Assessing Sea Stock After an 86% Climb and Recent Share Price Dip

Reviewed by Bailey Pemberton

If you’re here, you're probably wondering what to do next with Sea stock. Whether you've watched the share price soar over the past few years, or you're just now hearing about this Southeast Asian internet giant, there’s no question the market has been on quite a ride. Over the last year alone, Sea’s stock is up an eye-popping 86.6%, and it’s climbed 236.5% in just three years. Even with those strong multi-year gains, the last month has been tougher. The stock slipped 7.8% over 30 days and fell another 5.4% this week, despite staying up an impressive 72.3% year-to-date. Movements like these suggest that investor sentiment, along with shifting risk perceptions about high-growth tech in emerging markets, are playing a big role in Sea’s price action.

With volatility comes both opportunity and uncertainty. Some bigger macro factors, such as evolving regulations in digital payments and changing e-commerce competition, have been swirling around the company lately and nudging price targets in both directions. That’s why more investors are taking a close look at valuation methods for companies like Sea in an effort to answer the age-old question: is the run justified, and is there room to grow?

As it stands, Sea gets a valuation score of just 2, since it passes only two out of six common undervaluation checks, so it’s definitely not a slam-dunk bargain at first glance. But are these traditional metrics painting the whole picture? Next, we will break down exactly how Sea’s valuation stacks up using these approaches, and highlight an even more insightful way to evaluate the company at the end.

Sea scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sea Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation model estimates a company's value by projecting its future cash flows and adjusting them to today's value. This approach provides a long-range perspective by not just looking at what Sea is earning now but also at how its cash flows could grow over time based on business fundamentals.

For Sea, the most recently reported Free Cash Flow stands at $3.73 billion. Analysts expect this number to grow substantially, with forecasts projecting Free Cash Flow to reach approximately $7.14 billion by 2029. While analyst estimates only go out five years, further growth projections past that point are determined using trends and statistical methods.

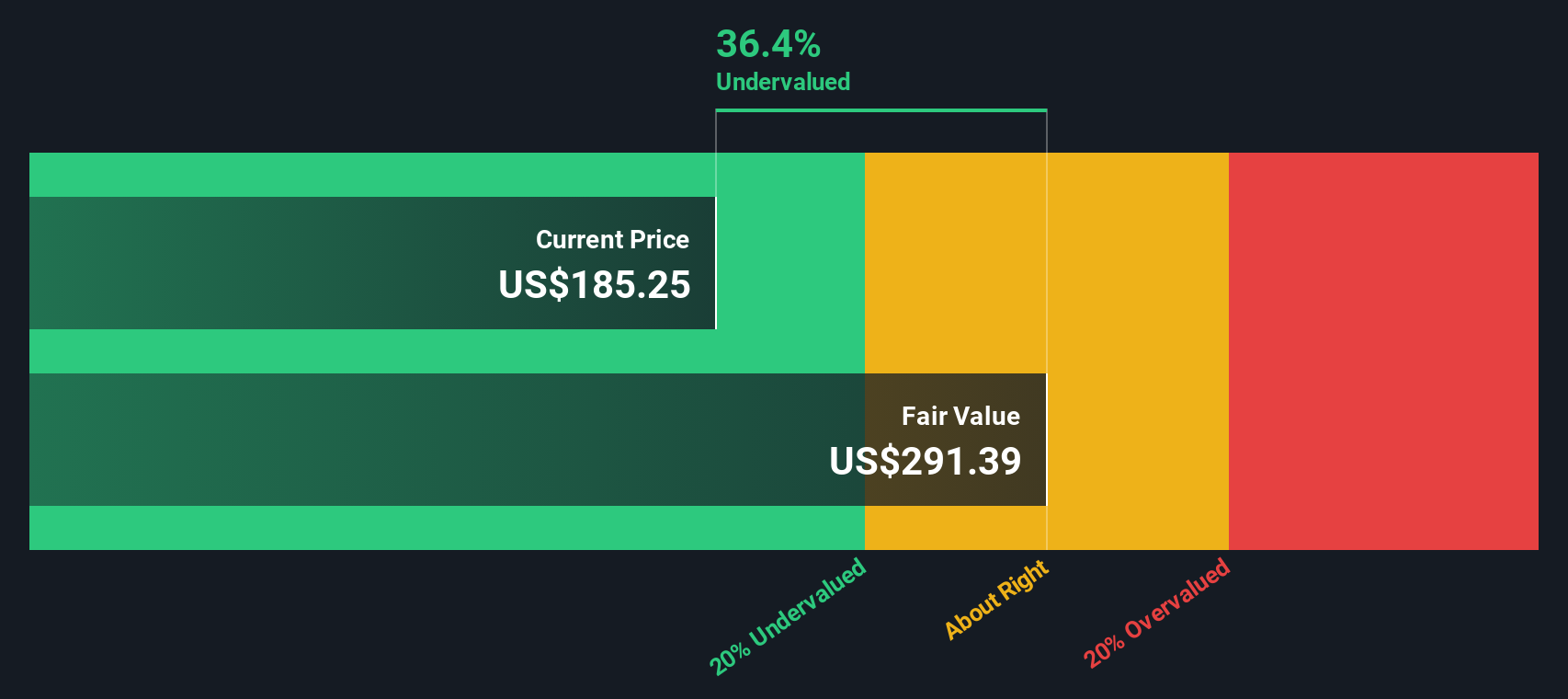

By factoring in both these near-term analyst estimates and longer-term extrapolations, the DCF model calculates an intrinsic value for Sea stock of $290.09 per share. This is about 37.7% higher than Sea’s recent share price, implying that the market might not be fully appreciating the company’s future earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sea is undervalued by 37.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sea Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like Sea because it relates share price to actual earnings, helping investors gauge how much they are paying for each dollar of profit. Typically, higher growth prospects or lower risks justify higher PE ratios, while slower growth or higher risks lead to lower ratios being considered reasonable or “fair.”

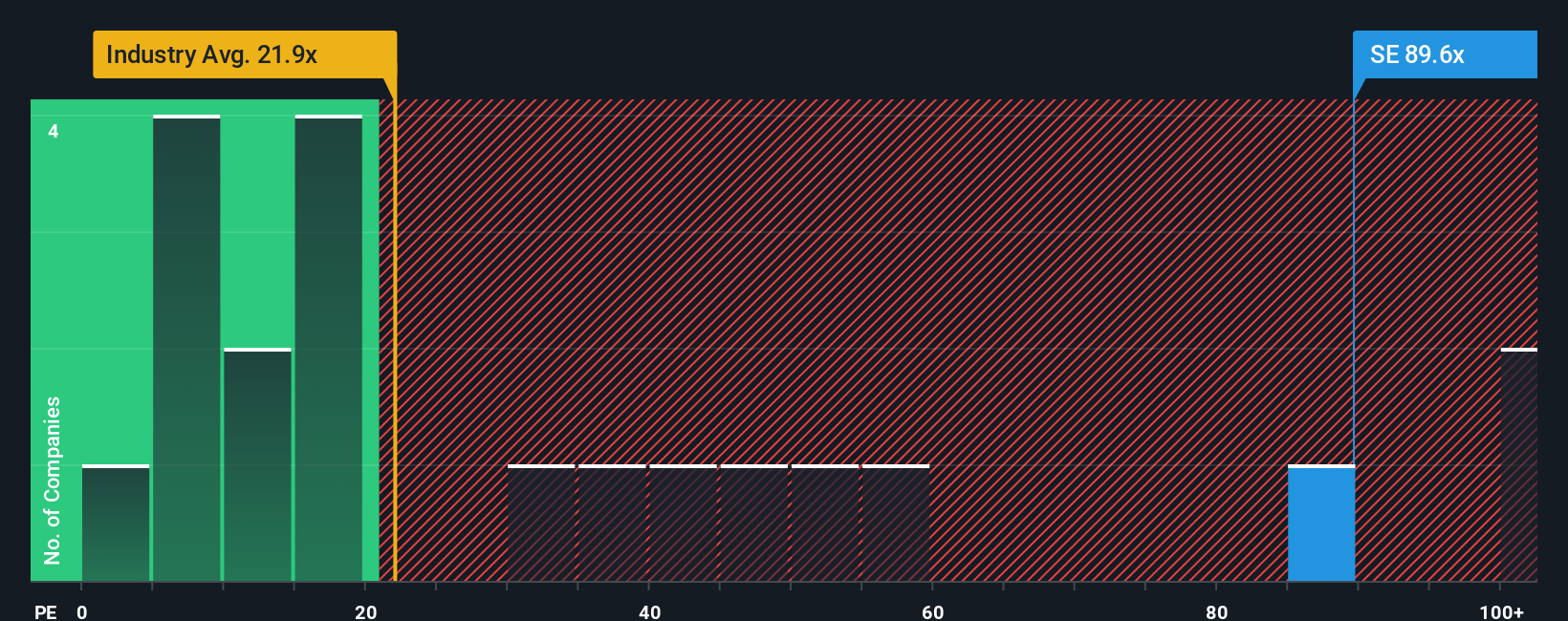

Sea currently trades on a PE ratio of 89.5x, far above the Multiline Retail industry average of 20.9x and higher than its peer group average of 58.4x. At first glance, this might make Sea look expensive relative to many competitors and the broader industry, especially given the heightened volatility seen across high-growth tech stocks.

This is where the Simply Wall St “Fair Ratio” comes in. For Sea, it stands at 39.0x. The Fair Ratio goes beyond simple comparisons by factoring in the company’s growth outlook, earnings quality, profitability, industry position, market cap, and its risks. By incorporating these insights, it provides a more tailored benchmark for what would be a justifiable multiple for Sea specifically.

Since Sea's current PE is more than twice its calculated Fair Ratio, the stock appears significantly overvalued by this methodology, even after considering its growth potential and competitive advantages.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sea Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story of what you believe will shape a company's future. It blends your perspective on the business with concrete forecasts about its future revenue, earnings, and margins. Unlike traditional metrics, a Narrative connects your unique view of Sea’s business prospects directly to specific financial assumptions and then to an estimated fair value for the stock.

Narratives are designed to be straightforward and interactive, and you can use them right on Simply Wall St’s Community page where millions of investors share and compare ideas. By quickly adjusting assumptions or revisiting your story as new information comes in, such as earnings reports or competitive updates, your Narrative’s fair value refreshes automatically. This helps you decide if now is the time to buy, hold, or sell based on the current price versus your calculated value.

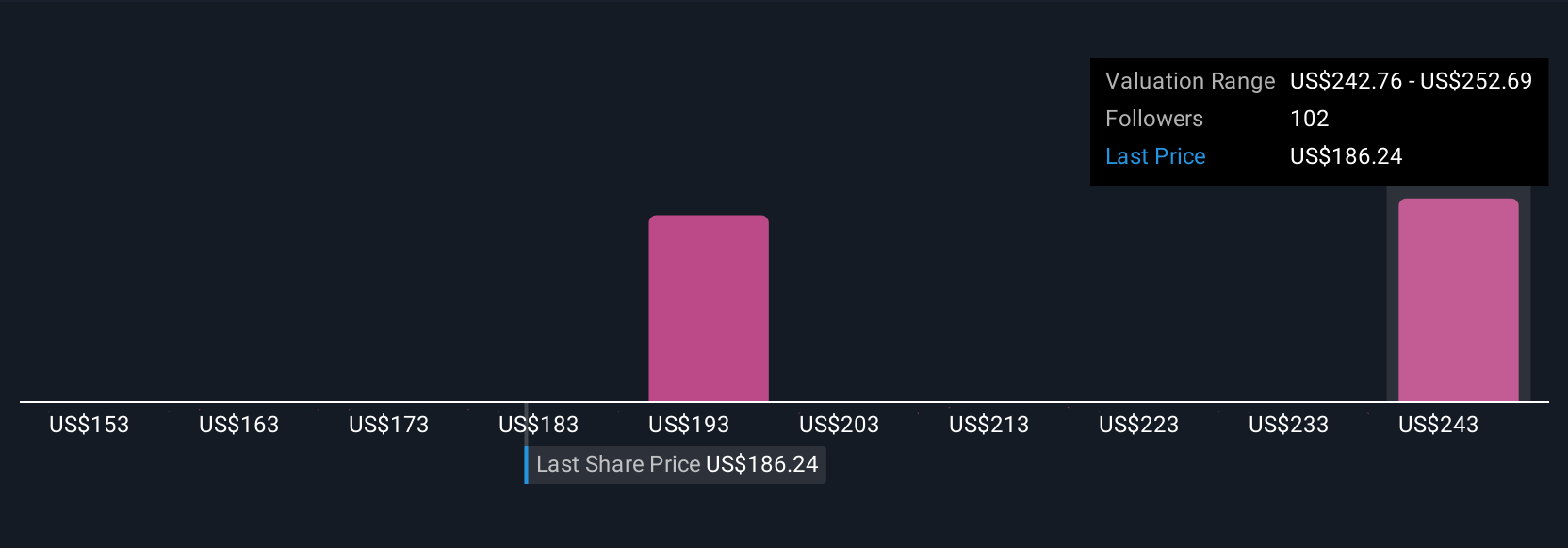

For example, one Sea Narrative expects sustained double-digit growth, margin expansion, and international wins, supporting a price target of $241. A more cautious Narrative worries about tougher competition and regulatory risks, resulting in a fair value closer to $165. Narratives empower you to make investment decisions that are both personal and adaptable, so you can invest with clarity and confidence in a fast-changing market.

Do you think there's more to the story for Sea? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives