- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

Is Now The Time To Put O'Reilly Automotive (NASDAQ:ORLY) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like O'Reilly Automotive (NASDAQ:ORLY), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for O'Reilly Automotive

O'Reilly Automotive's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years O'Reilly Automotive grew its EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

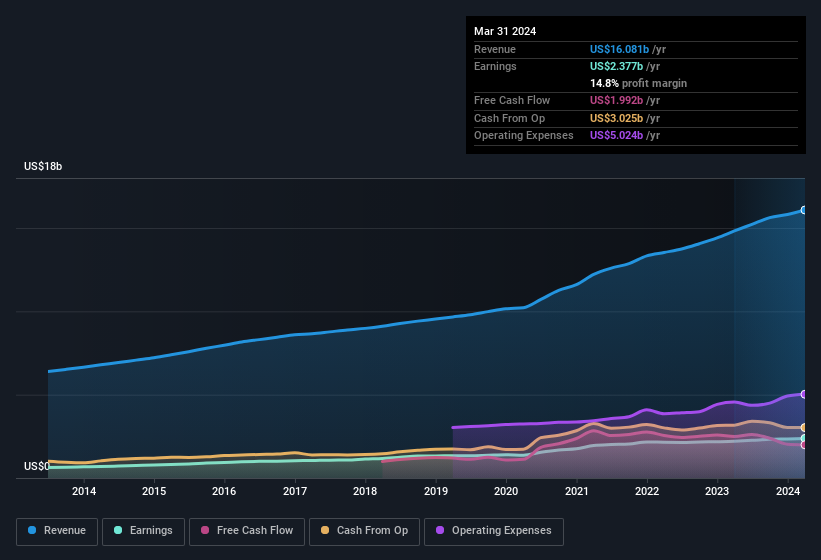

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for O'Reilly Automotive remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 8.5% to US$16b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of O'Reilly Automotive's forecast profits?

Are O'Reilly Automotive Insiders Aligned With All Shareholders?

Owing to the size of O'Reilly Automotive, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$566m. This comes in at 0.9% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to O'Reilly Automotive, with market caps over US$8.0b, is around US$14m.

O'Reilly Automotive's CEO took home a total compensation package of US$2.9m in the year prior to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add O'Reilly Automotive To Your Watchlist?

One positive for O'Reilly Automotive is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for O'Reilly Automotive, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. However, before you get too excited we've discovered 3 warning signs for O'Reilly Automotive (1 is significant!) that you should be aware of.

Although O'Reilly Automotive certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives