- United States

- /

- Specialty Stores

- /

- NYSE:TLYS

Introducing Tilly's (NYSE:TLYS), A Stock That Climbed 48% In The Last Three Years

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Tilly's, Inc. (NYSE:TLYS), which is up 48%, over three years, soundly beating the market return of 39% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 7.6%, including dividends.

View our latest analysis for Tilly's

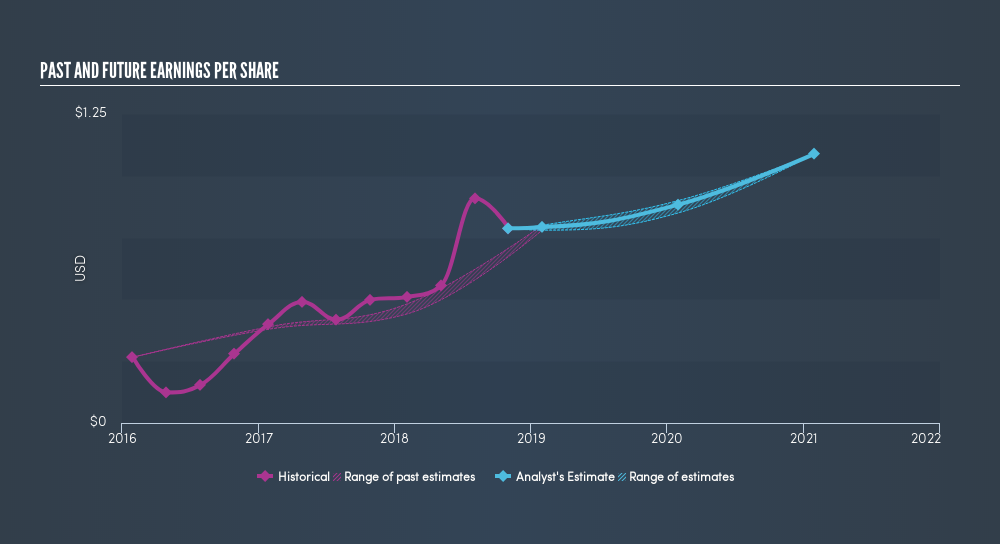

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Tilly's achieved compound earnings per share growth of 24% per year. This EPS growth is higher than the 14% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Tilly's has improved its bottom line lately, but is it going to grow revenue? This freereport showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Tilly's's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Tilly's's TSR, at 82% is higher than its share price rise of 48%. When you consider it hasn't been paying a dividend, this data suggests shareholders may have had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Tilly's shareholders have received a total shareholder return of 7.6% over the last year. That gain is better than the annual TSR over five years, which is 3.5%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Tilly's in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:TLYS

Tilly's

Operates as a specialty retailer of casual apparel, footwear, accessories, and hardgoods for young men and women, boys, and girls in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)