- United States

- /

- Specialty Stores

- /

- NYSE:FND

Capital Allocation Trends At Floor & Decor Holdings (NYSE:FND) Aren't Ideal

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think Floor & Decor Holdings (NYSE:FND) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Floor & Decor Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = US$391m ÷ (US$4.5b - US$1.1b) (Based on the trailing twelve months to June 2023).

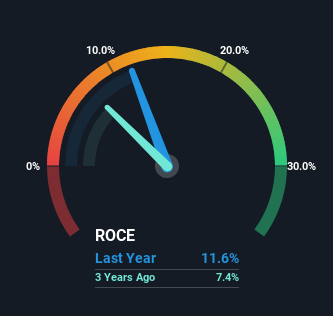

Therefore, Floor & Decor Holdings has an ROCE of 12%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Specialty Retail industry average of 13%.

See our latest analysis for Floor & Decor Holdings

In the above chart we have measured Floor & Decor Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Floor & Decor Holdings here for free.

The Trend Of ROCE

In terms of Floor & Decor Holdings' historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 12% from 17% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

The Bottom Line On Floor & Decor Holdings' ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Floor & Decor Holdings is reinvesting for growth and has higher sales as a result. And the stock has done incredibly well with a 161% return over the last five years, so long term investors are no doubt ecstatic with that result. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

If you're still interested in Floor & Decor Holdings it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Floor & Decor Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking to trade Floor & Decor Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with moderate growth potential.