Assessing Alibaba After 10% Share Price Drop and New US Export Control Concerns

Reviewed by Bailey Pemberton

Thinking of what to do with your Alibaba Group Holding shares? You are certainly not alone. The past year has been a wild ride for this stock, catching the eye of bold investors and cautious observers alike. Alibaba’s share price climbed an impressive 91.7% year-to-date and is up by a hefty 124.5% over the past three years. While the last week was rocky, with a 10.2% slide shaking out some of the momentum, the longer-term picture still points toward notable recovery after a multi-year slump that saw the stock down 44.7% over five years.

So, what is driving these ups and downs? Shifting risk perceptions from geopolitical headlines play a role, no doubt, as global policy tensions ebb and flow. Yet, even as chatter about export controls or regulatory winds occasionally sways investor confidence, Alibaba continues to rebuild trust and showcase a broader growth story. This hints at potential still to be harnessed.

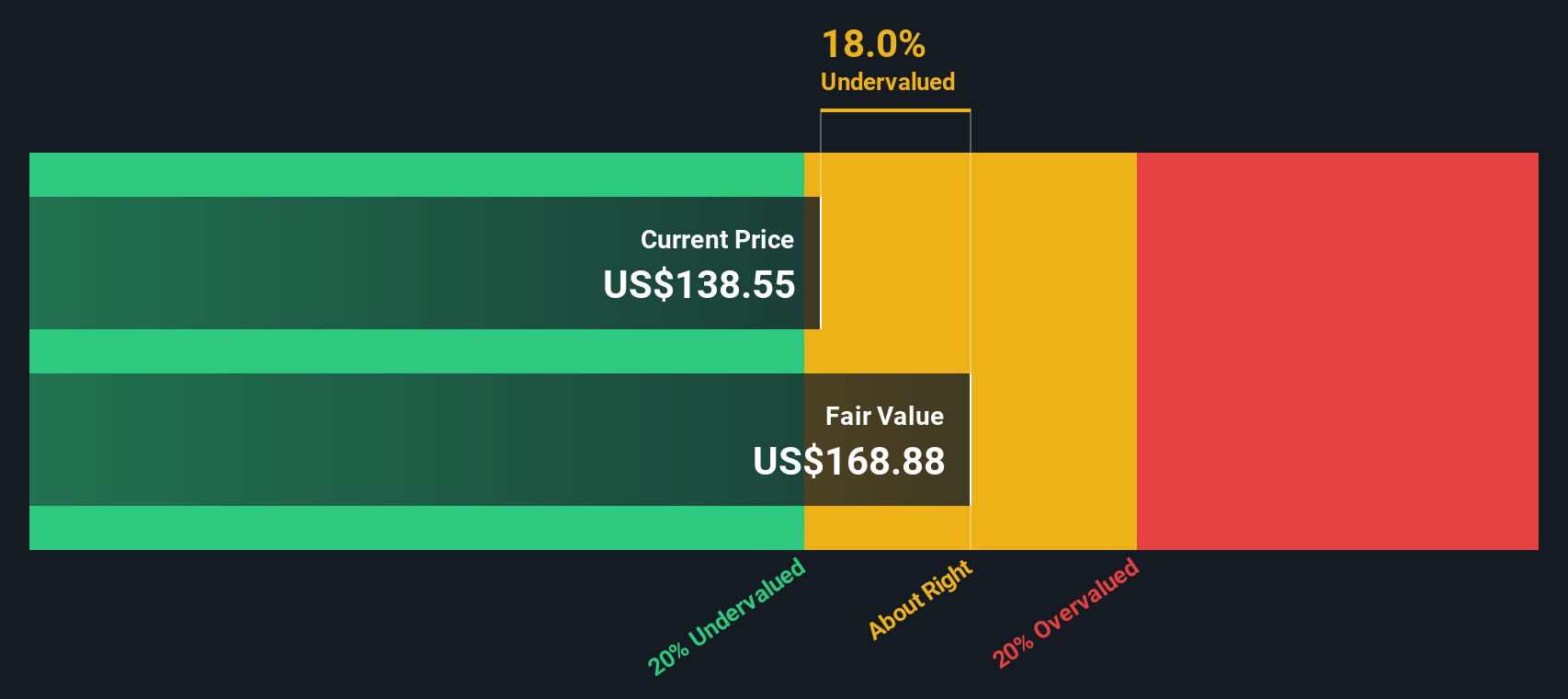

If you are looking for a quick sense of value, Alibaba currently scores a 3 on our valuation checkpoint. That means the company screens as undervalued in half of the six valuation checks we use. Not perfect, but it is certainly not expensive by most basic measures. This is a compelling point for value-conscious investors.

But numbers alone only tell part of the story. Let us dig in and see what each valuation approach reveals about Alibaba, and stick around for an even deeper take on what really matters when assessing its true worth.

Approach 1: Alibaba Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to their present value. This valuation approach helps investors gauge whether a stock is trading above or below its estimated intrinsic value based on real business performance, not market hype.

For Alibaba Group Holding, current Free Cash Flow (FCF) stands at about CN¥83.1 billion. Analysts forecast steady FCF growth, projecting annual cash flows of CN¥128.98 billion by 2028. While analysts offer five years of detailed estimates, further projections are extrapolated for the full ten years, with predicted FCF reaching as high as CN¥197.82 billion by 2035.

Applying the two-stage Free Cash Flow to Equity model, the DCF analysis estimates Alibaba's intrinsic value at CN¥147.71 per share. Compared to the company's recent share price, this implies the stock is trading 10.3% above its fair value, suggesting it is currently somewhat overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alibaba Group Holding may be overvalued by 10.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Alibaba Group Holding Price vs Earnings

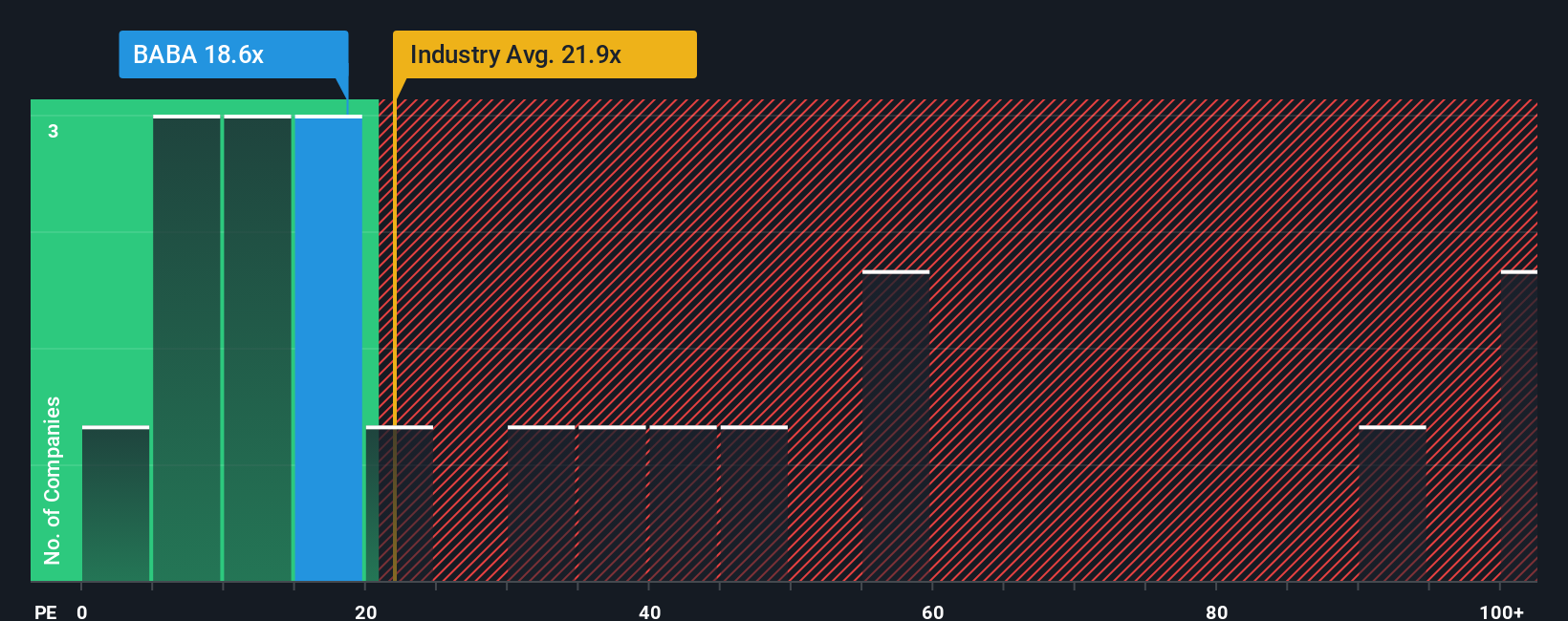

For profitable companies like Alibaba Group Holding, the Price-to-Earnings (PE) ratio is a widely accepted metric for valuation. The PE ratio helps investors gauge how much the market is willing to pay for each dollar of earnings, making it a practical tool for assessing established businesses generating consistent profits.

Interpreting what a “fair” PE should be, however, is more nuanced. Higher multiples often reflect above-average growth expectations or lower perceived risks. In contrast, lower multiples can indicate market skepticism about future prospects or heightened risks surrounding the business or industry.

Currently, Alibaba trades at 17.5x earnings, notably below the Multiline Retail industry average of 21.0x and even further beneath its peer group average of 47.2x. While these benchmarks provide context, they do not always account for Alibaba’s specific long-term prospects, risk profile, or earnings growth potential.

This is where the Simply Wall St Fair Ratio comes in. Unlike peer comparisons, the Fair Ratio delivers a bespoke benchmark by weighing Alibaba’s earnings growth, risk factors, profit margins, industry characteristics, and market cap. For Alibaba, the Fair Ratio is 28.9x, considerably higher than its current PE. This suggests the market is presently discounting Alibaba’s desirable characteristics more heavily than necessary, so there could be upside if sentiment shifts.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alibaba Group Holding Narrative

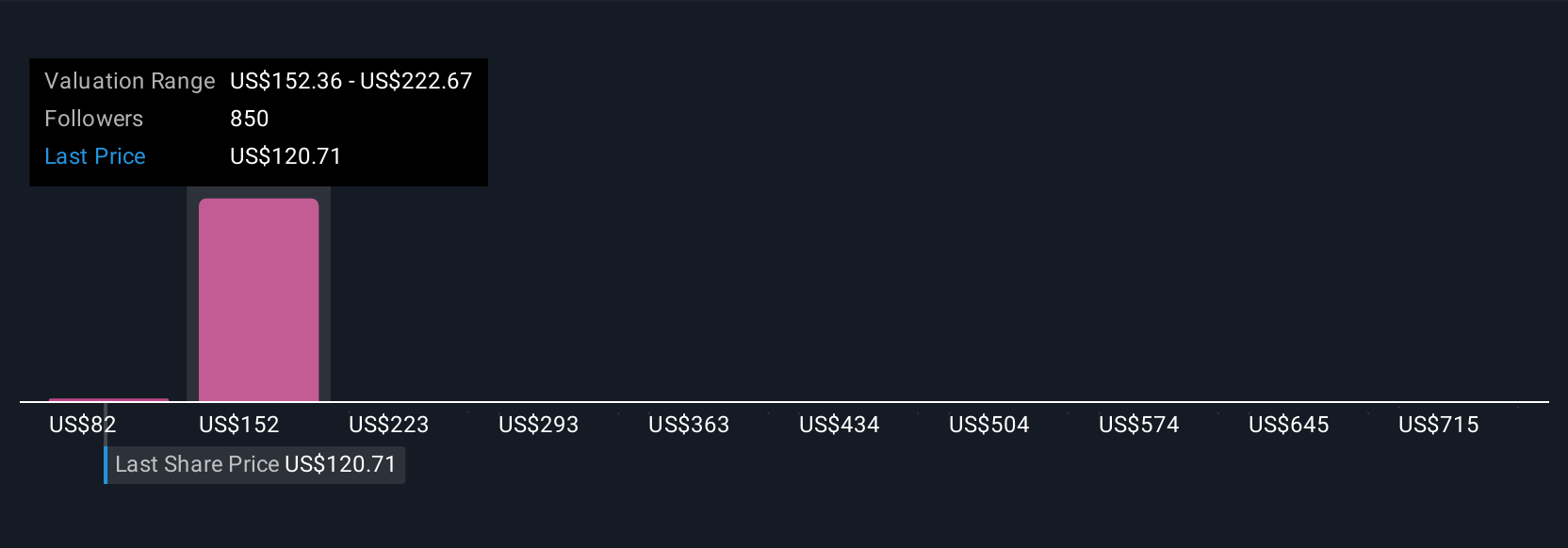

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply a way to describe your unique perspective on a company, pairing your story or thesis with numbers like fair value, projected revenue, earnings, and margins. By connecting a company's big-picture story to a detailed financial forecast and then to fair value, Narratives make it easier and more intuitive to invest with confidence.

On the Simply Wall St platform, Narratives are available for millions of investors to explore and share in the Community page. They allow you to see, at a glance, how your fair value compares to the current share price, and easily track when the market price drops below or rises above what you think Alibaba is really worth. Best of all, Narratives are kept up to date dynamically as new information such as earnings reports or news headlines comes in, giving you the insights you need when you need them.

For example, some investors currently have a Narrative with a fair value as high as $193 per share, driven by strong expectations for AI and cloud. Others see the fair value closer to $107, reflecting concerns around trade and regulatory risks. With Narratives, you can explore these perspectives, build your own, and decide whether now is the right time to buy, hold, or sell Alibaba shares on your terms.

For Alibaba Group Holding, however, we’ll make it really easy for you with previews of two leading Alibaba Group Holding Narratives:

🐂 Alibaba Group Holding Bull Case

Fair Value: $193.43

Current Price vs Fair Value: 15.8% undervalued

Forecast Revenue Growth: 8.8%

- Investment in AI, cloud, and quick commerce is expected to drive long-term revenue and margin growth. Alibaba is focusing on integration and partnerships to expand its enterprise reach.

- Analysts expect annual revenue growth of around 8%, though profit margins may shrink slightly as the company spends heavily on new business initiatives in the near term.

- The analysis concludes that the stock is trading below the fair value implied by the growth outlook. This suggests potential for upside if these digital investments are successful.

🐻 Alibaba Group Holding Bear Case

Fair Value: $107.09

Current Price vs Fair Value: 52.1% overvalued

Forecast Revenue Growth: 14.1%

- While Alibaba’s FY2025 results were solid and AI/cloud momentum is strong, the stock trades at a 14.6% premium to fair value using a DCF approach and may already be pricing in much of the good news.

- Risks include US-China trade tensions, regulatory pressures, competitive challenges in AI and cloud, and currency exposure, all of which could hamper future growth or profitability.

- Despite strong market positions and robust cash flow, macroeconomic and geopolitical headwinds limit optimism about near-term upside, raising caution about current valuations.

Do you think there's more to the story for Alibaba Group Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026