Alibaba Group Holding (NYSE:BABA) Surges 36% In Last Quarter With Major Share Buyback

Reviewed by Simply Wall St

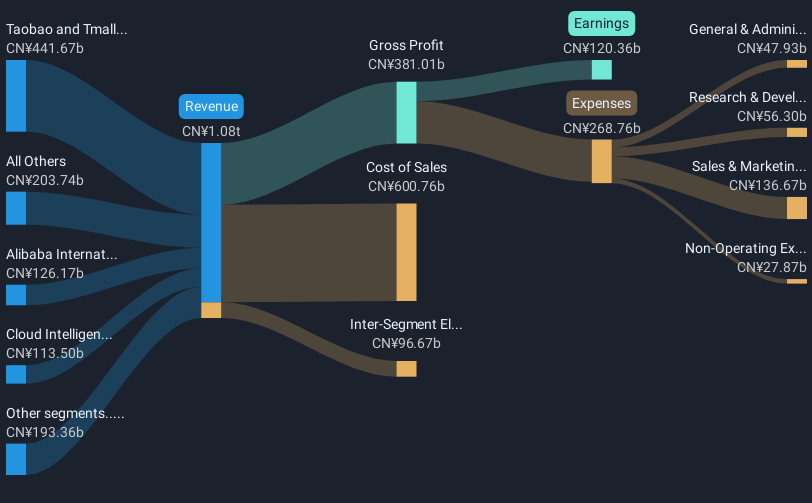

Alibaba Group Holding (NYSE:BABA) recently reported a 36% price increase over the last quarter, a period marked by significant events that likely influenced investor sentiment. Central to this was the company's buyback program update, with Alibaba repurchasing 51 million shares, representing 2.2% of shares outstanding, indicating strong shareholder return initiatives. This move coincided with robust third-quarter earnings growth, where net income surged significantly, which may have bolstered investor confidence. Despite broader market turbulence due to U.S.-China trade tensions affecting tech stocks, Alibaba's performance and strategic financial activities appeared to add positive momentum, aligning it favorably with general market gains.

The 36% price increase in Alibaba's shares over the last quarter reflects a positive investor response to the company's shareholder return initiatives like the repurchase of 51 million shares, representing 2.2% of shares outstanding. This shareholder-friendly move adds upward momentum to the stock, particularly if we consider last year's total shareholder return of 64.76%, inclusive of share price and dividends. Evaluating the longer-term context, this robust performance contrasts with Alibaba's past five-year average annual earnings decline of 16.4%, indicating a possible turning point for the company's financial trajectory.

The update on Alibaba's buyback program could potentially influence analysts' revenue and earnings forecasts. As share repurchase efforts aim to reduce share count and enhance shareholder value, they can positively affect earnings per share (EPS) calculations. Furthermore, anticipated investments in AI and cloud services are expected to bolster Alibaba's revenue and margins over the long term. However, these high investments and competitive market pressures could affect free cash flow and margin growth. Currently, Alibaba's share price trades with a considerable discount to the consensus price target of US$162.79, suggesting room for further appreciation if the projected growth materializes.

Additionally, Alibaba's one-year return of 64.76% significantly outpaced the US Multiline Retail industry, which returned 3.4% over the same period. This contrasting performance could emphasize Alibaba's relative strength in the market, reinforcing positive sentiment among investors, provided the revenue and earnings growth expectations align with reality. Although Alibaba is trading below the analyst community's consensus price target, aligning with a potential 30% upside, careful evaluation of the revenue and earnings assumptions underlying these projections is essential for a well-rounded assessment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives