- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

March 2025 Penny Stocks Worth Watching

Reviewed by Simply Wall St

As the U.S. stock market grapples with political and economic uncertainty, major indices have experienced mixed performances, reflecting a struggle to rebound from recent sell-offs. Amidst this volatility, investors often turn their attention to penny stocks—smaller or newer companies that can present unique opportunities for growth at lower price points. While the term "penny stock" may seem dated, these investments can still offer significant potential when they are backed by strong financials and solid fundamentals. In this article, we explore three promising penny stocks that stand out as potential hidden gems in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.83947 | $6.1M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.65 | $76.7M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $141.07M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.80 | $398.41M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.46 | $74.62M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.51 | $49.83M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.85 | $76.45M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.35 | $443.52M | ★★★★☆☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7455 | $13.25M | ★★★★☆☆ |

Click here to see the full list of 770 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ribbon Communications (NasdaqGS:RBBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ribbon Communications Inc. delivers communications technology solutions across the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally with a market cap of approximately $694.11 million.

Operations: The company's revenue is primarily derived from its Cloud and Edge segment, which generated $505.16 million, and its IP Optical Networks segment, contributing $328.72 million.

Market Cap: $694.11M

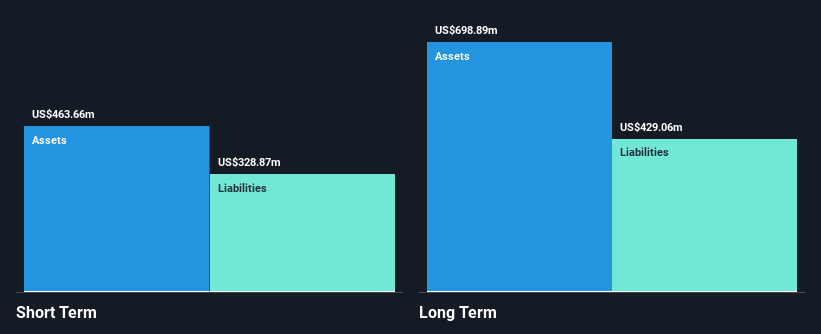

Ribbon Communications, with a market cap of approximately US$694.11 million, operates in the communications technology sector and has shown revenue growth despite being unprofitable. The company reported annual revenue of US$833.88 million for 2024, slightly up from the previous year, though it still posted a net loss of US$54.24 million. Its recent product announcements highlight innovation in network solutions with new routers enhancing operational efficiency and security features like software-driven MACsec. Despite high debt levels, Ribbon's cash runway exceeds three years, suggesting financial resilience amidst ongoing strategic developments and industry competition pressures.

- Navigate through the intricacies of Ribbon Communications with our comprehensive balance sheet health report here.

- Explore Ribbon Communications' analyst forecasts in our growth report.

United States Antimony (NYSEAM:UAMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United States Antimony Corporation engages in the production and sale of antimony, silver, gold, precious metals, and zeolite products across the United States and Canada with a market capitalization of $183.26 million.

Operations: The company's revenue is primarily derived from its United States antimony operations at $6.44 million, supplemented by zeolite sales totaling $2.80 million and precious metals contributing $0.49 million.

Market Cap: $183.26M

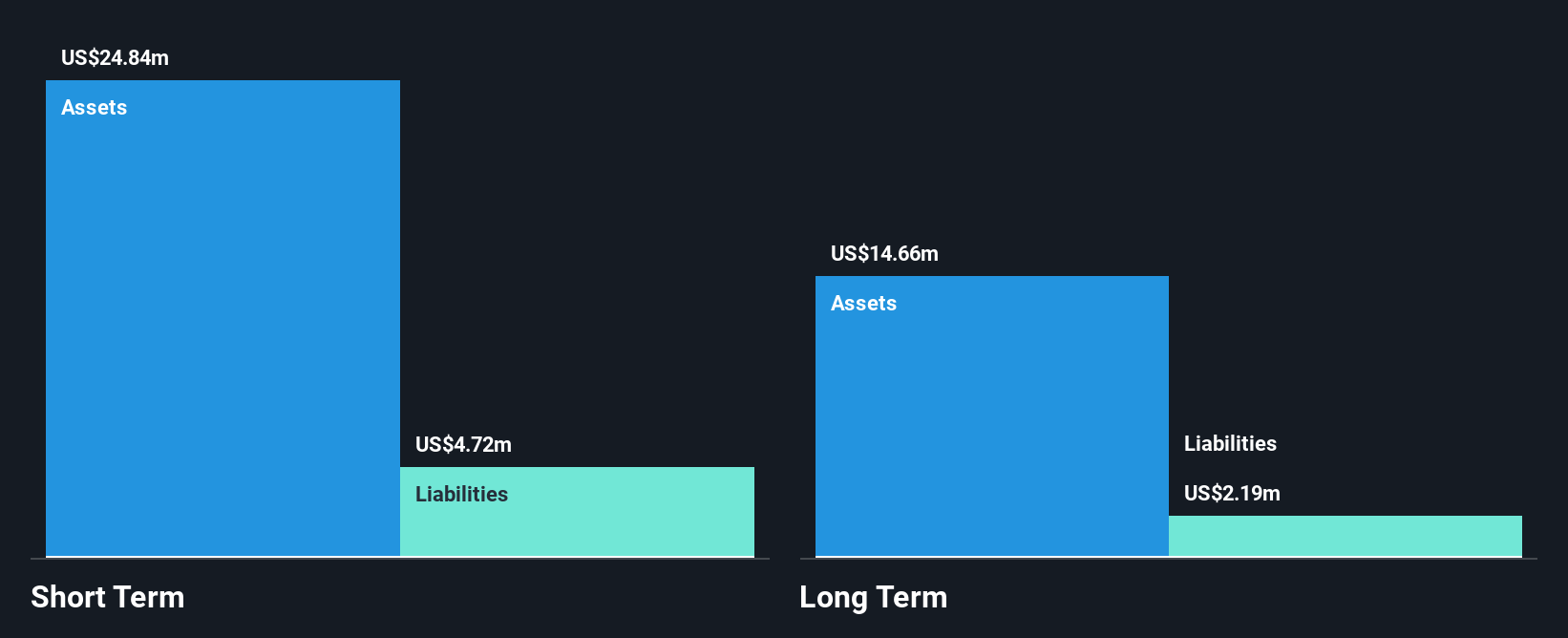

United States Antimony Corporation, with a market cap of US$183.26 million, remains unprofitable but has seen its debt to equity ratio significantly reduce from 20.3% to 1.4% over five years, indicating improved financial management. The company generates revenue primarily from antimony operations (US$6.44 million), supplemented by zeolite and precious metals sales. Despite high volatility in its share price and an inexperienced management team, the company maintains a cash runway exceeding three years without significant shareholder dilution recently. Upcoming presentations at investor summits suggest active engagement with stakeholders amidst ongoing strategic initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of United States Antimony.

- Understand United States Antimony's earnings outlook by examining our growth report.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cango Inc. operates an automotive transaction service platform in the People’s Republic of China, connecting various stakeholders in the car buying process, with a market cap of approximately $394.50 million.

Operations: The company's revenue is primarily derived from its Retail - Gasoline & Auto Dealers segment, which generated approximately CN¥804.49 million.

Market Cap: $394.5M

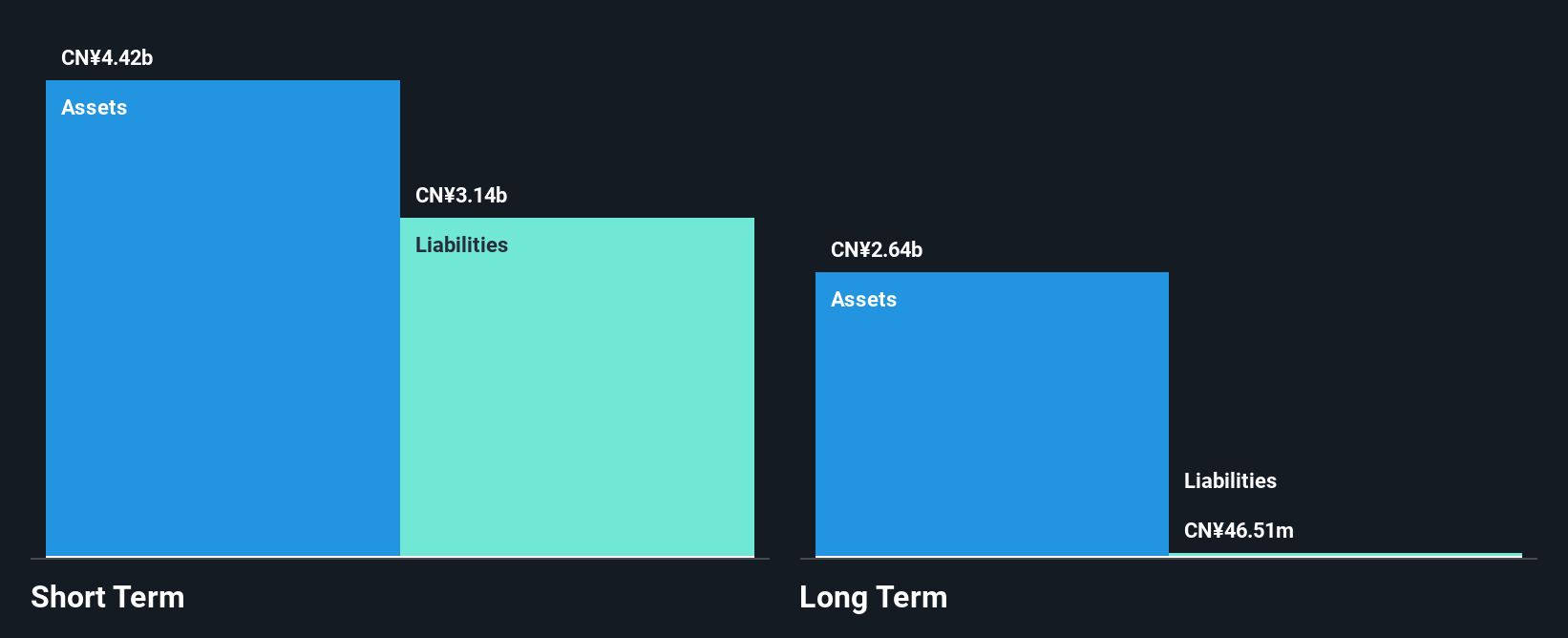

Cango Inc., with a market cap of approximately $394.50 million, has shown a turnaround by becoming profitable in the past year, reporting net income of CN¥299.82 million for 2024 compared to a loss previously. Despite high share price volatility and low return on equity at 7.3%, the company benefits from strong financial positioning, with short-term assets exceeding both short- and long-term liabilities significantly. Recent announcements include a $30 million share buyback program funded by existing cash reserves, indicating confidence in its valuation as it trades well below estimated fair value while maintaining high-quality earnings and substantial debt coverage through operating cash flow.

- Take a closer look at Cango's potential here in our financial health report.

- Evaluate Cango's prospects by accessing our earnings growth report.

Summing It All Up

- Investigate our full lineup of 770 US Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade United States Antimony, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, silver, gold, precious metals, and zeolite products in the United States, and Canada.

Flawless balance sheet with high growth potential.