- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Is MercadoLibre Still a Smart Bet After Amazon’s Rappi Investment?

Reviewed by Bailey Pemberton

If you’ve been following MercadoLibre’s stock lately, you’re not alone in wondering, “Is this the right time to make a move?” With the share price closing at $2,133.67, we’ve seen its fair share of ups and downs, down 1.8% in the last week and slipping 9.2% over the past month, yet still up a solid 20.9% for the year to date. Looking back, what’s really striking is the longer-term growth story: a whopping 181.9% jump over three years and a 67.8% increase in the last five years. Even with a recent dip, the long game has clearly paid off for patient investors.

What’s behind these recent moves? Headlines about Amazon’s new stake in Rappi have stirred up fresh chatter about competition and risk in Latin America’s e-commerce scene. While some see this as a headwind for MercadoLibre, others view it as validation of the region’s growing digital marketplace. Shifts like this can shake up sentiment, but they don’t always tell the whole story when it comes to value.

And speaking of value: according to our six-point valuation check, MercadoLibre scores a 4. That means it looks undervalued on four out of the six measures we use to separate real bargains from hype. In just a moment, we’ll break down exactly how we arrive at this score with a look at the different valuation approaches. Plus, we’ll share an even smarter way to assess MercadoLibre’s worth that every savvy investor should know.

Why MercadoLibre is lagging behind its peers

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model looks at a company’s potential by forecasting its future cash flows and calculating what those are worth in today’s dollars. This approach helps investors estimate the company’s intrinsic value based on how much cash it can generate in the future.

For MercadoLibre, the current Free Cash Flow stands at $7.52 Billion. Analyst estimates specifically forecast out to 2027, where Free Cash Flow is projected to reach about $9.58 Billion. Beyond that, Simply Wall St extrapolates out another few years, showing a steady increase in free cash flows, reaching an impressive $14.08 Billion by 2035. These projections factor in gradually moderating growth rates, offering a more balanced view of long-term value.

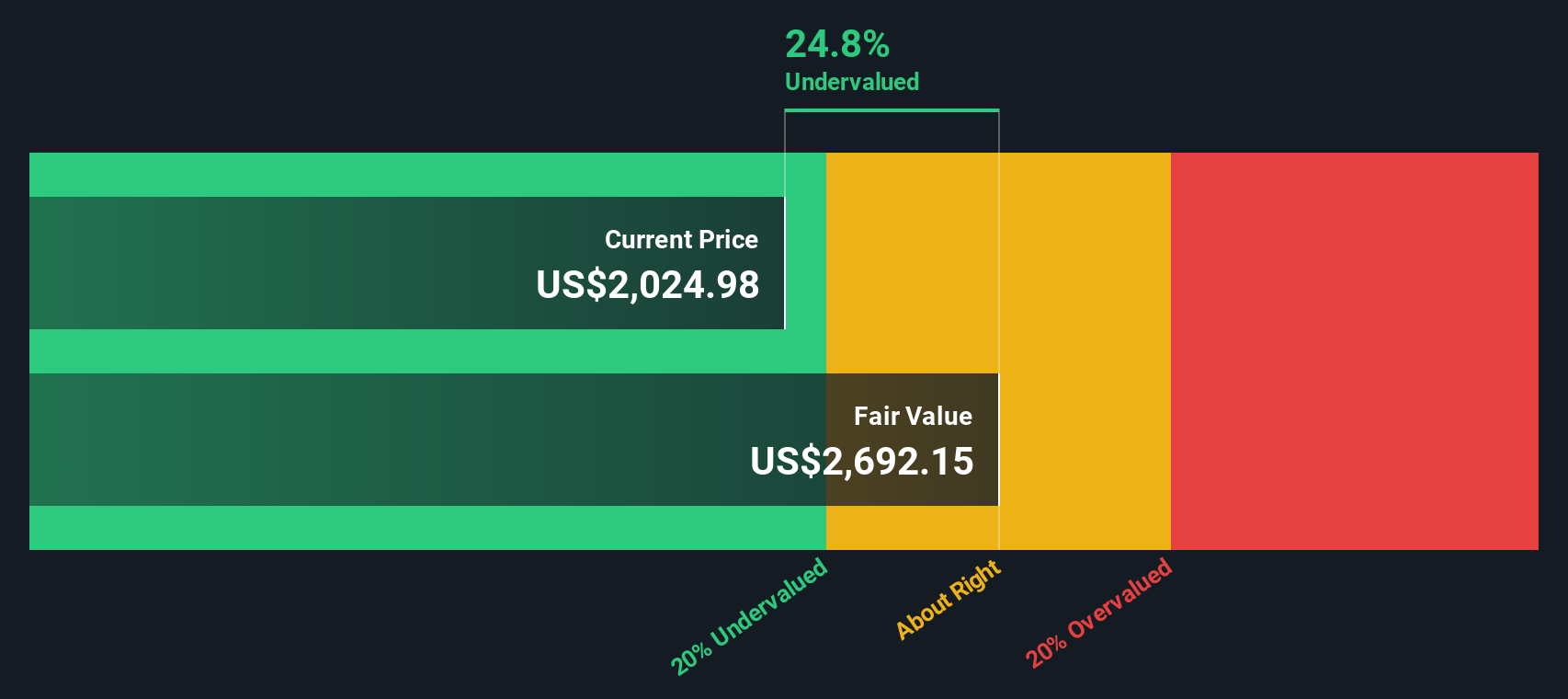

The bottom line from this DCF analysis is that MercadoLibre’s intrinsic value is pegged at $2,691.25 per share. Compared to the recent market price of $2,133.67, the stock appears about 20.7% undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 20.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: MercadoLibre Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable businesses like MercadoLibre, as it directly relates the current share price to the company’s earnings. For companies delivering consistent profits, the PE ratio gives investors a simple snapshot of how much they’re paying for each dollar of earnings.

What counts as a “normal” or “fair” PE ratio varies. Higher growth companies usually command higher PE multiples, while increased risk or weaker outlooks tend to lower them. Industry context also matters. Comparing to similar businesses helps, but doesn’t always tell the whole story.

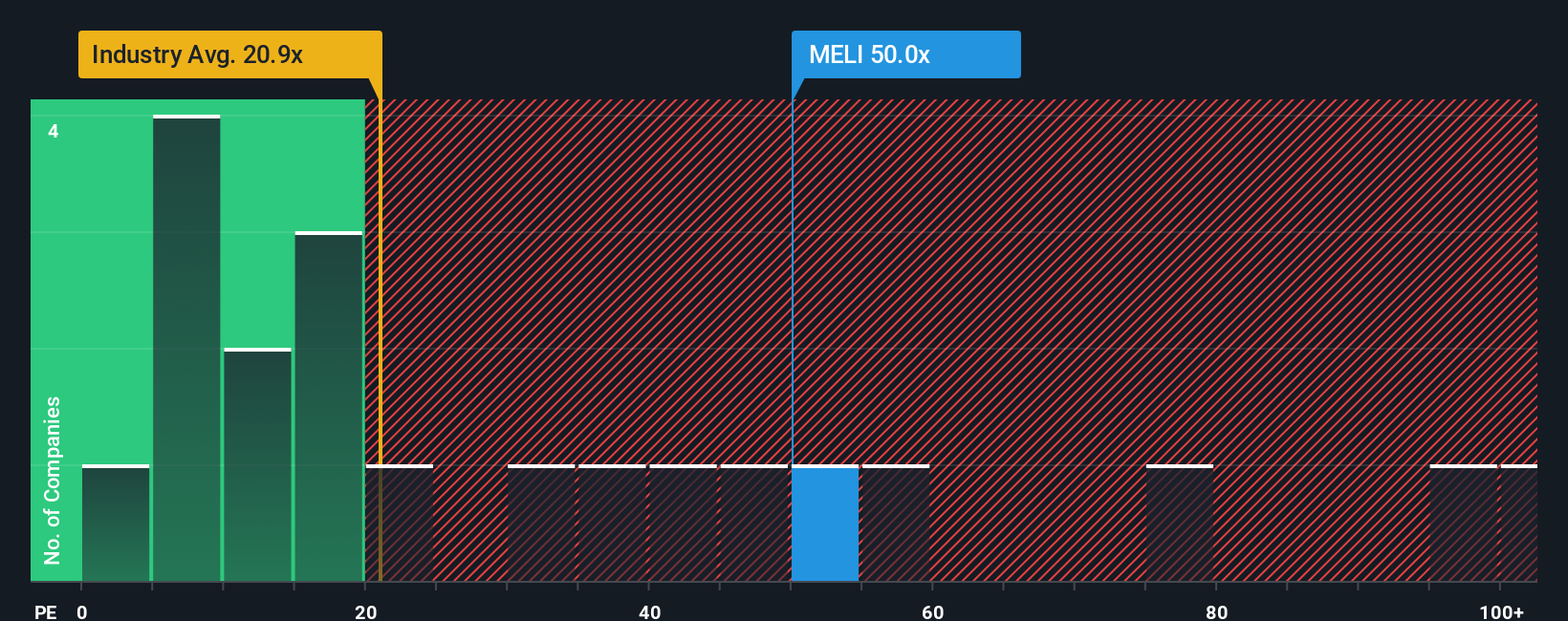

Right now, MercadoLibre trades at 52.7x earnings. That's above the Multiline Retail industry average of 21.9x, but below the peer group average of 66.7x. Simply Wall St’s proprietary Fair Ratio for MercadoLibre, factoring in growth, profit margins, market cap, and risk, lands at 34.0x. This specialized benchmark is more insightful than broad industry or peer comparisons, as it is tailor-made to the company's unique strengths and risks.

Comparing the Fair Ratio to MercadoLibre’s actual PE ratio of 52.7x, the stock looks expensive on this metric, trading significantly above where Simply Wall St’s analysis pegs its fair value multiple.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are your personalized story about a company, connecting your perspective on MercadoLibre’s future with concrete financial forecasts and a resulting fair value. Instead of simply relying on a single number or traditional metrics, Narratives let you define what you believe will drive future revenue, earnings, and margins, turning your outlook into actionable analysis. This approach links the big picture (like e-commerce growth, digital payments adoption, or competitive risks) directly to a financial model and a fair value result, making investment decisions more transparent and tailored to your thinking.

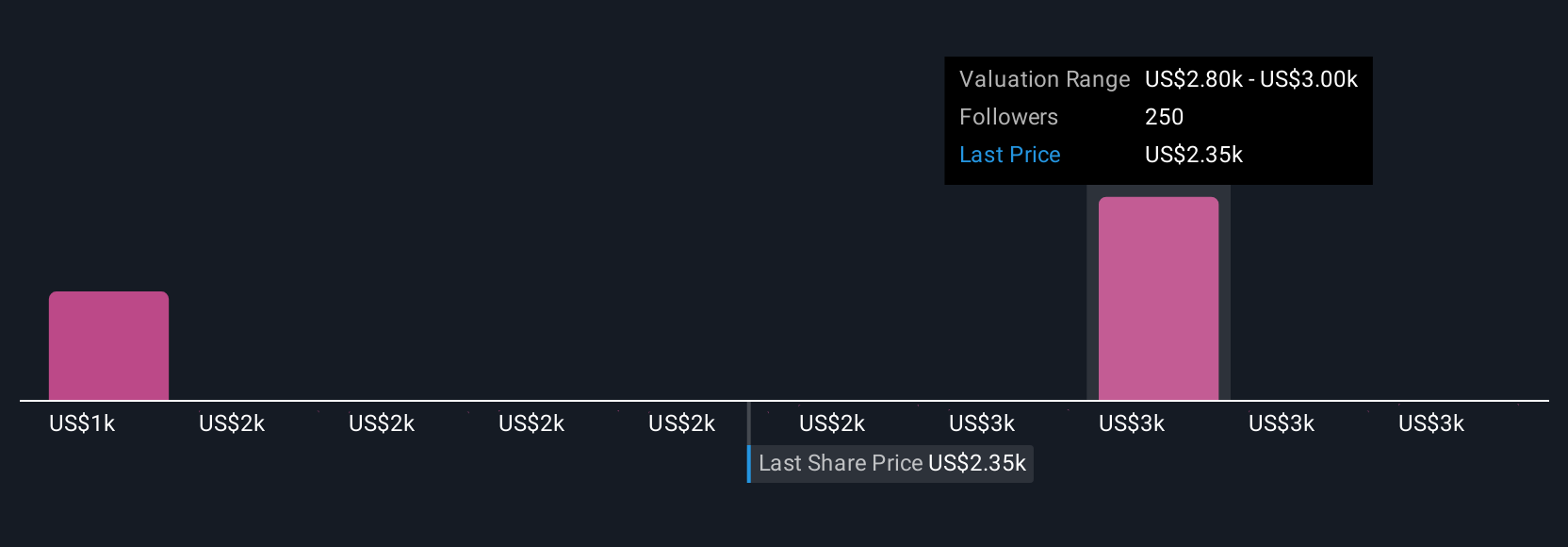

On Simply Wall St's Community page, used by millions of investors, Narratives are an accessible and dynamic tool designed to help you answer the question: “Is this a buy right now?” You’ll see fair value estimates automatically updated as fresh news or earnings reports are released, and can easily compare your view with the current share price to spot opportunities or risks.

- For MercadoLibre, for example, the most optimistic narrative expects a price target of $3,500, reflecting confidence in sustained ecosystem growth and fintech expansion.

- The most cautious narrative sets the price target at $2,170, focused on competition pressures and near-term margin risks.

Narratives empower you to invest not just with numbers, but with your perspective, making investing smarter and more personal.

Do you think there's more to the story for MercadoLibre? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives