- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (NYSE:CVNA) Up 11% In A Week Following Q4 Earnings Turnaround

Reviewed by Simply Wall St

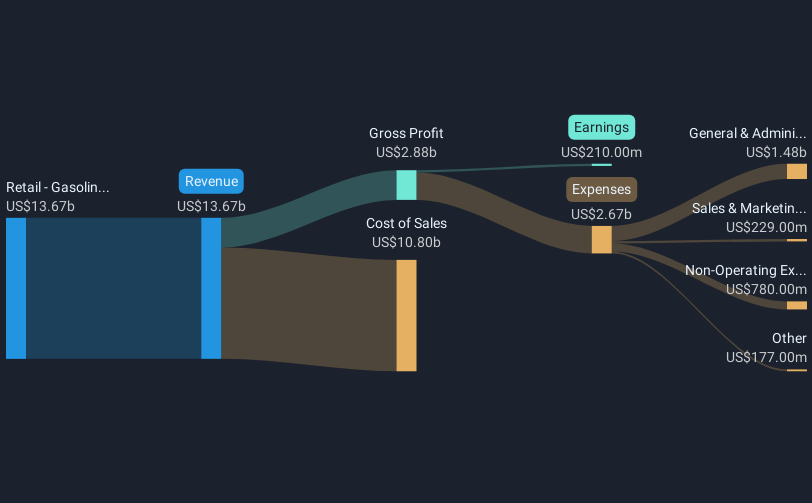

Carvana (NYSE:CVNA) recently announced a significant improvement in its Q4 2024 earnings, showcasing substantial growth in sales and revenue, and achieving a positive net income after a period of losses. This strong financial performance likely contributed to the company's 11% share price rise over the past week. Meanwhile, the broader market remained positive, with major indexes showing resilience, which may have further supported Carvana's gains. The improving performance signals a potential recovery for Carvana, contrasting with some market sectors experiencing volatility, like Nike and FedEx, which reported disappointing outlooks and declines.

Over the past five years, Carvana's shares have delivered a total return of 227.89%. This impressive performance can be attributed to several key developments. Notable among these was the successful integration of ADESA mega sites, significantly boosting reconditioning capacity and enhancing operational efficiency. Concurrently, Carvana's adoption of AI technologies optimized inventory management, streamlining processes and improving customer experiences. This focus on operational prowess and customer satisfaction positioned the company favorably against challenges like high debt levels and competitive market dynamics.

Further bolstering the company's position, Carvana's expansion initiatives, including the introduction of same-day vehicle delivery in multiple regions, enhanced sales capacity and customer convenience. Financial strategies including a substantial debt reduction of over US$1.325 billion also contributed to its financial stability. Over the past year, Carvana outperformed both the broader US market and the Specialty Retail industry, highlighting its strong market standing despite a challenging economic climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

High growth potential low.

Similar Companies

Market Insights

Community Narratives