Does the Recent 33% Rally Signal Real Upside for Kohl's in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Kohl's stock right now? You are not alone. Whether you are on the fence, eyeing a recovery play, or just watching after those headline-grabbing rallies, it has been a wild ride for shareholders lately. Just a few months ago, Kohl's found itself in the meme stock spotlight. A 33% spike was driven by retail traders piling in, hoping for the next big short squeeze. Since then, however, the share price has fallen back down to earth, dropping 17.3% over the past week and 12.8% this past month, with the stock closing at $13.98. The price swings are enough to rattle even the savviest investor.

What is spooking the market? Some of it is the usual retail sector drama, and some is company-specific, such as Kohl's asking vendors for more time to pay invoices. This is a clear signal the retailer is feeling the pinch as it works through a turnaround plan. At the same time, analysts are finally nudging price targets back up, as seen with Evercore ISI’s recent move to $13 from $8, noting Kohl's is at least beating low expectations.

Against this volatile backdrop, does the stock look tempting or too risky? Our deep dive into the numbers starts with a valuation score. Kohl's checks the undervalued box on 5 out of 6 major tests. That is a strong foundation, but as you will see, looking beyond the standard valuation toolbox may yield even better insights about what the company is really worth.

Why Kohl's is lagging behind its peers

Approach 1: Kohl's Discounted Cash Flow (DCF) Analysis

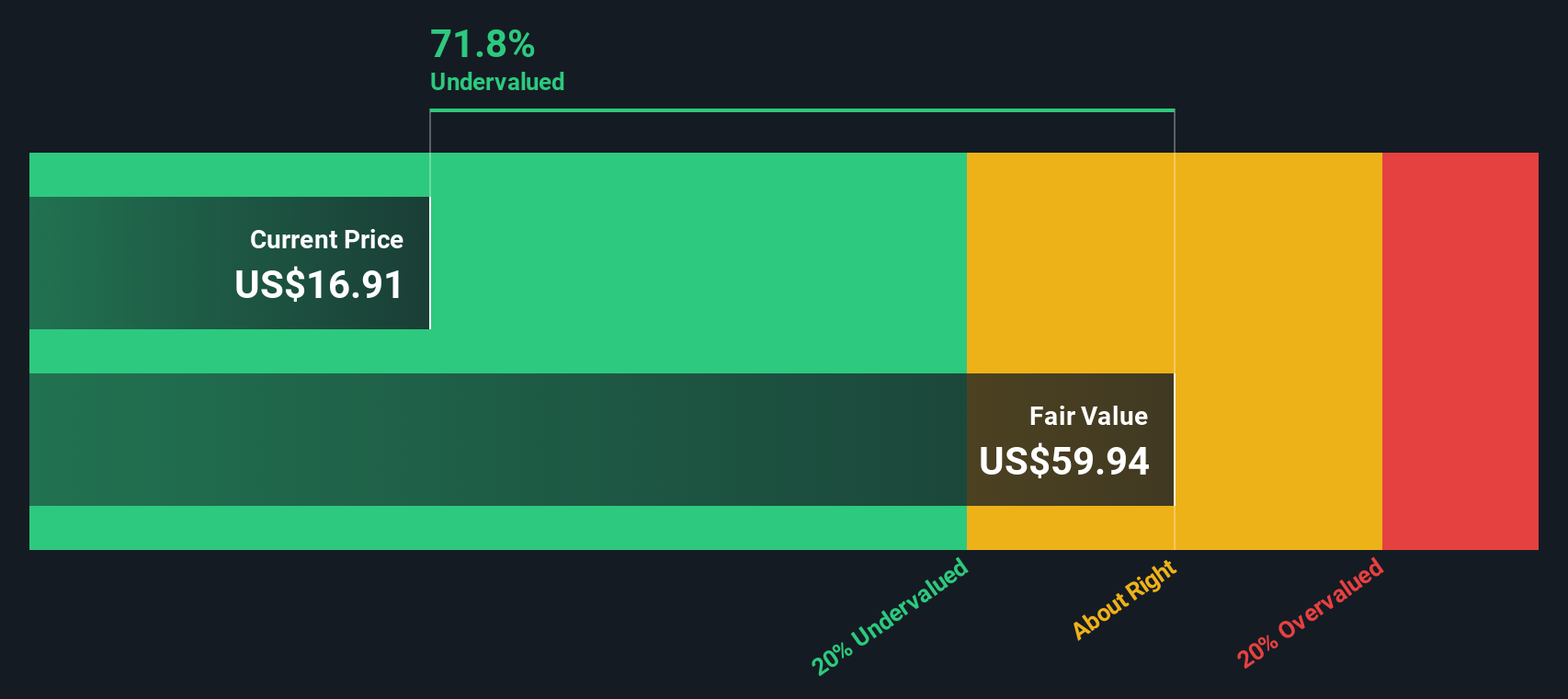

The Discounted Cash Flow (DCF) model values a company by projecting its future cash flows and discounting them back to today. This approach aims to reveal what the business is truly worth based on its expected ability to generate cash. For Kohl's, the current Free Cash Flow is $430.96 Million, and analysts forecast steady growth in the coming years.

