How China’s Curbs on NVIDIA Chip Purchases Could Reshape Alibaba Group Holding's (BABA) AI Ambitions

Reviewed by Simply Wall St

- Earlier in September 2025, the Cyberspace Administration of China instructed major technology companies, including Alibaba, to halt purchases of NVIDIA's AI chips as part of a policy drive to support domestic semiconductor production.

- This development introduces regulatory headwinds for Alibaba, potentially affecting its access to advanced AI hardware and impacting its cloud and artificial intelligence ambitions amid ongoing technology investment initiatives.

- We'll examine how China's restriction on NVIDIA chip purchases may influence the outlook for Alibaba's AI and cloud business strategy.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alibaba Group Holding Investment Narrative Recap

To see upside as a shareholder in Alibaba today, you’d need to be convinced that the company’s multibillion-dollar investment into AI and cloud will ultimately create new revenue streams strong enough to outweigh both competitive and regulatory challenges. While China’s new restrictions on NVIDIA chip purchases introduce headline regulatory risk, access to AI hardware is a variable that, for now, adds uncertainty but does not materially change the near-term catalysts tied to cloud and AI adoption. The most pressing risk remains that ongoing heavy investment could keep margins under pressure if those bets don’t yield expected returns.

Among recent announcements, Alibaba completed a sizable US$3.168 billion convertible bond offering due 2032. Though not directly related to the AI chip supply news, this move gives Alibaba extra flexibility to fund its ongoing technology investments and respond to fast-shifting regulatory and competitive conditions, both essential for maintaining momentum in cloud and artificial intelligence, which are front and center among the company’s biggest short-term catalysts.

On the flip side, investors should keep in mind that access to critical AI hardware can hinge on shifting regulatory …

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's narrative projects CN¥1,260.3 billion revenue and CN¥171.1 billion earnings by 2028. This requires 8.0% yearly revenue growth and a CN¥22.8 billion earnings increase from CN¥148.3 billion today.

Uncover how Alibaba Group Holding's forecasts yield a $165.48 fair value, in line with its current price.

Exploring Other Perspectives

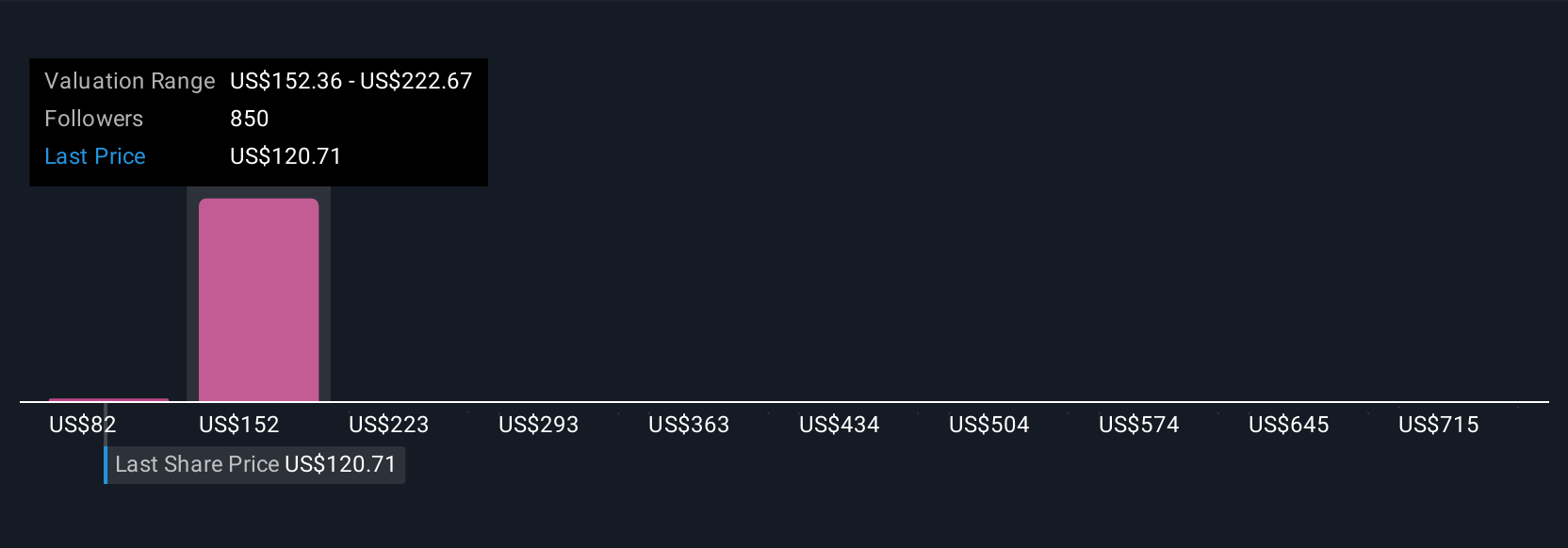

Over 78 fair value opinions from the Simply Wall St Community range from US$106.47 to US$785.21 per share. Against this wide backdrop, regulatory actions affecting AI hardware access could have outsized effects as Alibaba pushes to convert tech spending into sustainable cloud growth.

Explore 78 other fair value estimates on Alibaba Group Holding - why the stock might be worth 35% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives