Kohl's (NYSE:KSS) recently navigated through significant changes, including leadership restructuring and financial adjustments, which may have influenced its 32% rise in share price over the last month. The appointment of John Schlifske as the new Chair and the firm commitment to a regular dividend could have bolstered investor confidence. Additionally, the announcement of a $360 million debt financing initiative aimed at consolidating financial resources underscores the company's efforts to strengthen its financial foundation. While the broader market experienced a more modest rise, Kohl's strategic maneuvers might have added significant weight to its standout performance.

The recent developments at Kohl's, including the leadership restructuring and commitment to dividends, could help address the previously reported challenges in retaining customers and enhancing digital sales platforms. While the 32% rise in share price over the last month appears promising, the broader picture reveals that the company's total return over the past five years was a 35.53% decline, highlighting persistent struggles. This longer-term performance underlines the need for effective changes to ensure sustainable growth.

Over the past year, Kohl's share performance has lagged behind the US Multiline Retail industry, which posted a 12% return. This underperformance indicates that despite recent positive share price movements, the company still faces hurdles in matching industry standards. Investors will be keen to see if the recent strategic changes can translate into improved future results.

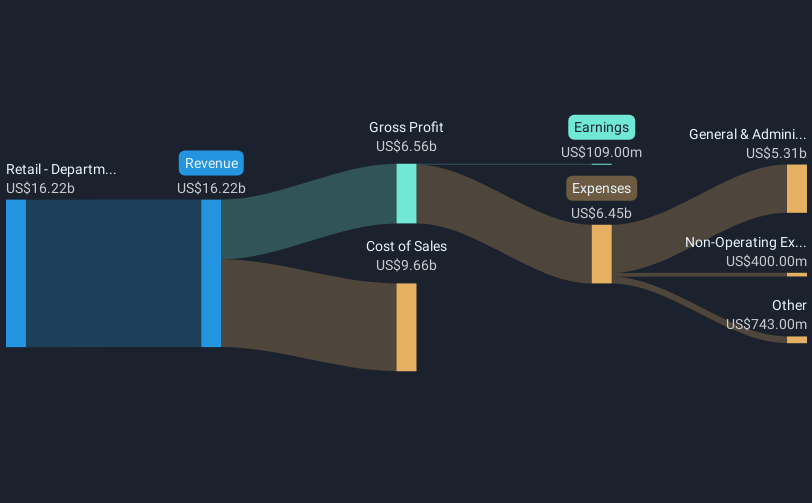

On the forecast front, Kohl's intention to enhance its merchandise strategy and optimize its omnichannel platform may contribute to bolstering revenue and profit margins. However, the ongoing forecast of revenue decrease and the need for substantial margin improvements remain challenges that Kohl's must overcome. The current price movement, while positive, remains shy of the consensus price target of $9.66, reflecting a 29.4% potential upside from the current US$6.82, presenting an opportunity for long-term repositioning if the strategic initiatives are successful.

Gain insights into Kohl's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives