- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Ross Stores (NasdaqGS:ROST) Declares US$0.41 Dividend for June 2025

Reviewed by Simply Wall St

Ross Stores (NasdaqGS:ROST) recently declared a quarterly cash dividend of $0.405 per share, adding stability despite the wider market's 1% decline. During the past month, Ross Stores experienced a price move of 13%, a stark contrast to the broader market's performance. The company's upcoming earnings release may have influenced investor optimism, as anticipation typically affects share price. Broader market trends, including a rebound from a sell-off and fluctuating bond yields, provided a backdrop to Ross Stores' performance, though its upward trajectory appears independent of these broader market movements.

Ross Stores has 1 weakness we think you should know about.

Ross Stores' recent announcement of a US$0.405 dividend could signal investor confidence and support for stability amid market shifts. Although the share price rose 13% in the past month, the total return over the past three years, which includes both share price appreciation and dividends, was a significant 94.29%. This growth surpasses the previous year's performance, where Ross Stores kept pace with the US Specialty Retail industry but exceeded the broader market.

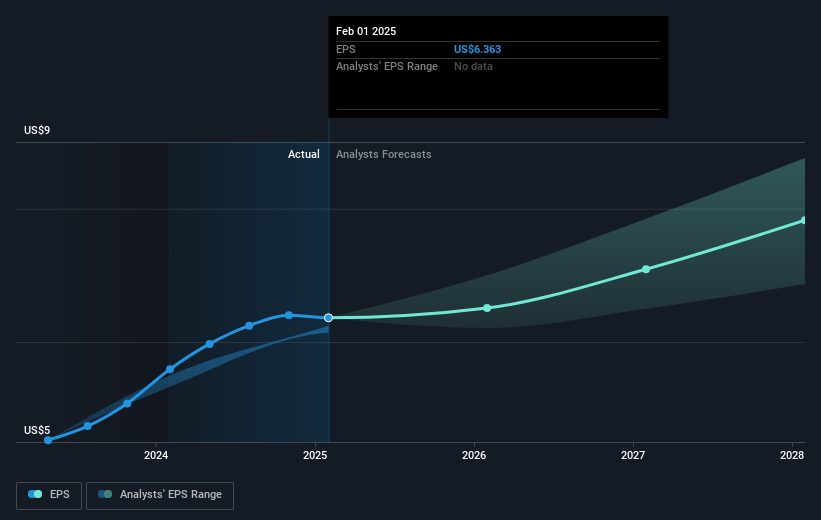

The company's strategy to expand dd's DISCOUNTS, alongside supply chain enhancements, may positively influence future revenue streams and earnings projections. Analysts forecast earnings to grow to US$2.4 billion by 2028, with revenue expected to hit US$24.4 billion, supported by ongoing share buybacks and dividends. The anticipated improvements in the store environment and marketing could further enhance customer experience and traffic, contributing to revenue growth.

At the current share price of US$141.61, the recent price movement reflects investor optimism, aligning closely with the consensus price target of US$154.83. This price target, which is just 8.5% above the current price, suggests the market views Ross Stores as fairly priced. However, potential factors such as macroeconomic volatility could impact these forecasts. Investors should monitor external influences and internal profit margin pressures that could affect the company’s ability to maintain its growth trajectory.

Our expertly prepared valuation report Ross Stores implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ross Stores, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives