- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Can PDD Holdings' (PDD) Ecosystem Investments Offset Trade Tensions and Shifting Consumer Trends?

Reviewed by Sasha Jovanovic

- In the past week, PDD Holdings faced renewed scrutiny as investors weighed expectations for slower EPS growth and steadier revenue gains ahead of upcoming earnings, set against a backdrop of escalating US-China trade tensions.

- An area to watch is PDD's substantial investments in fee reductions and logistics, aimed at supporting smaller merchants and deepening its reach into underserved markets during a period of shifting consumer patterns.

- We'll examine how PDD Holdings' targeted ecosystem investments amid trade uncertainty are influencing its business outlook and investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PDD Holdings Investment Narrative Recap

Investors considering PDD Holdings need conviction that the company's deep investments in ecosystem expansion, fee reductions, and logistics will translate into meaningful future growth, all while navigating earnings headwinds and US-China trade tensions. While recent news of a modest share price dip and expectations for a near-term EPS decline could fuel short-term volatility, analysts still see revenue gains as the key catalyst, whereas concerns about prolonged margin pressure from ongoing investments remain the most significant risk; the latest announcements do not materially alter these dynamics.

The most directly relevant update has been PDD Holdings' explicit decision to sustain lower transaction fees as part of its earnings strategy, reinforcing the company's long-term focus on supporting merchants and pursuing user growth. This aligns closely with ongoing margin concerns, even as management emphasizes capturing e-commerce market share and driving revenue over immediate profitability. The real test for investors is whether PDD's spending will yield lasting customer and merchant loyalty, or if those margin sacrifices could persist beyond expectations...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings is expected to achieve CN¥555.7 billion in revenue and CN¥147.1 billion in earnings by 2028. This outlook is based on analysts forecasting a 10.7% annual revenue growth rate and an earnings increase of CN¥49.2 billion from the current CN¥97.9 billion.

Uncover how PDD Holdings' forecasts yield a $143.36 fair value, a 12% upside to its current price.

Exploring Other Perspectives

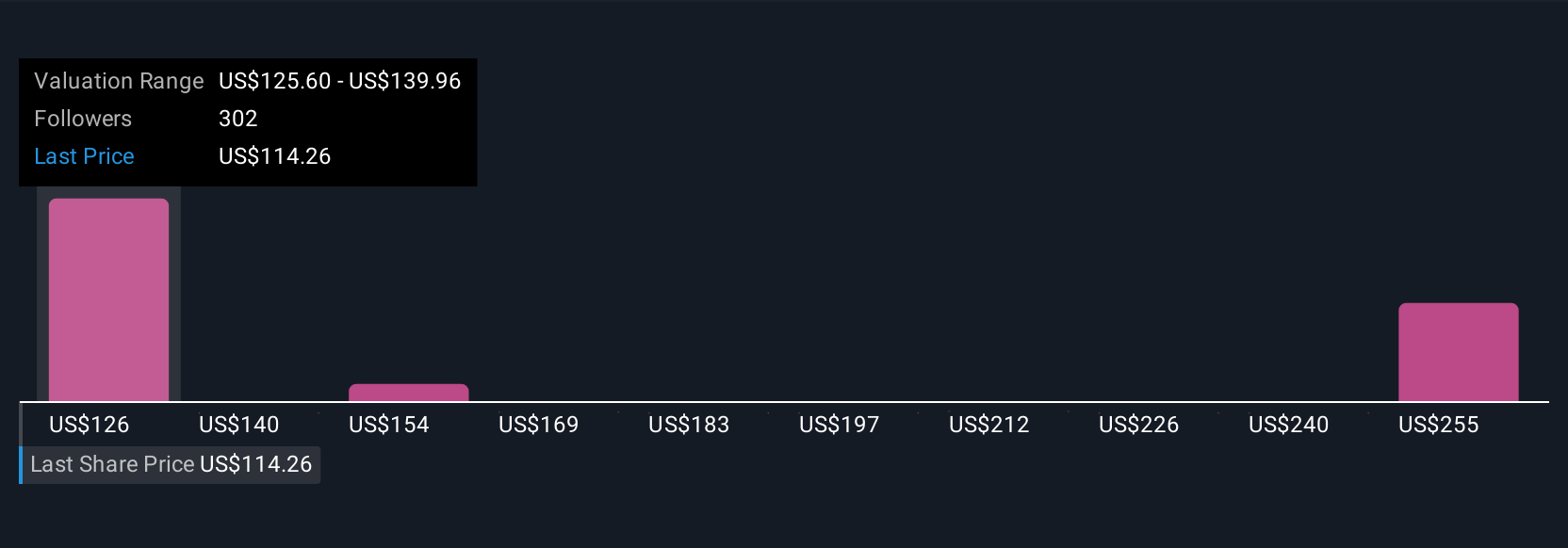

Twenty-three private investors in the Simply Wall St Community see fair value for PDD Holdings ranging from US$138.77 to US$361.04 per share. While many remain focused on ongoing ecosystem investments to support sustained growth, opinions differ widely on the balance between future returns and present margin risks.

Explore 23 other fair value estimates on PDD Holdings - why the stock might be worth just $138.77!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives