- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Will MercadoLibre’s (MELI) Humanoid Robots Quietly Reshape Its Margin and Operating Leverage Story?

Reviewed by Sasha Jovanovic

- Earlier this week, Agility Robotics announced a commercial agreement with MercadoLibre to deploy its Digit humanoid robots in MercadoLibre’s San Antonio, Texas fulfillment center, initially handling repetitive, physically demanding tote-handling tasks with potential expansion across Latin American warehouses.

- This move highlights how MercadoLibre is experimenting with AI-enabled humanoid automation to tackle labor gaps, improve ergonomic safety, and potentially boost logistics productivity without redesigning existing facilities.

- Next, we’ll explore how this push into humanoid-robot logistics could influence MercadoLibre’s margin expansion narrative and long-term operating leverage.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MercadoLibre Investment Narrative Recap

To own MercadoLibre, you need to believe it can keep scaling its e commerce and fintech ecosystems while gradually lifting margins despite competitive and credit pressures. The Agility Robotics deal fits into this story as a logistics efficiency experiment, but it is unlikely to change the near term focus on credit quality at Mercado Pago and competitive intensity in Brazil and Mexico, which remain the most important catalyst and risk right now.

Among recent announcements, the US$750 million issuance of 4.900% senior unsecured notes due 2033 stands out in this context. Additional liquidity could, over time, support heavier investment in logistics technology and automation, including humanoid robots, as MercadoLibre looks to balance growth initiatives with the margin pressure from free shipping incentives and higher fulfillment costs.

Yet while automation may help long term efficiency, investors should be aware that rising credit losses and non performing loans in key markets could still materially affect...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $46.9 billion revenue and $5.1 billion earnings by 2028. This requires 24.8% yearly revenue growth and a $3.0 billion earnings increase from $2.1 billion today.

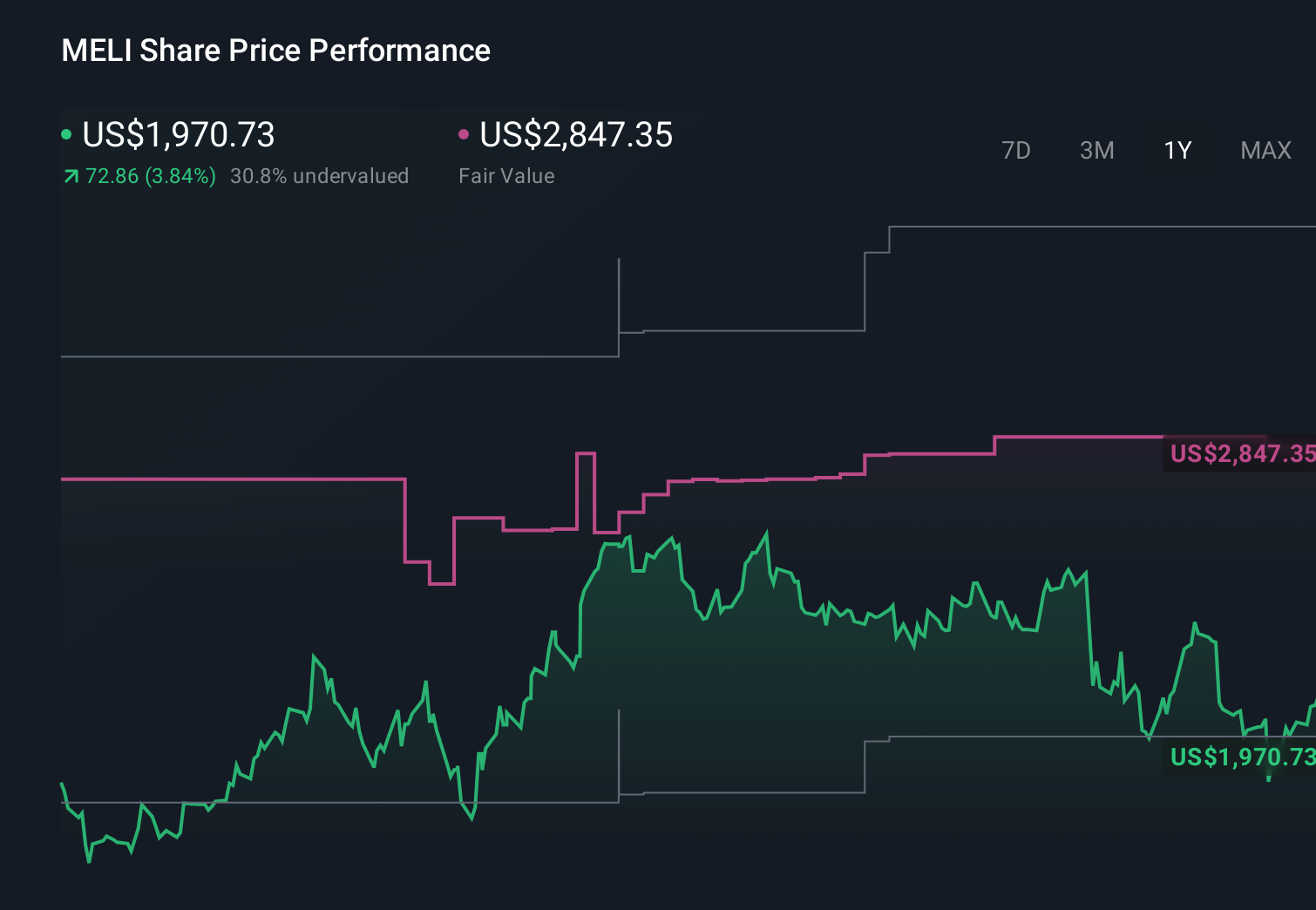

Uncover how MercadoLibre's forecasts yield a $2847 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Twenty three members of the Simply Wall St Community place MercadoLibre’s fair value between US$2,423.64 and US$3,406.20, underscoring how far opinions can spread. As you compare those views, keep in mind the ongoing risk that rapid credit growth in Argentina and Brazil could strain asset quality and influence how sustainably MercadoLibre can grow earnings over time.

Explore 23 other fair value estimates on MercadoLibre - why the stock might be worth just $2424!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion