- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O'Reilly Automotive (ORLY): A Fresh Look at Valuation Following Steady Share Price Gains

Reviewed by Kshitija Bhandaru

O'Reilly Automotive (ORLY) has shown steady performance recently, posting a 1% gain over the past month and delivering a strong 36% total return for investors over the past year. Its momentum continues to spark interest among those following the automotive retail sector.

See our latest analysis for O'Reilly Automotive.

Momentum appears to be picking up for O'Reilly Automotive. After a strong run over the past year, with a 1-year total shareholder return of 36%, the latest 30-day share price return reflects growing optimism about long-term prospects instead of just short-term swings.

Curious what other leaders in the auto sector are doing? This is an ideal moment to discover See the full list for free.

With O'Reilly Automotive's recent gains and robust long-term growth, investors are left to wonder: Is there still room for upside, or has the market already priced in all the good news about future growth potential?

Most Popular Narrative: Fairly Valued

At $104.79, O'Reilly Automotive's last close is closely aligned with the narrative fair value estimate of $107.55. This suggests little room for mispricing and reflects closely tracked analyst expectations.

Differentiated and improving supply chain network is driving best-in-class parts coverage and delivery, and sets up for accelerated share growth. Higher product costs and inflation are being successfully passed to customers, providing a comp tailwind; O’Reilly is also viewed as a tariff beneficiary.

What is the secret behind O'Reilly's relentless growth story? The narrative hints at a formula combining ambitious expansion plans and strong profitability assumptions. These are the figures that separate this valuation from the crowd. Get the details behind these confident projections inside the full analysis.

Result: Fair Value of $107.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changes in tariffs or intensified competition could pressure O'Reilly's margins and growth. This may potentially challenge the consensus outlook on future gains.

Find out about the key risks to this O'Reilly Automotive narrative.

Another View: Signals from the Market’s Ratios

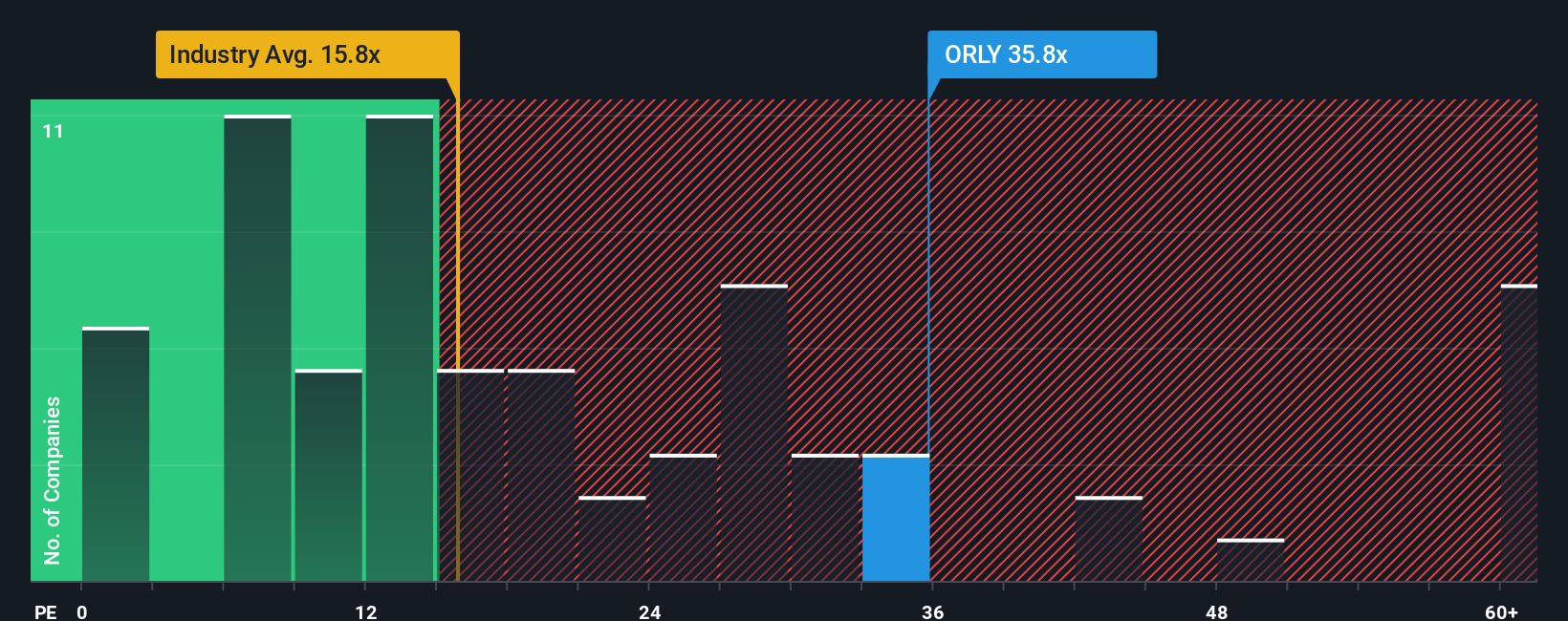

While analyst consensus calls O'Reilly Automotive fairly valued, the market’s main valuation marker tells a different story. Its price-to-earnings ratio sits at 36.7x, comfortably above both its industry peers at 17.3x and the company’s own estimated fair ratio of 19.4x. This premium hints at higher expectations, but it could mean valuation risk if the story changes. Are investors paying too much for O'Reilly’s growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own O'Reilly Automotive Narrative

If you see the story differently or want to draw your own conclusions, you can start your analysis and narrative in just a few minutes. Do it your way

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not wait. If you want to get ahead of the market, check out these unique ways to uncover your next potential winner:

- Earn more passive income by targeting yield with these 19 dividend stocks with yields > 3% that boast strong, consistent payouts.

- Spot early movers by hunting these 24 AI penny stocks embracing artificial intelligence before the rest of the market catches on.

- Find untapped potential by comparing these 3563 penny stocks with strong financials with robust fundamentals whose growth stories might just be getting started.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives