- United States

- /

- Specialty Stores

- /

- NasdaqGS:SCVL

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the wake of a significant surge in major U.S. indices following a pivotal U.S.-China tariff agreement, investors are keenly observing market dynamics as stocks like Amazon, Apple, and Nike drive notable gains. Amidst this optimistic backdrop, dividend stocks remain an attractive option for those seeking steady income and potential growth, especially during times of economic uncertainty when consistent returns become increasingly valuable.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.02% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.97% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.22% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.27% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.94% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.33% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.99% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.07% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.53% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.37% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

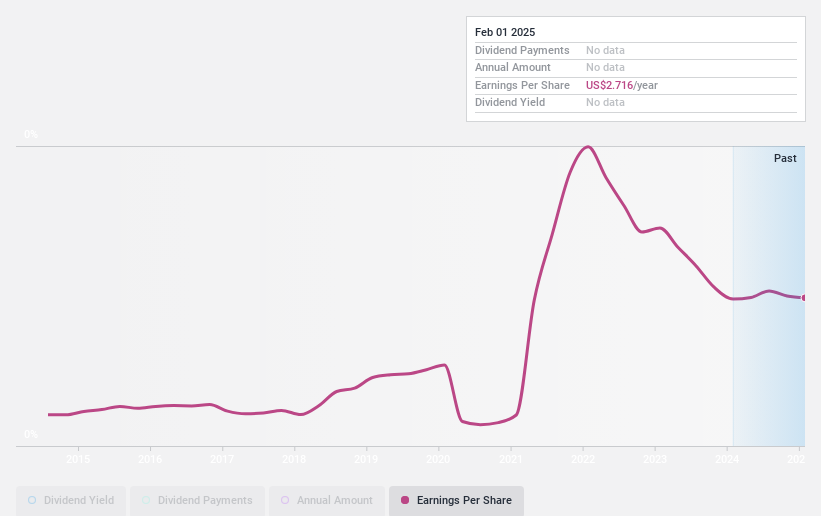

Shoe Carnival (NasdaqGS:SCVL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shoe Carnival, Inc. operates as a family footwear retailer in the United States with a market cap of approximately $488.60 million.

Operations: Shoe Carnival, Inc. generates its revenue primarily from its retail footwear segment, which accounts for $1.20 billion.

Dividend Yield: 3.3%

Shoe Carnival offers a stable dividend yield of 3.34%, supported by a low payout ratio of 19.9% and cash flow coverage at 23.5%. The company has consistently increased dividends over the past decade, recently raising its quarterly dividend by 11.1% to $0.15 per share. Despite earnings growth of just $0.42 million last year, future earnings are projected to decline, which could pressure dividend sustainability in the long term.

- Click here and access our complete dividend analysis report to understand the dynamics of Shoe Carnival.

- The valuation report we've compiled suggests that Shoe Carnival's current price could be quite moderate.

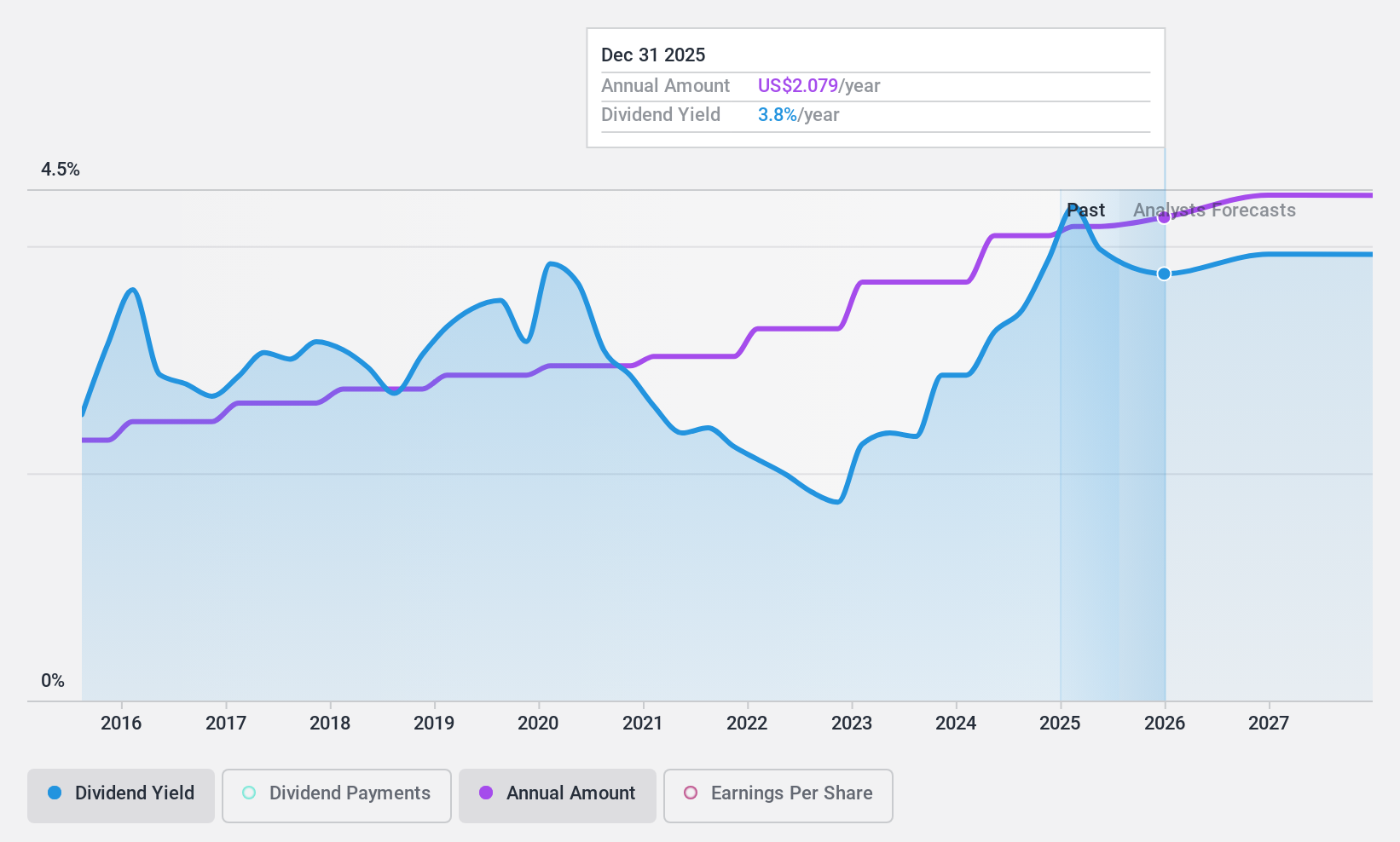

Archer-Daniels-Midland (NYSE:ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products globally, with a market cap of approximately $23.32 billion.

Operations: Archer-Daniels-Midland Company's revenue is primarily derived from its AG Services and Oilseeds segment at $66.68 billion, followed by Carbohydrate Solutions at $12.00 billion, and Nutrition at $7.40 billion.

Dividend Yield: 4.2%

Archer-Daniels-Midland's dividend reliability is underscored by a decade of stable and growing payments, although its current 4.2% yield lags behind top-tier payers in the US market. The dividend is covered by earnings with a reasonable payout ratio of 71.3%, but not well-supported by cash flows, evidenced by a high cash payout ratio of 441.5%. Recent earnings showed decreased net income and sales, which could impact future dividend sustainability despite ongoing strategic alliances and potential divestitures to streamline operations.

- Unlock comprehensive insights into our analysis of Archer-Daniels-Midland stock in this dividend report.

- Our valuation report here indicates Archer-Daniels-Midland may be overvalued.

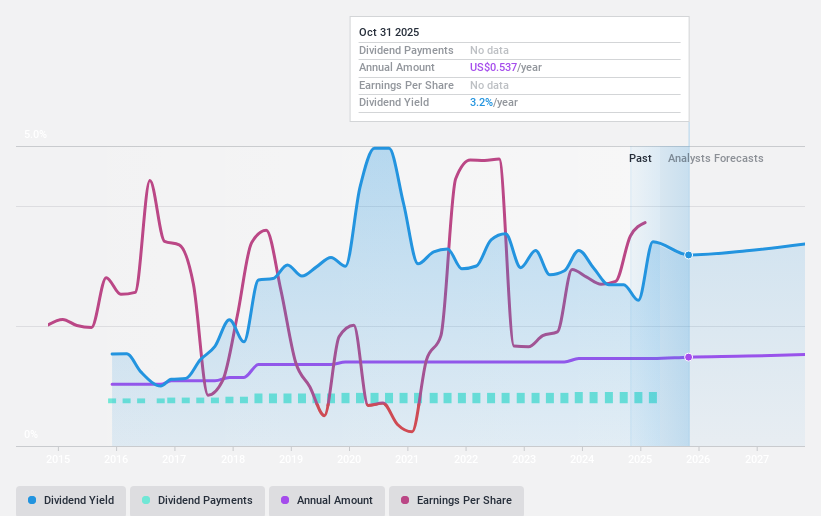

Hewlett Packard Enterprise (NYSE:HPE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hewlett Packard Enterprise Company offers data solutions across various regions, including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan, with a market cap of approximately $22.19 billion.

Operations: Hewlett Packard Enterprise's revenue is primarily derived from its Server segment at $17.17 billion, Hybrid Cloud at $5.52 billion, Intelligent Edge at $4.48 billion, and Financial Services at $3.51 billion.

Dividend Yield: 3.1%

Hewlett Packard Enterprise's dividend history reflects stability and growth over the past decade, with a current yield of 3.08%, lower than top-tier US dividend payers. The dividends are well-covered by both earnings and cash flows, with payout ratios of 24.7% and 41.4%, respectively, suggesting sustainability. Recent initiatives include a preferred dividend declaration and strategic deployments in networking technology, reinforcing its commitment to shareholder returns amidst evolving market dynamics.

- Delve into the full analysis dividend report here for a deeper understanding of Hewlett Packard Enterprise.

- Our valuation report here indicates Hewlett Packard Enterprise may be undervalued.

Summing It All Up

- Navigate through the entire inventory of 145 Top US Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shoe Carnival, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCVL

Shoe Carnival

Operates as a family footwear retailer in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives