- United States

- /

- Specialty Stores

- /

- NYSE:GPI

Is Group 1 Automotive (GPI) Still Undervalued? A Fresh Look at Its Recent Share Price Shift

Reviewed by Kshitija Bhandaru

See our latest analysis for Group 1 Automotive.

While the latest 1% gain continues a resilient streak for Group 1 Automotive, it comes on the back of an impressive 19.7% total shareholder return over the past year. Momentum has cooled since March with a 9.1% one-month share price decline. However, the longer-term trajectory remains firmly positive and reflects ongoing optimism about the company’s growth.

If you’re curious about what else stands out in today’s market, this is a great time to broaden your search and discover See the full list for free.

With Group 1 Automotive’s steady fundamentals and shares still trading below analyst price targets, the key question is whether the recent dip signals a buying opportunity or if the market already reflects all future gains.

Most Popular Narrative: 11% Undervalued

Group 1 Automotive’s most followed narrative places its fair value noticeably above the last close of $423.89, highlighting the belief that the shares still offer meaningful upside. This perspective leans on forecasts of rising earnings power and improved profitability, setting high expectations for future performance.

The sustained growth in the high-margin parts & service (aftersales) segment, driven by an aging vehicle fleet and rising average vehicle age in both the U.S. and U.K., positions Group 1 to capitalize on increasing repair and maintenance needs. This should continue to expand recurring revenue and bolster margins. Ongoing expansion of technician headcount, investments in service capacity, and focus on customer outreach to owners of older vehicles are expected to further increase aftersales throughput, providing earnings stability and margin growth with less correlation to vehicle sales cycles.

Want to know exactly what powers this bullish valuation? The narrative hinges on aftersales resilience, consistent earnings tracks, and future margin boosts. What are the boldest financial bets behind these targets? Discover the full blueprint inside the detailed forecast to see what makes this story so compelling for the analysts calling the shots.

Result: Fair Value of $478.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying online competition and rising electric vehicle adoption could threaten Group 1 Automotive’s recurring revenue stability and profit growth in the future.

Find out about the key risks to this Group 1 Automotive narrative.

Another View: Is Good Value Relative to Peers and Industry

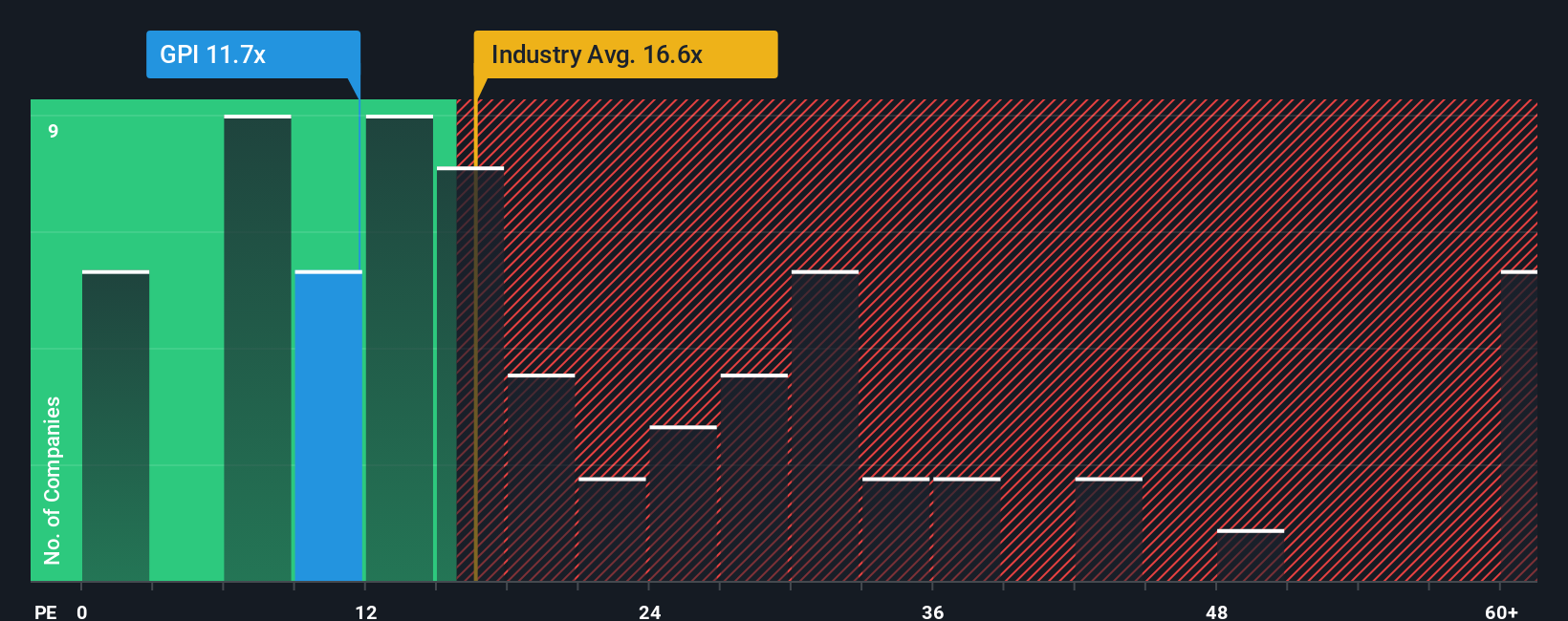

Taking a step back from future projections, Group 1 Automotive stands out today when comparing its valuation metrics. Its price-to-earnings ratio of 11.4 is below both the industry average of 15.8 and the peer average of 11.5, and it is also below its own fair ratio of 15.6. This suggests the market may be underestimating the company’s relative value right now. But does the gap offer genuine upside, or is it a warning sign that consensus forecasts are too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Group 1 Automotive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Group 1 Automotive Narrative

If you want to dig deeper or think your perspective adds something new, it’s easy to analyze the numbers and shape your own outlook in just a few minutes with Do it your way.

A great starting point for your Group 1 Automotive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their watchlist fresh. Now is the perfect time to uncover high-potential themes you might otherwise miss with Simply Wall Street’s targeted screeners.

- Catch up with income opportunities and boost your portfolio by checking out these 18 dividend stocks with yields > 3%, which offers stable yields and consistent payouts above 3%.

- Uncover hidden gems in emerging tech with these 25 AI penny stocks, a resource packed with companies at the forefront of artificial intelligence and automation.

- Stay ahead of the curve and spot undervalued picks by tapping into these 881 undervalued stocks based on cash flows, focused on strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPI

Group 1 Automotive

Through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives