- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

The Pinduoduo (NASDAQ:PDD) Share Price Has Soared 327%, Delighting Many Shareholders

It might be of some concern to shareholders to see the Pinduoduo Inc. (NASDAQ:PDD) share price down 20% in the last month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In fact, it is up 327% in that time. Arguably, the recent fall is to be expected after such a strong rise. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Check out our latest analysis for Pinduoduo

Because Pinduoduo made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Pinduoduo grew its revenue by 75% last year. That's a head and shoulders above most loss-making companies. But the share price seems headed to the moon, up 327% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

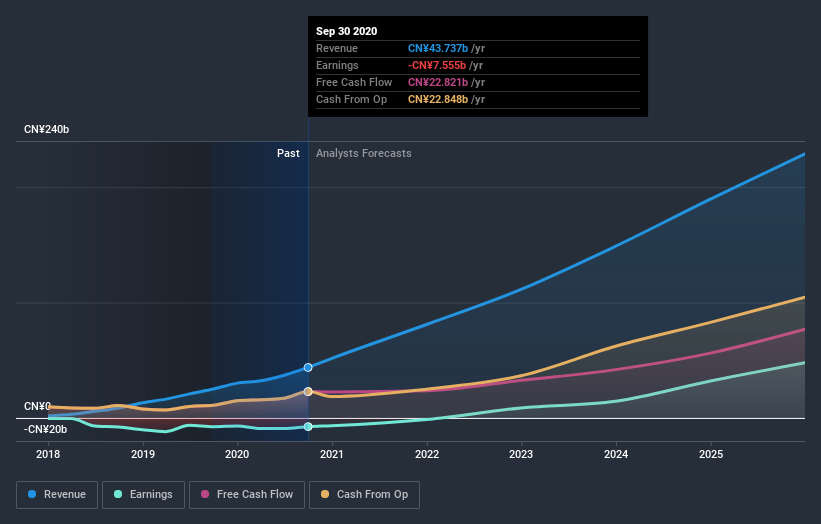

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Pinduoduo is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Pinduoduo boasts a total shareholder return of 327% for the last year. That's better than the more recent three month gain of 6.8%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Pinduoduo has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Pinduoduo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group, owns and operates a portfolio of businesses.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives