- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Should Rising Sales and Falling Profits in Q2 2025 Require Action From PDD Holdings (PDD) Investors?

Reviewed by Simply Wall St

- PDD Holdings recently reported its second quarter 2025 earnings, with sales rising to CNY 103.98 billion while net income declined to CNY 30.75 billion compared to a year earlier.

- Despite higher revenues, the decrease in both net income and earnings per share highlights ongoing margin pressures as the company continues aggressive investment.

- We will examine how the combination of growing sales and reduced profitability is shaping PDD Holdings' long-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PDD Holdings Investment Narrative Recap

To be a shareholder in PDD Holdings, you need to believe that its ongoing heavy investment in customer and merchant support will eventually translate into durable revenue growth and stronger ecosystem loyalty, even if near-term profitability comes under pressure. The latest quarterly results, highlighting stronger sales but a decline in net income and earnings per share, point to intensifying margin pressures yet do not change the biggest short-term catalyst: the impact of these investments on user and merchant retention. The key risk remains whether this spending will deliver the improved outcomes needed for long-term profit growth; based on current figures, this impact cannot be considered material to the overall investment case just yet.

Among recent announcements, the RMB 100 billion merchant and consumer support program is most relevant to these results, and aligns with management’s willingness to sacrifice margins in pursuit of greater long-term scale. This large spending, designed to boost user engagement and competitive positioning, is reflected in the declining net income despite rising revenue, showing the ongoing trade-offs as PDD pursues aggressive expansion.

In contrast, one important risk that investors should be aware of is the potential for a sustained mismatch between spending and returns if these investments do not create lasting improvements in the platform ecosystem...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings' outlook points to CN¥557.7 billion in revenue and CN¥147.0 billion in earnings by 2028. Achieving this would require 10.8% annual revenue growth and a CN¥49.1 billion increase in earnings from the current CN¥97.9 billion.

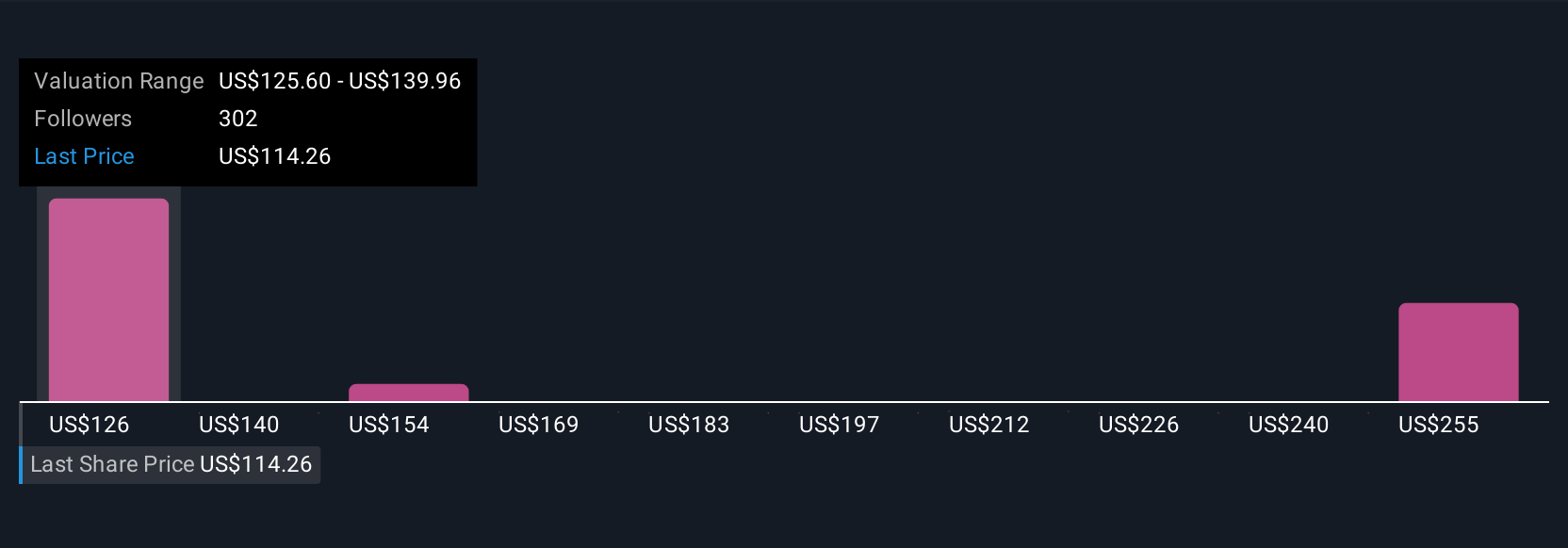

Uncover how PDD Holdings' forecasts yield a $140.27 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$140 to US$352, with 22 private investor views included. Continued heavy investment and resulting profit margin pressure remain key themes, inviting you to consider several alternative viewpoints about PDD Holdings’ future.

Explore 22 other fair value estimates on PDD Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives