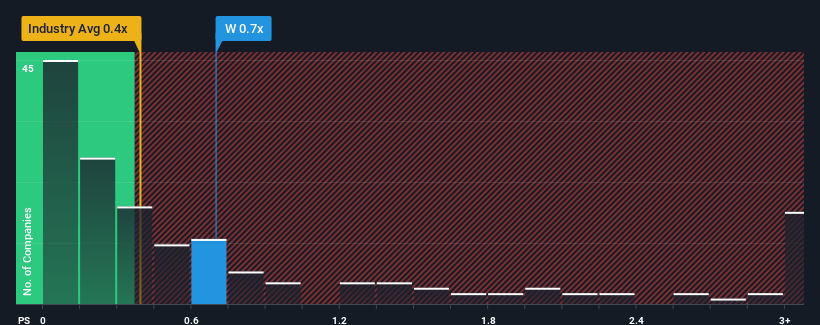

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Specialty Retail industry in the United States, you could be forgiven for feeling indifferent about Wayfair Inc.'s (NYSE:W) P/S ratio of 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Wayfair

What Does Wayfair's Recent Performance Look Like?

Wayfair could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Wayfair's future stacks up against the industry? In that case, our free report is a great place to start.How Is Wayfair's Revenue Growth Trending?

Wayfair's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 22% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.5% per year over the next three years. With the industry predicted to deliver 5.7% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why Wayfair is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Wayfair's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Wayfair's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Plus, you should also learn about these 4 warning signs we've spotted with Wayfair (including 1 which is a bit concerning).

If you're unsure about the strength of Wayfair's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Undervalued low.

Similar Companies

Market Insights

Community Narratives