- United States

- /

- Specialty Stores

- /

- NYSE:PAG

Does Penske Automotive Group (NYSE:PAG) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Penske Automotive Group, Inc. (NYSE:PAG) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Penske Automotive Group

What Is Penske Automotive Group's Debt?

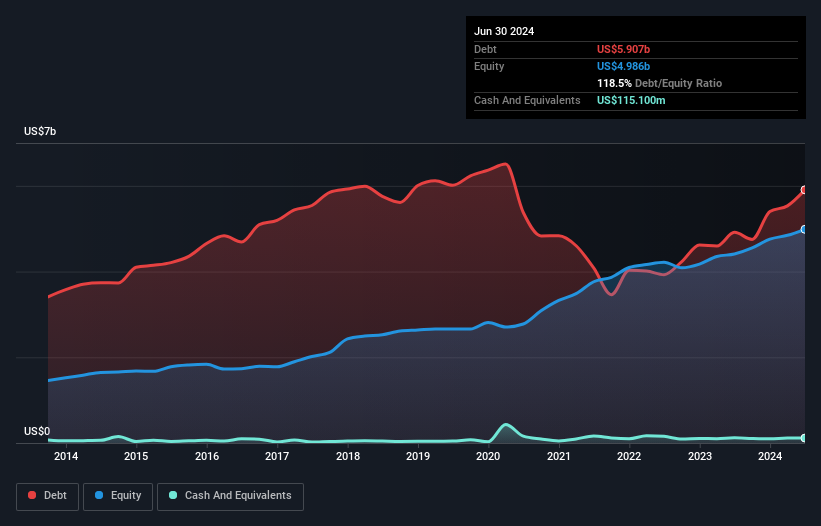

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Penske Automotive Group had US$5.91b of debt, an increase on US$4.92b, over one year. And it doesn't have much cash, so its net debt is about the same.

A Look At Penske Automotive Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Penske Automotive Group had liabilities of US$6.17b due within 12 months and liabilities of US$5.47b due beyond that. Offsetting this, it had US$115.1m in cash and US$1.04b in receivables that were due within 12 months. So its liabilities total US$10.5b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its very significant market capitalization of US$11.3b, so it does suggest shareholders should keep an eye on Penske Automotive Group's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Penske Automotive Group's debt is 4.0 times its EBITDA, and its EBIT cover its interest expense 5.1 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Unfortunately, Penske Automotive Group's EBIT flopped 10% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Penske Automotive Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Penske Automotive Group produced sturdy free cash flow equating to 61% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both Penske Automotive Group's net debt to EBITDA and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Penske Automotive Group's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Penske Automotive Group you should be aware of, and 1 of them is a bit concerning.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PAG

Penske Automotive Group

A diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

Adequate balance sheet average dividend payer.