- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:OLLI

Is Ollie's Rally to $131 Backed by Fundamentals After Latest Earnings Report?

Reviewed by Bailey Pemberton

If you are looking at Ollie's Bargain Outlet Holdings and wondering if now is the right time to invest, you are not alone. This stock has been on quite a run lately and has consistently sparked debate among value-minded investors. Let's face it, when a retailer piles up an eye-catching 21.4% return year-to-date and a striking 34.9% surge over the past twelve months, it's hard not to take notice. Long-term holders are even happier, with gains of 148.0% over three years. At $131.42 per share as of the latest close, Ollie's is trading well above where it started the year, even after a slight 1.5% dip over the last month.

Recent momentum in discount retail and shifts in consumer behavior have added fuel to the story, helping to balance out minor pullbacks in sentiment, such as the small 0.7% dip over the past week. All this activity has investors asking how Ollie's trades relative to its true worth. Is the market getting ahead of itself, or is there still value on the table?

To help answer that, I will walk you through the most common valuation approaches and how Ollie's stacks up. Based on the numbers, the company scores a 0 out of 6 on the typical undervaluation checks, meaning it is not flashing any obvious bargains by standard metrics. However, valuation is not always as simple as a single score, and there is an even more insightful angle on this stock waiting for you at the end of the article.

Ollie's Bargain Outlet Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ollie's Bargain Outlet Holdings Discounted Cash Flow (DCF) Analysis

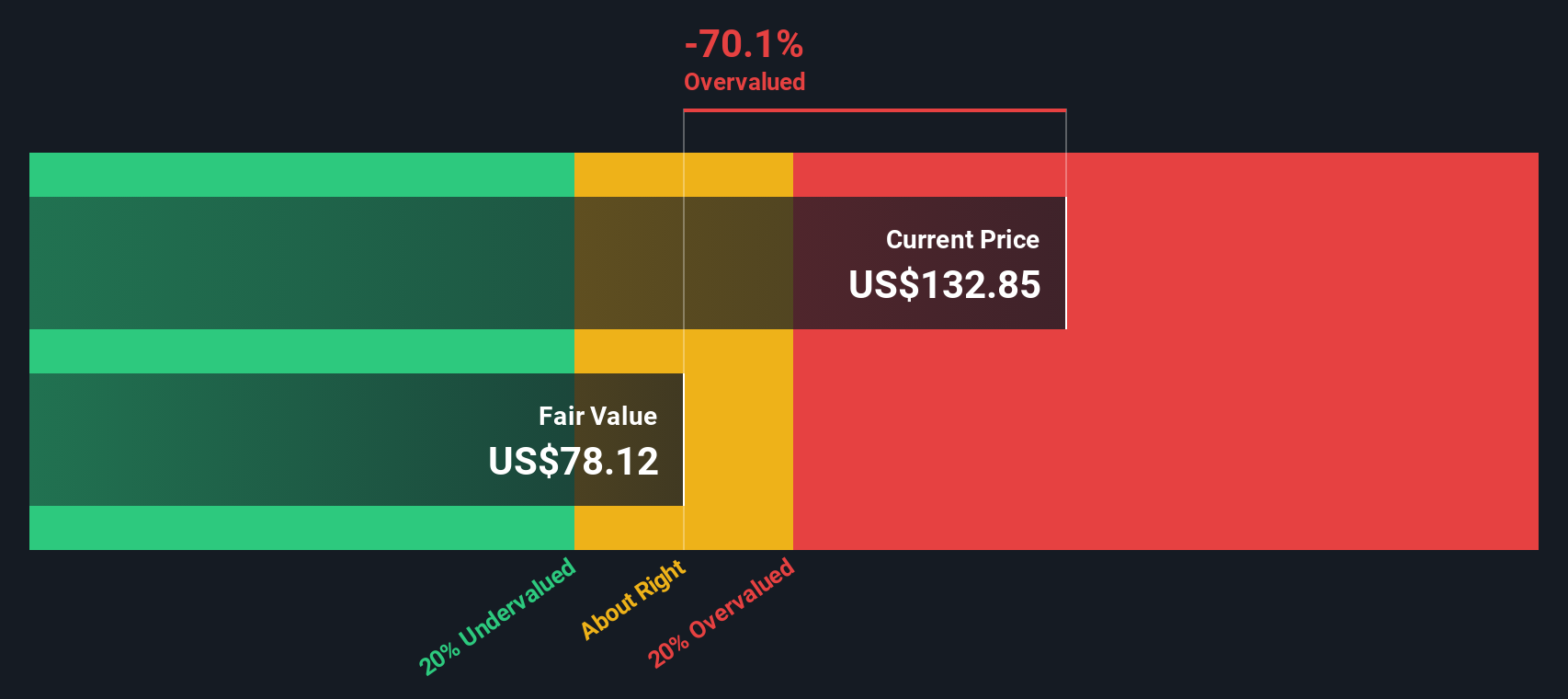

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This provides an objective lens on what the business is really worth. For Ollie's Bargain Outlet Holdings, this approach starts with the company's last twelve months Free Cash Flow of $131.9 million and looks ahead at expected growth.

Analyst estimates suggest Ollie's annual Free Cash Flow could rise to $237.0 million by 2028. The model extends these projections for another five years, using conservative growth rates as provided by Simply Wall St. Over the full ten-year period, annual FCF is projected to steadily climb each year. Even with these optimistic forecasts, the DCF places Ollie's fair value at $78.28 per share.

With the current share price at $131.42, this implies the stock is trading about 67.9% higher than its calculated intrinsic value. In other words, the DCF model indicates Ollie's may be significantly overvalued at today's levels, even when factoring in expected business growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ollie's Bargain Outlet Holdings may be overvalued by 67.9%. Find undervalued stocks or create your own screener to find better value opportunities.

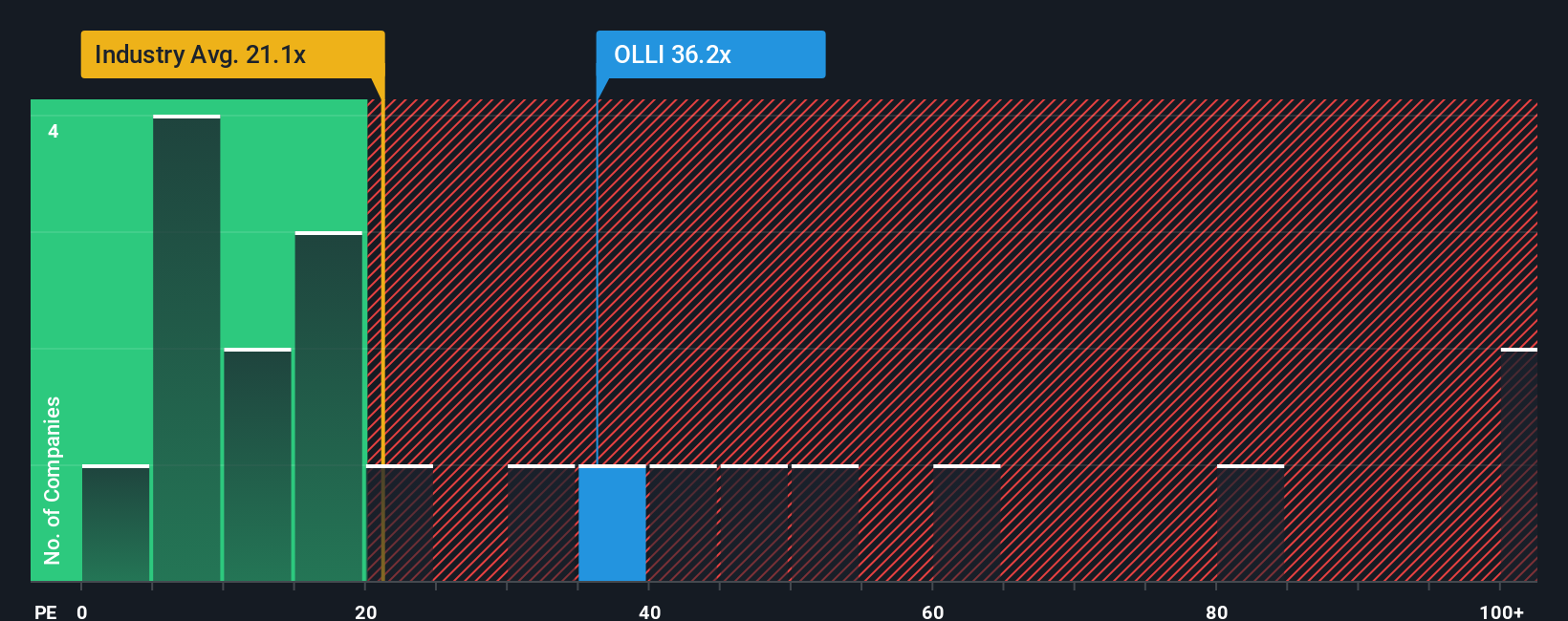

Approach 2: Ollie's Bargain Outlet Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is the market’s go-to metric for valuing profitable companies, because it compares a company’s current share price to its earnings per share. For businesses with consistent profits like Ollie's, the PE ratio makes it easier to judge how much investors are willing to pay for each dollar of earnings.

What makes a "fair" PE ratio? Companies with higher expected growth or lower risk often command a premium multiple, while slower growers or riskier firms typically trade at a discount. That’s why simply comparing to the market average isn’t always enough; context matters.

Ollie's Bargain Outlet Holdings is currently trading on a PE of 37.8x. This sits significantly higher than the industry average PE of 21.8x for Multiline Retail stocks, and above its peer group average of 22.7x. On the surface, Ollie’s looks very expensive compared to its direct competition.

Enter Simply Wall St's Fair Ratio, which refines the benchmark by factoring in the company’s specific growth prospects, risk profile, margins, and size. For Ollie's, the Fair PE Ratio is calculated at 19.5x, well below where the stock trades today. This approach moves beyond simple peer comparisons to give a more complete picture of valuation, especially for companies with unique strengths or challenges.

With Ollie's current PE nearly double its Fair Ratio, the stock appears materially overvalued based on this earnings multiple perspective.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ollie's Bargain Outlet Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your unique perspective on Ollie's Bargain Outlet Holdings—the story you see unfolding for the company—with the numbers behind future revenue, earnings, and margins to arrive at your own fair value estimate. Instead of relying solely on standard financial models, Narratives allow you to reflect what you believe about the company's prospects, tying together the business story, your forecasts, and a fair value, all in one place.

This approach is accessible to everyone on Simply Wall St's Community page, where millions of investors craft and update their Narratives as new information, like earnings or significant news, emerges. Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current Price, adapting dynamically as situations change. For example, some investors see Ollie’s as a clear winner, forecasting robust revenue growth, expanding margins, and setting a Fair Value as high as $159.0 per share. Others are more cautious, emphasizing challenges like inventory sourcing or digital competition and arriving at a Fair Value closer to $130.0. With Narratives, you are in control. Your investment decision is powered by the story you believe and the numbers you trust.

Do you think there's more to the story for Ollie's Bargain Outlet Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OLLI

Ollie's Bargain Outlet Holdings

Operates as a retailer of closeout merchandise and excess inventory in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives