- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): How New California Expansion Shapes Its Current Valuation

Reviewed by Simply Wall St

Carvana (CVNA) just revealed plans to add its Inspection and Reconditioning Center capabilities to the long-running ADESA Golden Gate wholesale auction site in Tracy, California. For investors, this is more than a simple facility upgrade. It means substantial growth in reconditioning capacity and stronger service offerings for both retail and wholesale customers in a core region. With around 100 new jobs on the way and proprietary tech supporting operational consistency, Carvana’s move signals a renewed investment in logistics and customer experience.

This strategic expansion adds to an already eventful year for Carvana, which recently rolled out same-day vehicle delivery in Seattle and is set to present at a major industry conference. Over the past year, Carvana’s stock has shot up 133%, reflecting both optimism around growth initiatives and an evolving risk profile. The company’s momentum looks strong, further underlined by impressive jumps in both revenue and net income during the past year.

After a surge like this, is there still value left on the table, or are investors now paying up for expected growth that may already be reflected in Carvana’s price?

Most Popular Narrative: 12% Undervalued

The most widely followed narrative sees Carvana as undervalued by 12% based on analysts' consensus around its aggressive future growth and margin expansion potential.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market. This is expected to support long-term increases in units sold and revenue growth.

How is Carvana setting the stage for explosive growth? The underlying narrative is fueled by bold assumptions about future sales and profits, hinging on ambitious projections rarely found elsewhere. Is Carvana’s earnings trajectory on the verge of significant growth, or is the market already reflecting these expectations in its current price? This valuation draws upon aggressive forecasts and one surprising financial multiple.

Result: Fair Value of $414.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustaining rapid growth poses operational hurdles, and intensifying competition may limit market share. Both factors could dampen Carvana’s future earnings potential.

Find out about the key risks to this Carvana narrative.Another View: Based on Market Comparisons

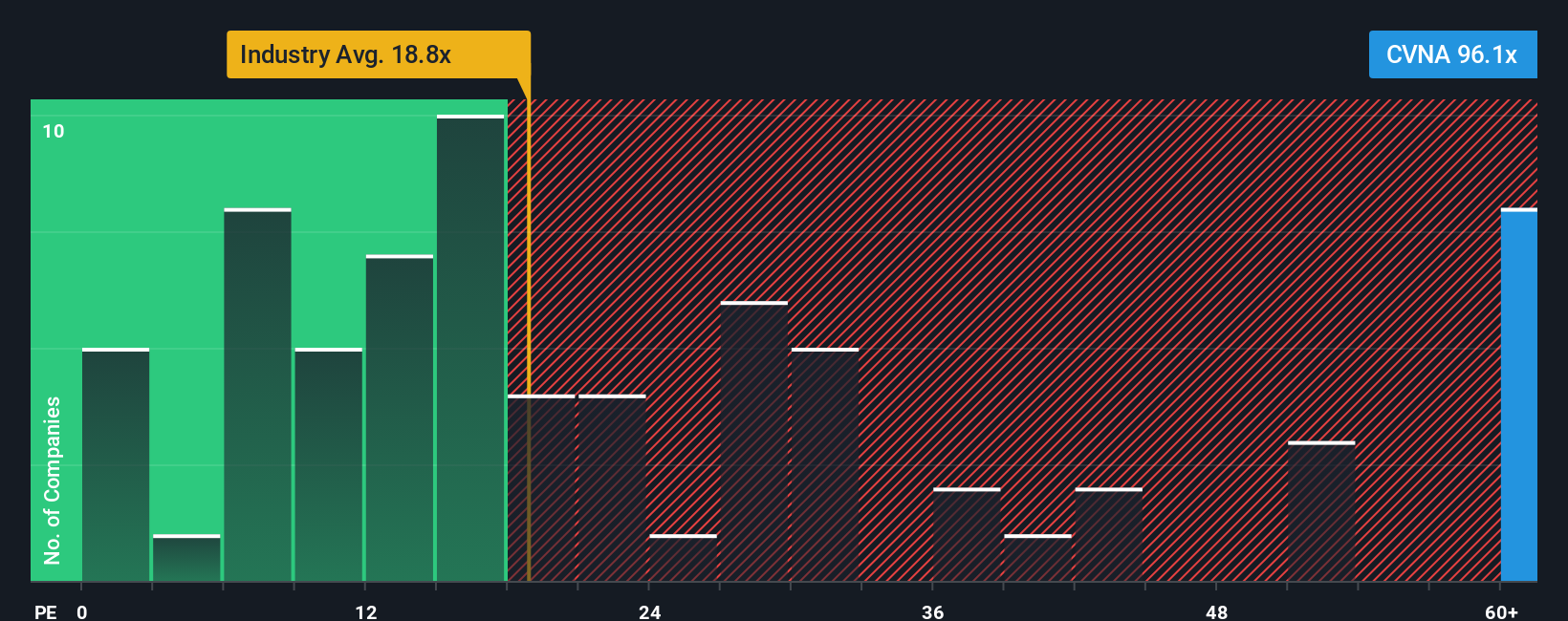

Looking at how the market prices Carvana compared to industry peers, a different picture emerges. By market standards, shares appear expensive rather than undervalued, challenging the optimistic growth outlook. Could the market be overstating Carvana’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Carvana to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Carvana Narrative

If you have your own perspective or want to dig deeper into the numbers, you can build a personalized take on Carvana’s outlook in just minutes. Do it your way

A great starting point for your Carvana research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop with just one opportunity? Uncover new possibilities right now and make sure you never miss the next breakout performer or high-potential trend.

- Target high yields and steady growth by checking out dividend champions through dividend stocks with yields > 3% who consistently pay over 3%.

- Capitalize on tomorrow's tech leaders by tapping into AI penny stocks featuring companies leveraging artificial intelligence innovations.

- Spot undervalued gems ready for a comeback by starting your search with undervalued stocks based on cash flows based on strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives