- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy's (NYSE:CHWY) Recovery Lies in Balance Between Profit Margins and Customer Retention

- CHWY missed its revenue by a tiny margin

- Lowering guidance is not surprising given the macro environment

- Pandemic tailwinds are likely over but that has been priced in, investors should watch out for margin improvements.

Over 3 years since its market debut, Chewy, Inc. ( NYSE: CHWY ) is back at the baseline as it trades around the price levels where it IPO'd.

During that time, the company more than doubled its revenues, yet consistent performance seems to elude it.

See our latest analysis for Chewy

Chewy Q2 Earnings Results

- EPS: US$0.053 (up from US$0.04 loss in 2Q 2022).

- Revenue: US$2.43b (up 13% from 2Q 2022).

- Net income: US$22.3m (up US$39.0m from 2Q 2022).

- Profit margin: 0.9% (up from net loss in 2Q 2022). The move to profitability was driven by higher revenue.

Chewy lowered the expectations for the full-year guidance, giving the range of US$9.9b to US$10b vs. the previous US$10.2b-US$10.4b).

This created mixed reactions from institutions. Morgan Stanley is cautious about reduced marketing spending and the margins - giving an Equal-weight rating with a price target of US$39. Meanwhile, Evercore ISI has a much higher price target at US$54, as well as Outperform rating – although they acknowledge the high Y/Y jump in inventories, likely caused by the Pandemic aftermath.

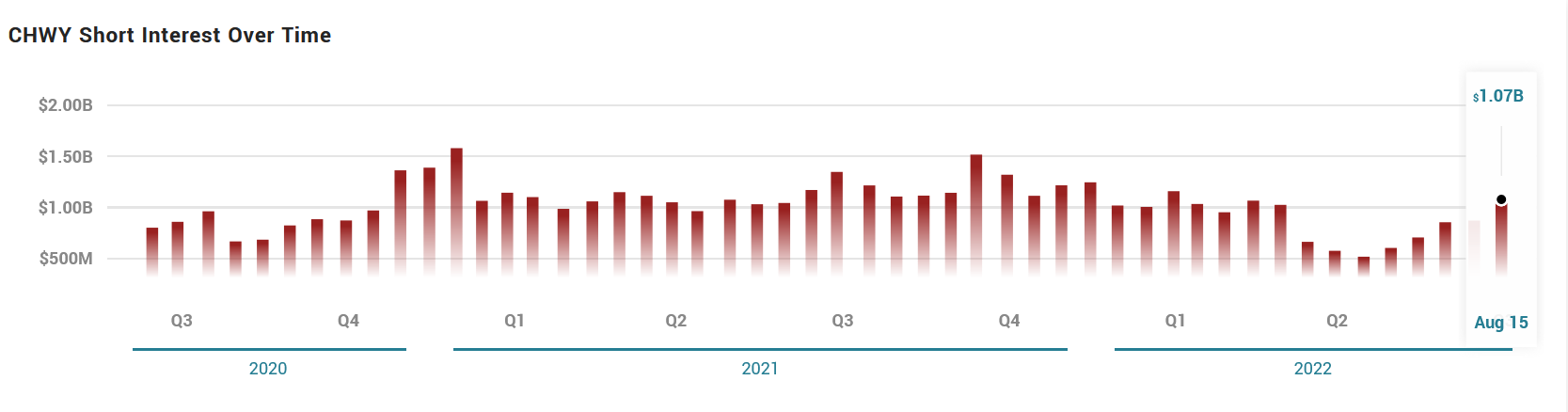

CHWY Has Rising Short Interest

The following data shows short interest in CHEWY

It is currently at 24% and rising, making it a potential candidate for the short squeeze. The last time this happened was in May, when the stock rallied over 100% from its lows. Interestingly, the current chairman of GameStop, the most popular retail stock, is Ryan Cohen – a founder and previous CEO of CHWY.

According to popular sentiment trackers, CHWY hasn't shown heightened activity among retail investors.

CHWY Revenue Growth & Projections

Chewy grew its revenue by 17% over the last year. We think that is pretty nice growth. Unfortunately, investors wanted more because the share price was down 57% then. It is, of course, possible that the business will still deliver strong growth. It will just take longer than expected to do it. To our minds, it isn't enough to look at revenue, anyway. Always consider when profits will flow.

The image below shows how earnings and revenue have been tracked over time (if you click on the image, you can see greater detail).

It's good to see some significant insider buying in the last three months. We think earnings and revenue growth trends are even more important factors. So we recommend checking out this free report showing consensus forecasts.

A Different Perspective

The last twelve months weren't great for Chewy shares, which performed worse than the market, costing holders 57%. Meanwhile, the broader market slid about 18%, likely weighing on the stock. While tempting, it is unlikely that the company will pursue retail-investor activism compared to the likes of GME and AMC. Chewy is a company that focuses its marketing on customer retention - betting on the predictability of pet food consumption and the convenience of the subscription-based business model. For this reason, potential investors should pay close attention to margins, as management recently adjusted EBITDA margin targets upwards to 1.75-2%.

To understand Chewy better, we need to consider other factors. For instance, we've identified 1 warning sign for Chewy that you should be aware of. If you're interested in other stocks the insiders are buying, take a peek at this free list of growing companies with insider buying.

Please note, that the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Chewy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CHWY

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives