A Fresh Look at Alibaba (NYSE:BABA) Shares: Is the Current Valuation Justified?

Reviewed by Kshitija Bhandaru

See our latest analysis for Alibaba Group Holding.

Alibaba Group Holding’s recent surge has captured plenty of attention, with the share price climbing over 10% in the past month and up a striking 87% year-to-date. Even so, sharp pullbacks like the recent 8% drop are reminders of how sentiment and momentum can shift. Over longer periods, the total shareholder return paints a more nuanced story, rising 47% over one year but still down 45% over five years.

If Alibaba’s ride has you exploring what else the market has to offer, now's a smart time to discover fast growing stocks with high insider ownership

With shares rebounding in recent months but still lagging their five-year peak, the question remains: is Alibaba undervalued at current levels, or are investors already factoring in most of its future growth potential?

Most Popular Narrative: 48.5% Overvalued

Alibaba’s market price is trading well above the narrative’s fair value estimate, highlighting a tension between recent optimism and tougher macro realities. As momentum builds, the underlying assumptions become the key focus for anyone questioning if future returns can keep pace with expectations.

"Alibaba delivered solid FY2025 results with revenue growing 6% to RMB 996.3 billion ($137.3B). Key highlights include core e-commerce (Taobao/Tmall) customer management revenue growing 12%, Cloud Intelligence revenue accelerating to 18% growth, and AI-related products achieving triple-digit growth for the seventh consecutive quarter."

The numbers at the heart of this story may surprise you. The narrative relies on rapid gains in cloud, e-commerce, and a growth engine that shows no sign of slowing. Which bold projections about future business lines drive this contested valuation? Find out how aggressive assumptions about profit and expansion could change your entire view of Alibaba’s prospects.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed US-China tensions or fresh regulatory crackdowns could quickly shift sentiment and challenge even the most optimistic growth outlooks for Alibaba.

Find out about the key risks to this Alibaba Group Holding narrative.

Another View: Relative Value Points to Opportunity

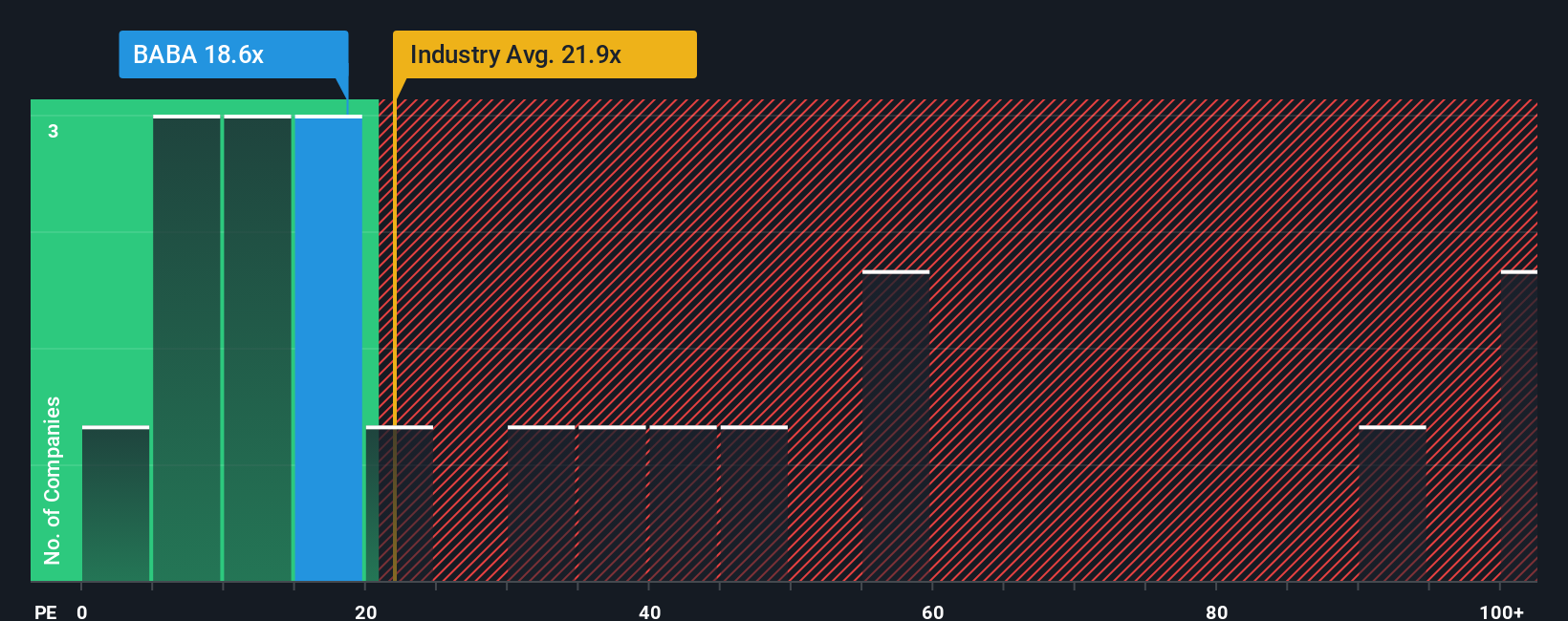

Looking at Alibaba’s valuation through a price-to-earnings lens, shares trade at 17.1x, which is notably cheaper compared to both the global industry average of 21.9x and peers at 46.9x. The fair ratio suggests the market could eventually move closer to 29x. Does this create a hidden opportunity or leave investors exposed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you think this perspective misses the mark or prefer forming your own conclusions, dive into the numbers yourself and shape your personal outlook. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for more investment ideas?

Unlock your edge as an investor by checking out handpicked stock collections powered by the latest financial data and trends. You’ll regret missing out on these unique opportunities designed to help you get ahead.

- Amplify your portfolio with income opportunities by checking out these 19 dividend stocks with yields > 3%, which delivers yields over 3% for strong potential returns.

- Ride the AI wave and see what’s next by scanning through these 24 AI penny stocks, poised to lead breakthroughs in areas from automation to big data.

- Position yourself for long-term gains with these 898 undervalued stocks based on cash flows, which the market might be overlooking based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives