- United States

- /

- Specialty Stores

- /

- NYSE:PAG

Penske Automotive Group (PAG): Exploring Current Valuation Following Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Penske Automotive Group.

Penske Automotive Group’s share price has seen some short-term ups and downs, but with a 13.88% gain year-to-date and an impressive 11.57% total return over the past year, there is clear evidence of momentum building in the long run. While the most recent dip may have put it on investors’ radar, long-term holders have seen substantial rewards, highlighted by a 240.45% total return over five years.

If PAG’s run has you thinking about other names in the space, this is a great time to explore what else is moving among auto retailers. See the full list here: See the full list for free.

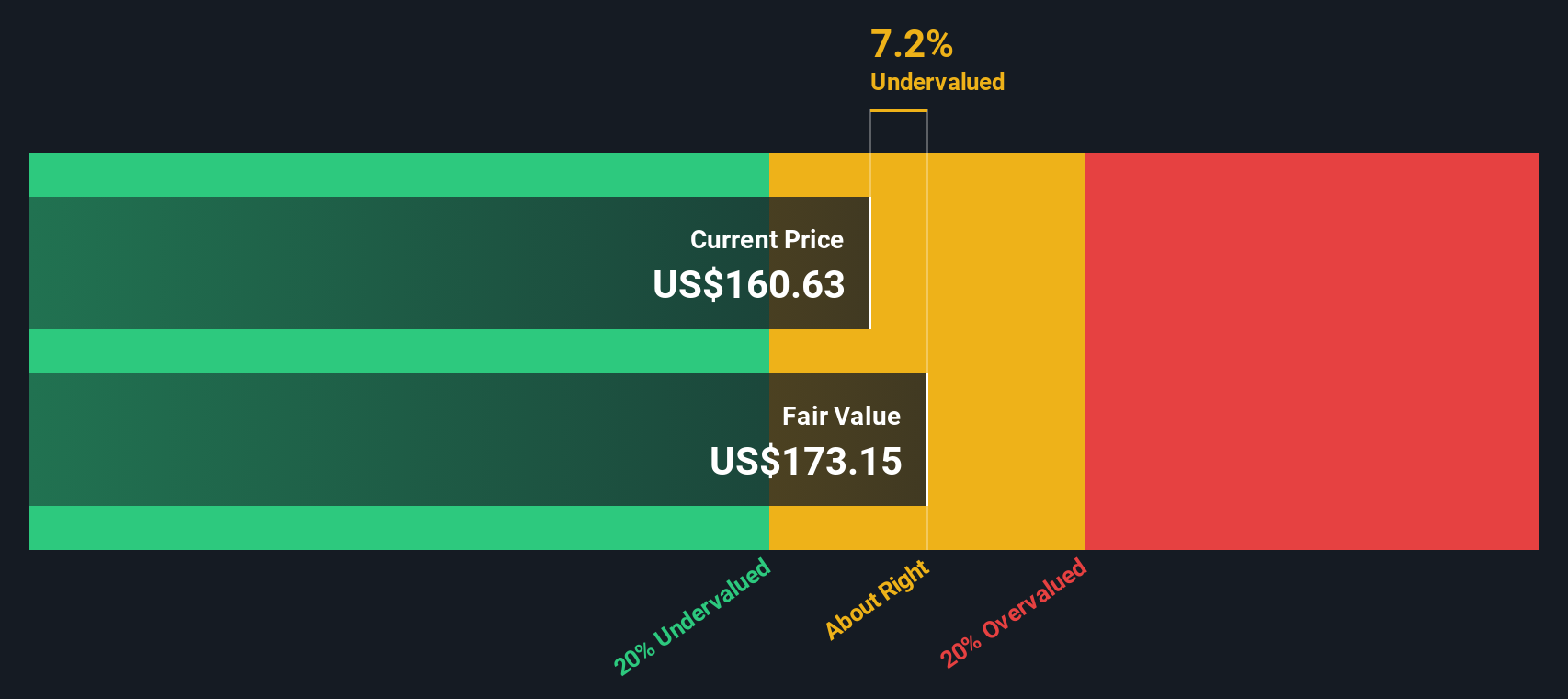

Given steady profit growth but recent dips in price, investors are asking whether Penske Automotive Group shares are undervalued or if today’s price already reflects all the future potential. Is this the buying moment, or is growth fully priced in?

Most Popular Narrative: 4.9% Undervalued

With Penske Automotive Group's fair value estimated at $179.86 and the last close at $171.01, there is room for further upside if current trends continue. The most influential narrative points to resilient service revenues and digital investments as driving forces for long-term value and sets the stage for a deeper valuation discussion below.

Record growth in service and parts revenue (up 7%) and gross profit (up 9%) is being driven by the aging vehicle fleet (average age now over 6 years), increased vehicle complexity, and higher warranty and customer-pay work. This creates durable, recurring revenue streams and supports expanding net margins as the average vehicle age rises in both the U.S. and Europe.

Curious how service growth and digital transformation are powering this valuation? One quantitative forecast in this narrative completely flips the script on profit expectations. Want to know which number could shift Penske's fair value equation? Discover what might drive the next leg higher (or flag hidden risks) in the full narrative!

Result: Fair Value of $179.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts toward electric vehicles and increased regulatory demands overseas could put pressure on Penske's margins and test the durability of its current growth story.

Find out about the key risks to this Penske Automotive Group narrative.

Another View: What Does the DCF Model Reveal?

While analyst targets suggest fair value for Penske Automotive Group, our SWS DCF model comes to a slightly different conclusion. It currently estimates PAG is trading just above its calculated fair value, which indicates only limited upside from here. But are DCF models missing something about Penske’s momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Penske Automotive Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Penske Automotive Group Narrative

If you want to put your own spin on the numbers or prefer hands-on analysis, you can easily craft your own Penske Automotive Group narrative in under three minutes. Do it your way.

A great starting point for your Penske Automotive Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Take advantage of new trends and hidden opportunities before others catch on by using these handpicked stock search tools.

- Uncover high-yield opportunities and create a cash flow boost when you review these 18 dividend stocks with yields > 3% offering over 3% yields in today's market.

- Spot tomorrow’s tech disruptors by scanning these 24 AI penny stocks, where rapid innovation is changing the playing field for bold investors.

- Start your hunt for true bargains and target great businesses trading below their intrinsic worth with these 874 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAG

Penske Automotive Group

A diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives