Optimistic Investors Push Jumia Technologies AG (NYSE:JMIA) Shares Up 34% But Growth Is Lacking

Despite an already strong run, Jumia Technologies AG (NYSE:JMIA) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 169% following the latest surge, making investors sit up and take notice.

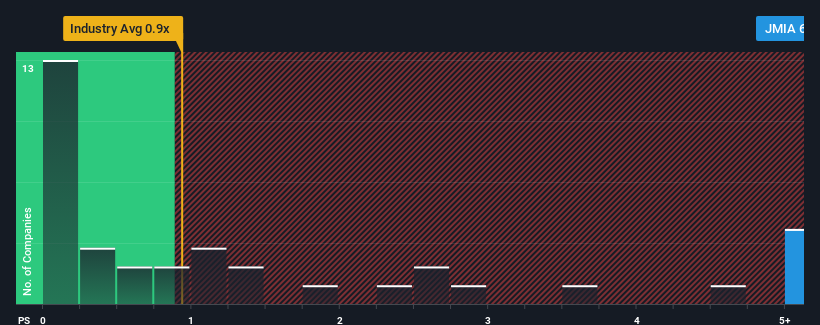

After such a large jump in price, when almost half of the companies in the United States' Multiline Retail industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Jumia Technologies as a stock not worth researching with its 6.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Jumia Technologies

What Does Jumia Technologies' P/S Mean For Shareholders?

Jumia Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Jumia Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Jumia Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 1.5% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 14% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Jumia Technologies' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Jumia Technologies' P/S Mean For Investors?

Jumia Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Jumia Technologies' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jumia Technologies (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Jumia Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East Africa, Europe, the United Arab Emirates, and internationally.

Flawless balance sheet low.