- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Evaluating Valuation After Strong Results, Raised Outlook, and New Growth Initiatives

Reviewed by Kshitija Bhandaru

Chewy (CHWY) delivered stronger-than-expected quarterly results, with net sales exceeding guidance and an improved outlook for the year. The dominance of Autoship, introduction of new service offerings, and solid margins reflect a business showing momentum.

See our latest analysis for Chewy.

After a period of uneven trading, Chewy’s 12.6% share price return over the last month stands out, and its 34.1% total shareholder return in the past year signals renewed momentum as recurring revenue, margin gains, and fresh offerings capture investor attention. While the longer-term picture has been volatile, there is a clear sense that the company’s recent execution is starting to shift sentiment in its favor.

If you want to keep an eye on emerging winners beyond the headlines, now is a great opportunity to broaden your investing search and discover fast growing stocks with high insider ownership

With Chewy’s shares trading below analysts’ price targets and its rapid growth continuing to outpace many peers, investors are left to wonder if the recent rally signals untapped value or if the market has already accounted for future gains.

Most Popular Narrative: 14.1% Undervalued

Compared to Chewy’s last close price of $39.03, the most-followed valuation narrative pegs fair value at $45.45. This notable gap is worth examining. The core drivers are growth catalysts across new markets and digital platforms, as detailed below.

Chewy's strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market, likely increasing revenue and active customer engagement in 2025 and beyond. The migration to a 1P ad platform allows for enhanced advertising capabilities, including off-site ads and new content formats like video, which could grow the sponsored ads business up to 3% of total enterprise net sales, positively impacting gross margins.

Want to see what powers this bullish forecast? The numbers behind the narrative hint at bold expansion bets, digital innovation, and eye-catching margin projections. Unpack the full set of assumptions, as some will surprise even veteran market watchers. Dive in to explore which single growth lever could have the greatest impact on Chewy’s future value.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Chewy’s heavy reliance on Autoship subscriptions and modest customer growth present potential challenges to its long-term revenue and margin expansion outlook.

Find out about the key risks to this Chewy narrative.

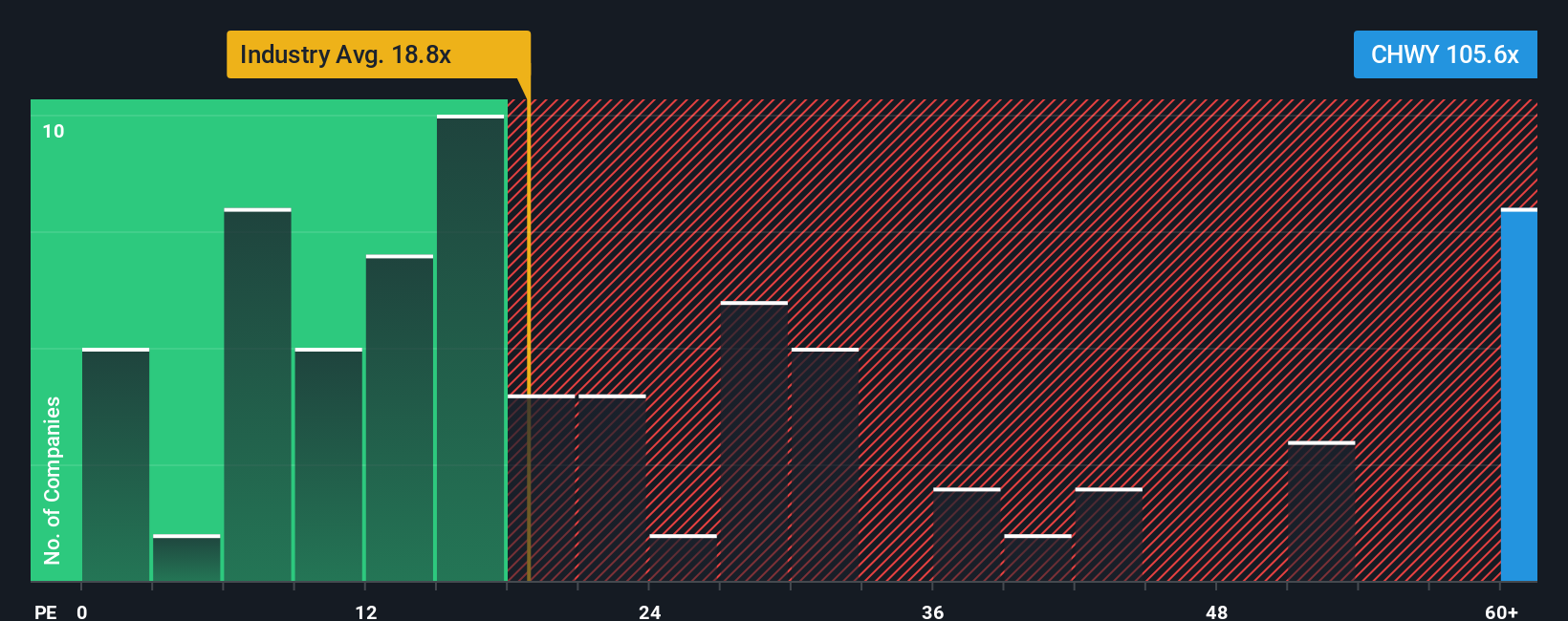

Another View: Multiples Suggest Chewy Is Pricey

While fair value estimates imply Chewy has room to run, a look at its earnings multiple offers a sharper reality check. Chewy trades at 107.1 times earnings, far above the US Specialty Retail industry average of 15.8x and its own fair ratio of 29.4x. This premium signals investors may be pricing in a lot of future success already.

Is Chewy’s premium justified? Could expectations run too far ahead of actual performance? The numbers spark as many questions as answers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you see the story differently, or trust your own research instincts, you can build your own perspective on Chewy’s value in just a few minutes. Do it your way

A great starting point for your Chewy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Successful investors never settle for just one opportunity. Expand your portfolio by targeting stocks with high potential using these cutting-edge search tools before the crowd catches on.

- Capture growth in digital health by tapping into these 33 healthcare AI stocks and see which companies are powering the next wave of medical innovation.

- Get ahead of the curve by uncovering value with these 893 undervalued stocks based on cash flows to spot promising businesses trading below their fair worth.

- Boost your income portfolio through these 19 dividend stocks with yields > 3%, featuring stocks that offer attractive yields greater than 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives