Can Kohl’s (KSS) Proprietary Brand Push Reinvent Its Value Proposition for Families?

Reviewed by Sasha Jovanovic

- This past season, Kohl's expanded its proprietary brands by launching FLX apparel for kids, an activewear and athleisure line focused on comfort, durability, and value, with products available online and in 300 stores and plans for further expansion.

- The rollout of FLX for kids demonstrates Kohl's effort to strengthen its in-house brands, offering adaptable options that respond to evolving family and youth fashion needs as part of its broader merchandise strategy.

- We'll examine how expanding proprietary brands with targeted new offerings like FLX for kids may reshape Kohl's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kohl's Investment Narrative Recap

To be a shareholder in Kohl's right now, you need to believe that continued investment in proprietary brands and digital capabilities will drive margin improvement and help recapture market share, even amid a tough retail environment. The recent launch of FLX for kids supports the brand strategy, but it is not expected to materially shift the most immediate catalyst, stabilizing core traffic, or address the major risk, which remains persistent store transaction declines and margin pressure from promotional activity.

Among recent announcements, the appointment of a new Chief Digital Officer stands out. This move is highly relevant as it connects directly to the short-term catalyst: improving digital performance, which is essential for countering reduced physical foot traffic and shifting consumer behavior.

However, investors should be aware that despite merchandise innovation and new digital leadership, ongoing consumer migration away from department stores remains a central risk...

Read the full narrative on Kohl's (it's free!)

Kohl's is projected to reach $15.2 billion in revenue and $199.4 million in earnings by 2028. This outlook assumes a 1.6% annual revenue decline and a $9.6 million decrease in earnings from the current $209.0 million.

Uncover how Kohl's forecasts yield a $14.92 fair value, a 4% downside to its current price.

Exploring Other Perspectives

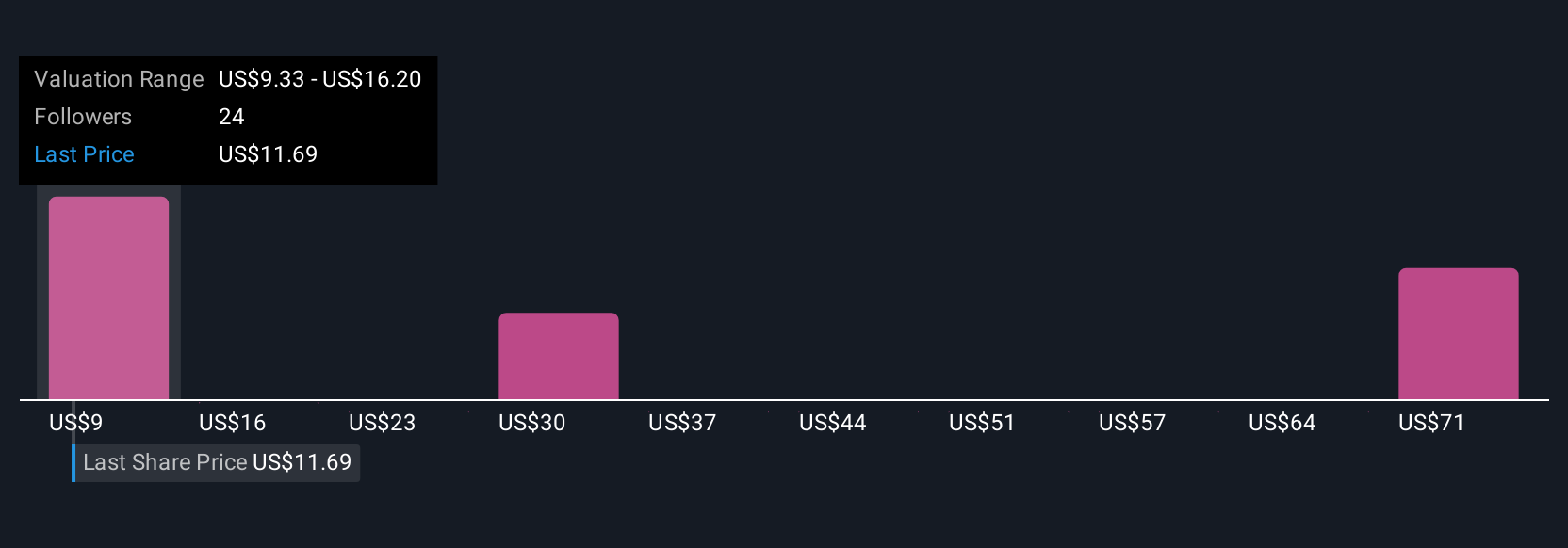

Simply Wall St Community members provided five fair value estimates for Kohl's ranging from US$14.72 to US$59.94 per share. While opinions span a wide valuation gap, persistent declines in store traffic and shifting shopping habits remain a key concern that could impact all outcomes; readers can explore the varied perspectives on what drives value for the company.

Explore 5 other fair value estimates on Kohl's - why the stock might be worth 5% less than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives