We're Hopeful That Jumia Technologies (NYSE:JMIA) Will Use Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Jumia Technologies (NYSE:JMIA) stock is up 153% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky Jumia Technologies' cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Jumia Technologies

How Long Is Jumia Technologies' Cash Runway?

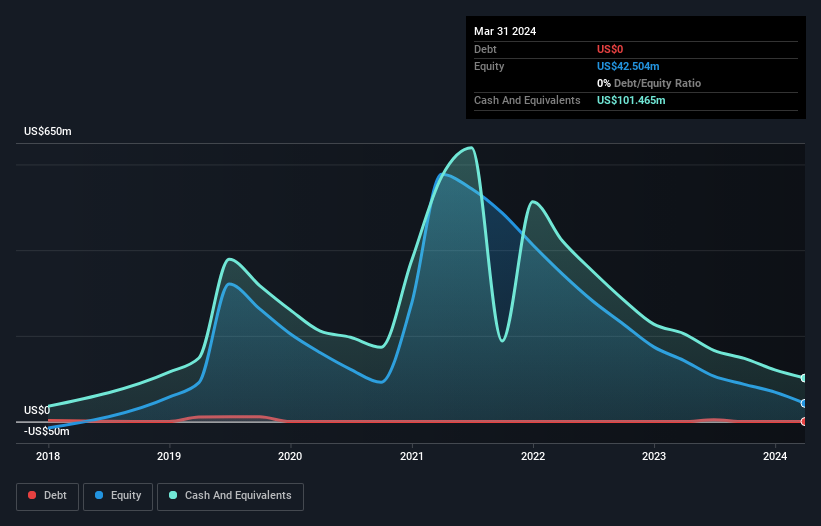

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2024, Jumia Technologies had cash of US$101m and no debt. Importantly, its cash burn was US$51m over the trailing twelve months. So it had a cash runway of about 2.0 years from March 2024. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Jumia Technologies Growing?

Happily, Jumia Technologies is travelling in the right direction when it comes to its cash burn, which is down 74% over the last year. Mundanely, though, operating revenue growth was flat. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Jumia Technologies Raise More Cash Easily?

While Jumia Technologies seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Jumia Technologies' cash burn of US$51m is about 5.4% of its US$941m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Jumia Technologies' Cash Burn Situation?

As you can probably tell by now, we're not too worried about Jumia Technologies' cash burn. In particular, we think its cash burn reduction stands out as evidence that the company is well on top of its spending. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Jumia Technologies (1 is potentially serious!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives