Macy's (M) Valuation in Focus After Surprising Q2 Growth and Raised Full-Year Guidance

Reviewed by Simply Wall St

Macy's (NYSE:M) just gave investors a lot to consider with its latest second-quarter results. The storied department store delivered its first positive same-store sales growth in three years, surprising the market and sending shares sharply higher. What's grabbing everyone's attention is not just the headline beat but also the confidence management showed by raising both earnings and revenue guidance for the year. This move signals that Macy’s sees meaningful momentum behind its turnaround strategy.

This round of results didn’t appear from thin air. Over the past year, Macy’s strategy of revamping select stores and focusing on its Bloomingdale’s and Bluemercury banners has started to show real progress. After a period where the stock bounced around, Macy’s shares surged nearly 20% following the news, building on steady gains over the last month and quarter. With investors encouraged by improving sales metrics and the renewed push for operational efficiency, Macy’s is entering the back half of the year with more optimism than we’ve seen in a while.

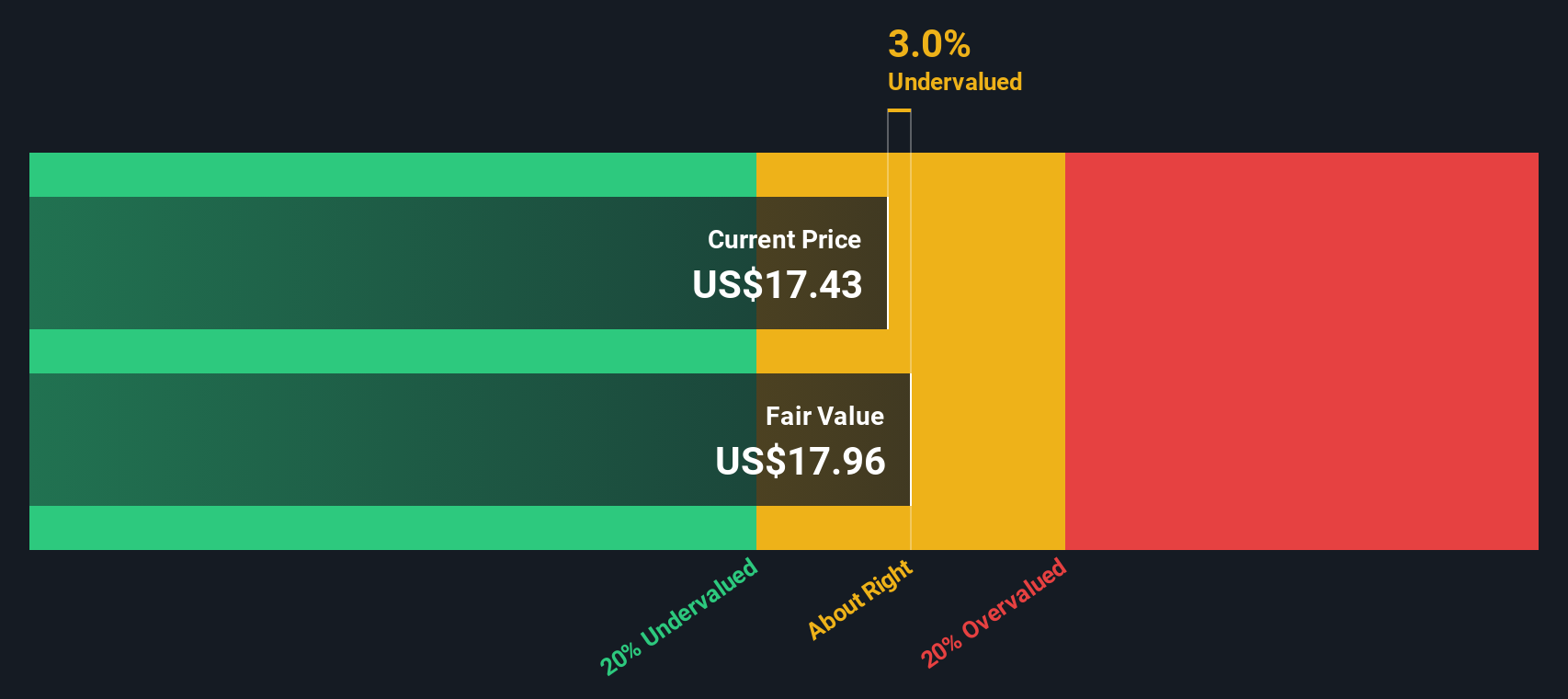

So with shares on the move and optimism clearly priced in, the burning question remains: is Macy’s undervalued given its turnaround progress, or has the recent rally captured most of the upside?

Most Popular Narrative: 30% Undervalued

According to the most widely followed narrative, Macy's stock is significantly undervalued, with its fair value estimated to be far above the current price. This perspective suggests the market may be missing some important strengths and opportunities for the retailer.

Macy’s owns significant real estate that can be sold to provide liquidity, pay down debt, and finance new investments. The firm intends to raise about $600 million to $750 million from real estate sales over the next three years.

Curious about what’s powering this bold valuation call? The narrative is built on a handful of quantitative projections, with future earnings, profit margins, and a surprisingly low future price-to-earnings ratio playing central roles. Wondering how these numbers drive the growth story? Unlock the full story to see which metrics support the fair value gap.

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still concerns that ongoing store closures and a lack of sustained turnaround could limit Macy’s upside if operational improvements stall.

Find out about the key risks to this Macy's narrative.Another View: Our DCF Model Chimes In

While some see clear value based on fair value estimates, our SWS DCF model takes a different approach. By using projected cash flows to assess where Macy’s really stands, this method also points toward undervaluation. However, will both methods prove right over time, or is the outlook too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macy's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macy's Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own Macy’s narrative in just a few minutes. Do it your way

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investment strategy and expand your opportunities by using the Simply Wall Street Screener. These handpicked themes are brimming with companies set to rewrite the future, so don't let these moves pass you by!

- Grab undervalued opportunities by spotting market gaps before others do with undervalued stocks based on cash flows. Let strong fundamentals give your portfolio an edge.

- Capitalize on tomorrow’s breakthroughs by backing healthcare pioneers powered by artificial intelligence through healthcare AI stocks and stay ahead in medical innovation.

- Lock in reliable income with companies delivering impressive yields over 3% by tapping into dividend stocks with yields > 3%, and keep your finances working harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)