While analysts only outline estimates for the next five years, Simply Wall St extrapolates further. By 2028, Kohl's Free Cash Flow is projected to reach $628 Million, with longer-term estimates extending that trend all the way to 2035. These figures suggest optimism about Kohl's ability to deliver increasing returns over time.

According to this two-stage DCF analysis, the estimated intrinsic value of the stock is $59.94 per share. This is in sharp contrast to the current market price of $13.98. The implied discount is a striking 76.7 percent, suggesting the stock may be significantly undervalued if these projections hold up.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kohl's is undervalued by 76.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kohl's Price vs Earnings (PE Ratio)

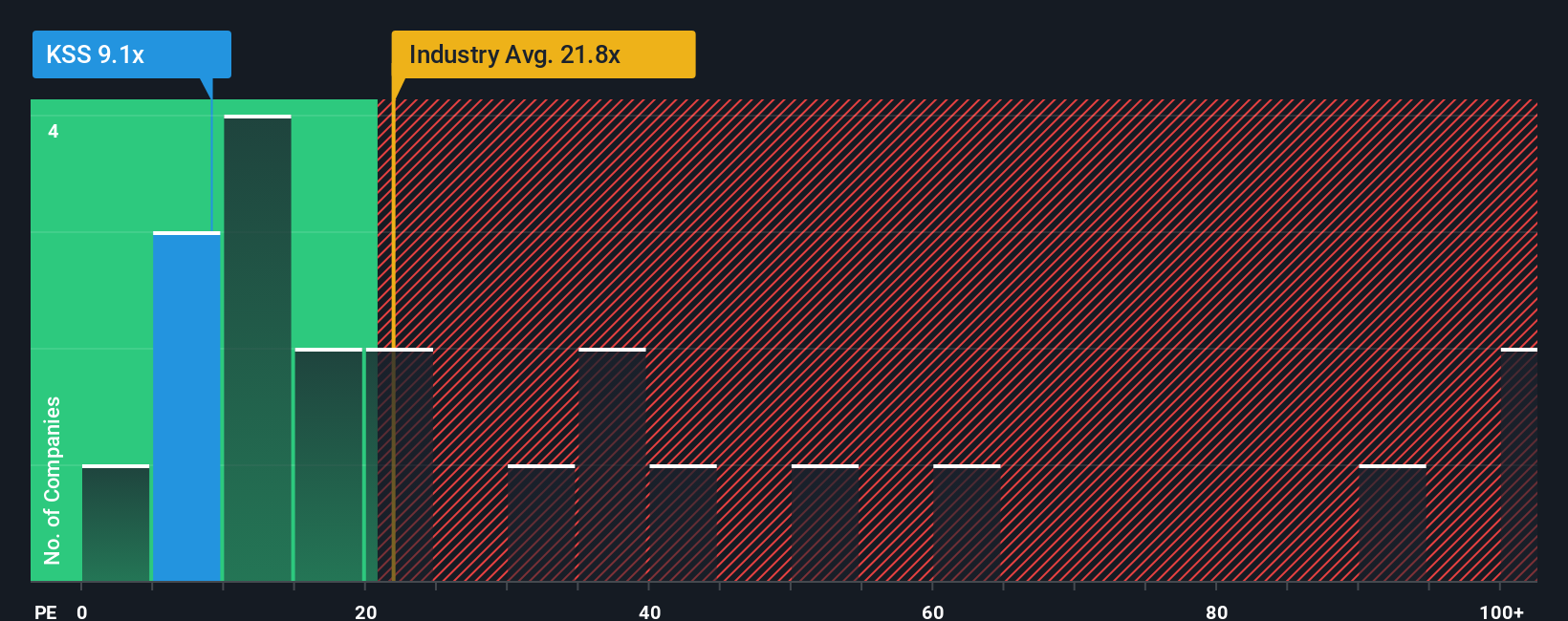

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies because it connects the price investors are willing to pay with the company’s actual earnings. For steady earners like Kohl's, evaluating the stock's PE gives a quick sense of whether it trades at a discount or premium relative to its underlying profits.

