- United States

- /

- Specialty Stores

- /

- NYSE:KMX

Will CarMax's (KMX) New Store Expansion Offset Legal Uncertainty in Its Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this month, CarMax, Inc. announced the grand opening of its first Arkansas store in Rogers, marking its 255th location nationwide and highlighting new customer-focused offerings like at-home vehicle pickup and the Offer Watch tool.

In the days following significant corporate changes, multiple law firms disclosed the filing and expansion of securities class action lawsuits against CarMax, alleging that management made materially false or misleading statements regarding growth prospects and finance portfolio quality during recent quarters. - We'll examine how this wave of legal scrutiny, amidst operational changes, influences CarMax's investment narrative and future business outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CarMax Investment Narrative Recap

To be a CarMax shareholder right now, you need to believe in the company’s ability to grow its omnichannel used car business and improve profitability by expanding digital and in-store integration, even as it faces heightened legal scrutiny. The recent wave of securities class action lawsuits, combined with ongoing leadership changes, introduces a material near-term risk as it could distract management from focusing fully on operational improvements, while the most important short-term catalyst remains the company’s ability to stabilize and grow comparable store sales amid challenging macroeconomic conditions.

One recent announcement with direct relevance is the introduction of enhanced appraisal experience tools such as at-home vehicle pickup and the Offer Watch feature, which aim to improve customer engagement and empower sellers with greater flexibility. These updates are designed to support CarMax’s key growth catalyst of expanding its digital and omnichannel capabilities, helping drive volume and customer satisfaction as the business adapts to evolving consumer needs.

In contrast, investors should be aware that ongoing litigation alleging misleading statements regarding growth prospects could...

Read the full narrative on CarMax (it's free!)

CarMax's narrative projects $29.8 billion revenue and $919.9 million earnings by 2028. This requires 1.3% yearly revenue growth and a $361.4 million earnings increase from $558.5 million today.

Uncover how CarMax's forecasts yield a $39.83 fair value, a 3% upside to its current price.

Exploring Other Perspectives

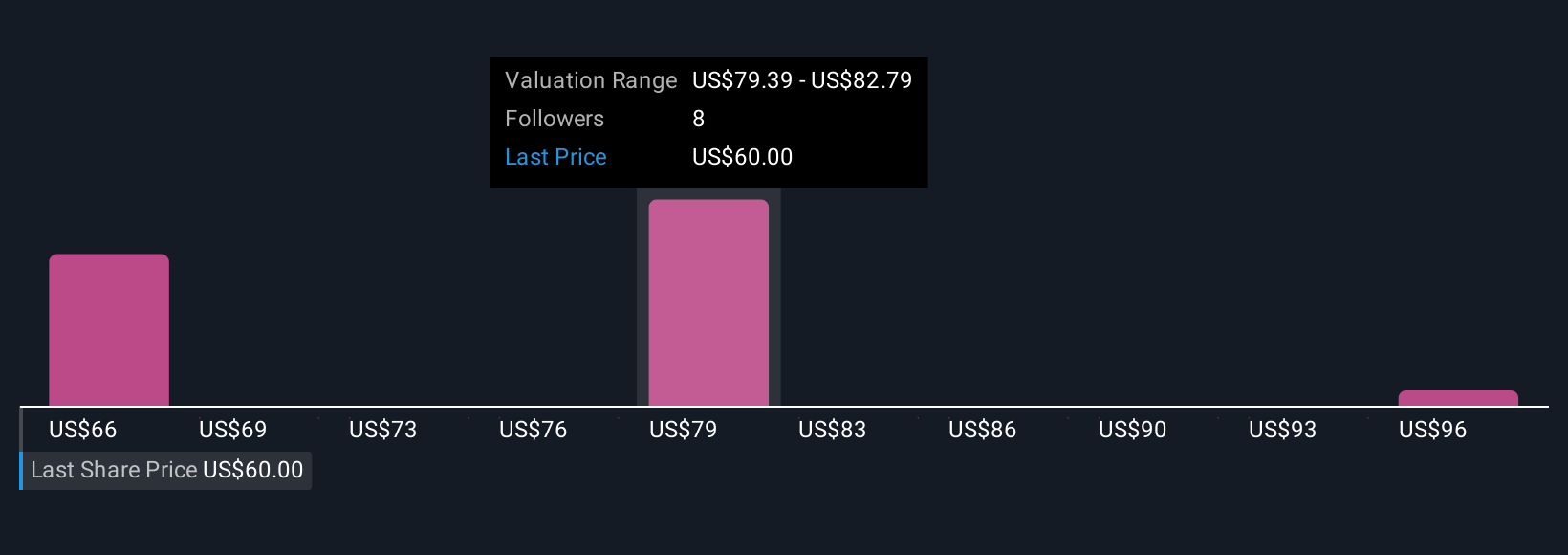

The Simply Wall St Community’s five fair value estimates for CarMax range from US$39.83 to US$99.80. While views on the company’s worth differ greatly, increasing legal and operational risks could remain a focus for investors considering their next move.

Explore 5 other fair value estimates on CarMax - why the stock might be worth over 2x more than the current price!

Build Your Own CarMax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarMax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarMax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarMax's overall financial health at a glance.

No Opportunity In CarMax?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.