- United States

- /

- Specialty Stores

- /

- NasdaqCM:XELB

Xcel Brands, Inc.'s (NASDAQ:XELB) Popularity With Investors Under Threat As Stock Sinks 26%

The Xcel Brands, Inc. (NASDAQ:XELB) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 23%.

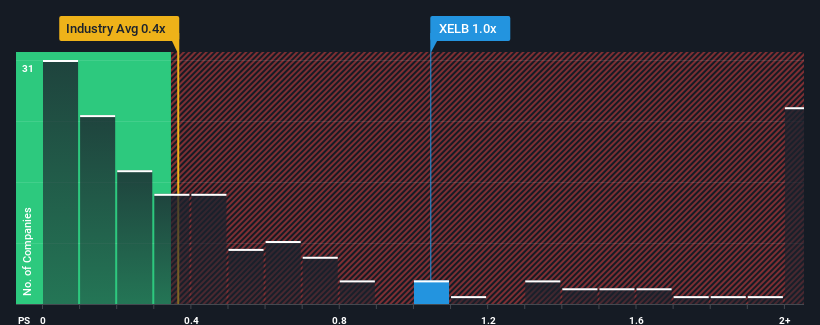

Even after such a large drop in price, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Xcel Brands as a stock probably not worth researching with its 1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Xcel Brands

What Does Xcel Brands' P/S Mean For Shareholders?

Xcel Brands could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xcel Brands.How Is Xcel Brands' Revenue Growth Trending?

Xcel Brands' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's top line. As a result, revenue from three years ago have also fallen 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 13% as estimated by the two analysts watching the company. That's not great when the rest of the industry is expected to grow by 5.6%.

In light of this, it's alarming that Xcel Brands' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Xcel Brands' P/S Mean For Investors?

Despite the recent share price weakness, Xcel Brands' P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Xcel Brands currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Xcel Brands you should know about.

If these risks are making you reconsider your opinion on Xcel Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XELB

Xcel Brands

Operates as a media and consumer products company in the United States.

Fair value low.

Similar Companies

Market Insights

Community Narratives