- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O'Reilly Automotive, Inc. (NASDAQ:ORLY) Released Earnings Last Week And Analysts Lifted Their Price Target To US$1,376

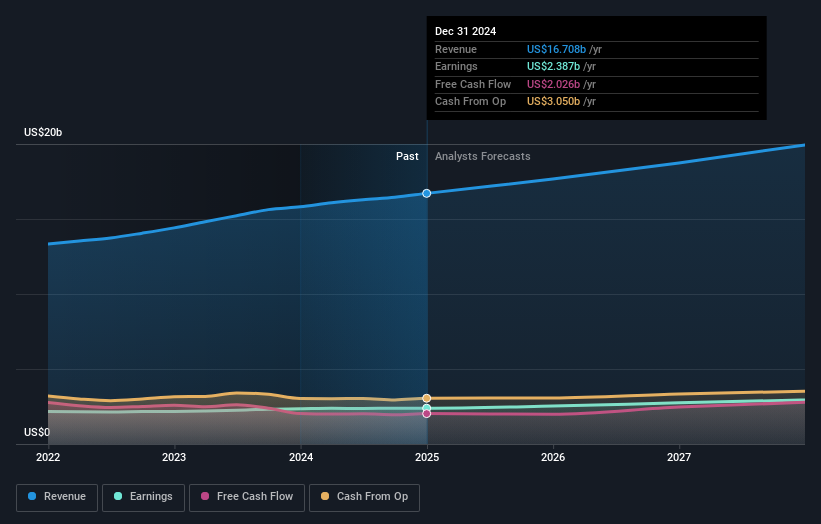

O'Reilly Automotive, Inc. (NASDAQ:ORLY) last week reported its latest full-year results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. O'Reilly Automotive reported in line with analyst predictions, delivering revenues of US$17b and statutory earnings per share of US$40.66, suggesting the business is executing well and in line with its plan. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for O'Reilly Automotive

Taking into account the latest results, the most recent consensus for O'Reilly Automotive from 26 analysts is for revenues of US$17.7b in 2025. If met, it would imply an okay 5.7% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to accumulate 7.6% to US$44.66. Before this earnings report, the analysts had been forecasting revenues of US$17.6b and earnings per share (EPS) of US$45.21 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

With the analysts reconfirming their revenue and earnings forecasts, it's surprising to see that the price target rose 5.7% to US$1,376. It looks as though they previously had some doubts over whether the business would live up to their expectations. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values O'Reilly Automotive at US$1,550 per share, while the most bearish prices it at US$870. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that O'Reilly Automotive's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 5.7% growth on an annualised basis. This is compared to a historical growth rate of 9.9% over the past five years. Compare this to the 152 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 4.6% per year. Factoring in the forecast slowdown in growth, it looks like O'Reilly Automotive is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for O'Reilly Automotive going out to 2027, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 3 warning signs for O'Reilly Automotive (1 can't be ignored!) that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion