- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

Will Winmark’s (WINA) Special Dividend Reveal a Shift in Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Winmark Corporation recently announced that its Board of Directors approved both a quarterly cash dividend of US$0.96 per share and a special dividend of US$10.00 per share, both to be paid on December 1, 2025, to shareholders of record as of November 12, 2025.

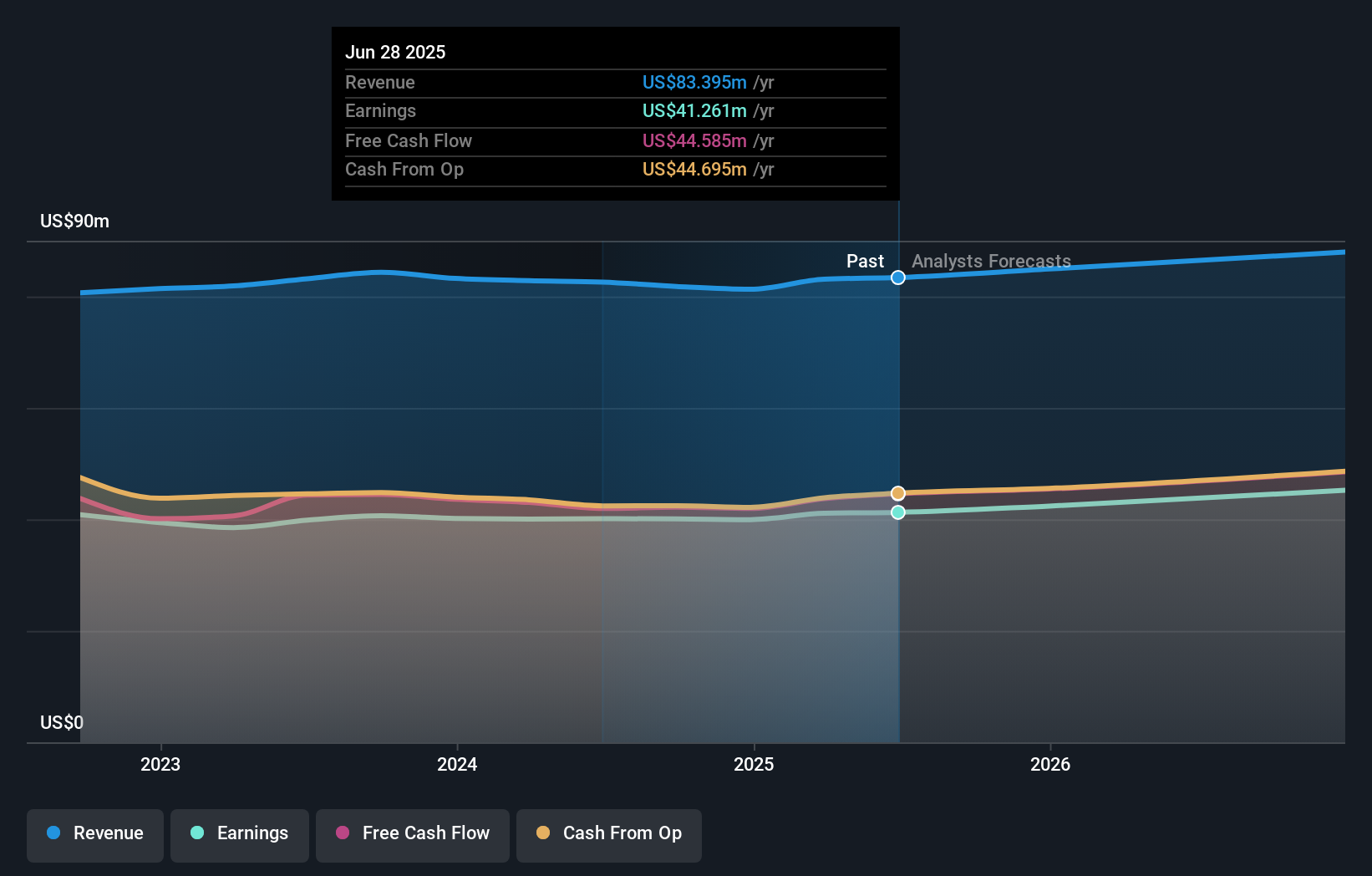

- This dividend news came alongside Winmark’s third quarter earnings report, which highlighted steady revenue growth and net income compared to the prior year.

- We'll explore how the special dividend funded by cash on hand strengthens Winmark’s investment narrative and shareholder appeal.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Winmark's Investment Narrative?

To be a Winmark shareholder, you typically need conviction in its focused franchise model, disciplined cost management, and cash-generative business that’s supported stable growth even as top-line revenue gains have moderated. The freshly announced special dividend of US$10.00 per share, funded by cash on hand, serves as an eye-catching sign of management confidence, rewarding shareholders without relying on new debt. While this payout may temporarily shrink the company’s cash reserves, it doesn’t change the underlying catalysts: steady franchise expansion, margin stability, and operational discipline. Still, this sizable distribution, alongside recent insider selling, a relatively high valuation, and negative shareholders’ equity, could amplify market concern about Winmark’s ability to maintain balance sheet strength and future flexibility. In the short term, expect attention on how management preserves financial resilience after such a large capital return. However, insider selling and negative equity remain key risks for anyone considering Winmark.

Winmark's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Winmark - why the stock might be worth as much as $284.42!

Build Your Own Winmark Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Winmark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winmark's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives