- United States

- /

- Specialty Stores

- /

- NYSE:W

Market Participants Recognise Wayfair Inc.'s (NYSE:W) Revenues Pushing Shares 29% Higher

Wayfair Inc. (NYSE:W) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

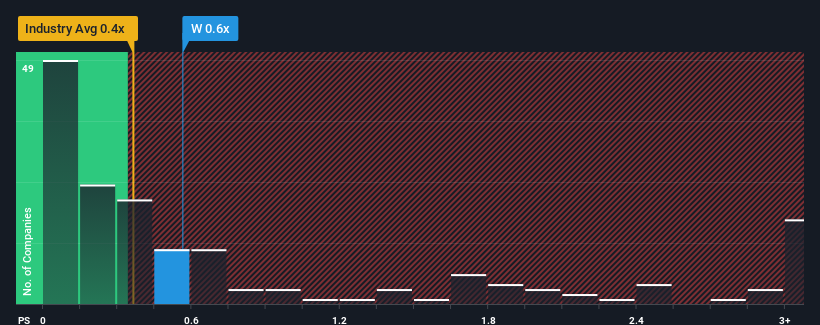

In spite of the firm bounce in price, there still wouldn't be many who think Wayfair's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wayfair

How Wayfair Has Been Performing

Wayfair could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wayfair will help you uncover what's on the horizon.How Is Wayfair's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Wayfair's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 20% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 4.3% per annum as estimated by the analysts watching the company. That's shaping up to be similar to the 5.6% per year growth forecast for the broader industry.

In light of this, it's understandable that Wayfair's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Wayfair's P/S

Wayfair's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Wayfair's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware Wayfair is showing 4 warning signs in our investment analysis, and 1 of those is a bit concerning.

If you're unsure about the strength of Wayfair's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:W

Wayfair

Provides e-commerce business in the United States and internationally.

Good value slight.