A "normal" or "fair" PE ratio depends not only on current profits, but also on the company’s expected earnings growth and risk profile. Higher growth and lower risk typically justify a higher PE, while slower growth or elevated risk push fair multiples lower.

Kohl's currently trades at a PE ratio of 7.5x, which is well below both the Multiline Retail industry average of 21.9x and its peer group’s 30.6x average. This sharp discount can catch investor attention, but headline multiples do not tell the whole story.

Simply Wall St’s "Fair Ratio" model provides a more targeted benchmark by incorporating Kohl's earnings growth prospects, profit margins, industry position, and market cap into the assessment. Unlike peer or industry averages, the Fair Ratio of 22.2x factors in these additional dynamics for a more holistic view of what the stock should be worth today.

Comparing Kohl’s current PE of 7.5x with its Fair Ratio of 22.2x, the stock appears substantially undervalued based on its earnings fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kohl's Narrative

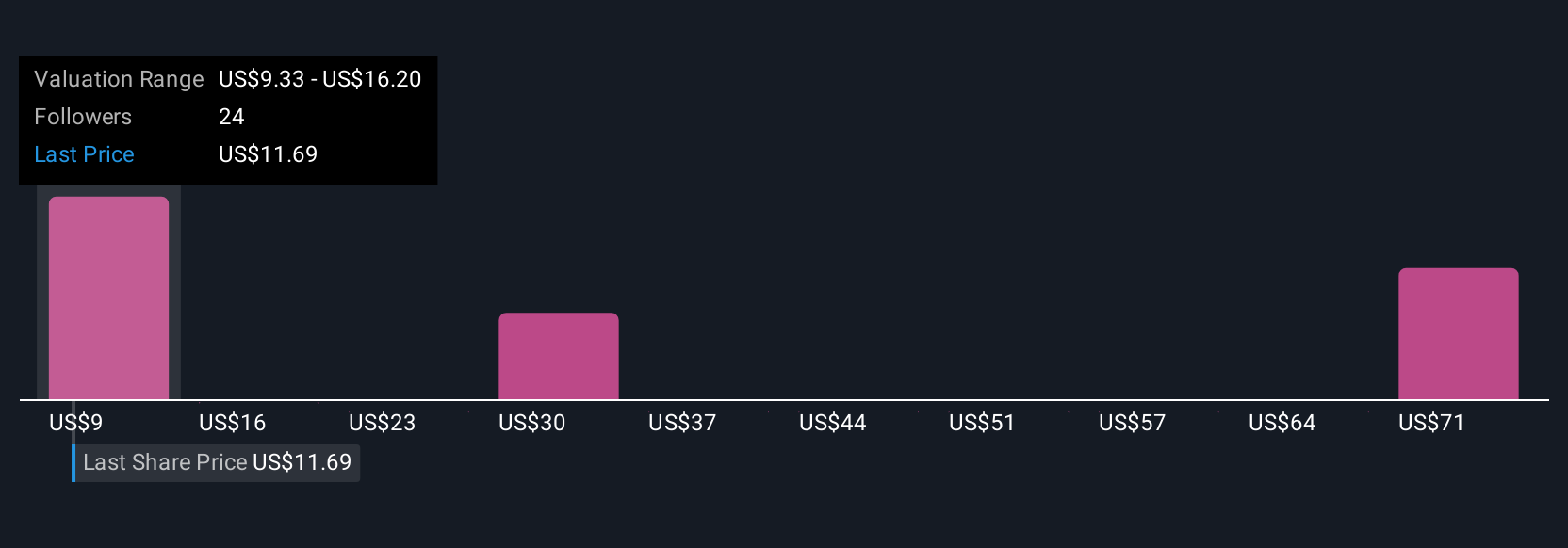

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple but powerful tool that helps you connect your view of a company’s story—how you see its future prospects and risks—with the numbers, translating your assumptions about future revenue, earnings, and margins into a clear fair value estimate.

By linking the company’s story to your financial forecast and to an actionable fair value, Narratives let you move beyond one-size-fits-all metrics like PE ratios and embrace a more personalized way to evaluate stocks.

On Simply Wall St's Community page, used by millions of investors, anyone can create and share a Narrative for a company like Kohl's, making it easy to track your own perspective or see what others in the market think.

Narratives are also dynamically updated as new information comes in, such as news or quarterly results, ensuring your fair value stays current with the latest data and insights.

Two investors may view the same stock very differently: while one Narrative might see Kohl’s as a long-term value play with a fair value north of $34 per share, another more cautious Narrative could cite industry headwinds and arrive at a fair value around $14.90. This shows there is no single right answer, but a smarter, more personal way to decide when to buy or sell.

Do you think there's more to the story for Kohl's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives