- United States

- /

- Specialty Stores

- /

- OTCPK:LMPX

Did The Underlying Business Drive LMP Automotive Holdings' (NASDAQ:LMPX) Lovely 386% Share Price Gain?

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. While not every stock performs well, when investors win, they can win big. For example, LMP Automotive Holdings, Inc. (NASDAQ:LMPX) has generated a beautiful 386% return in just a single year. It's also good to see the share price up 47% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. We'll need to follow LMP Automotive Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for LMP Automotive Holdings

LMP Automotive Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, LMP Automotive Holdings' revenue grew by 117%. That's stonking growth even when compared to other loss-making stocks. But the share price has really rocketed in response gaining 386% as previously mentioned. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

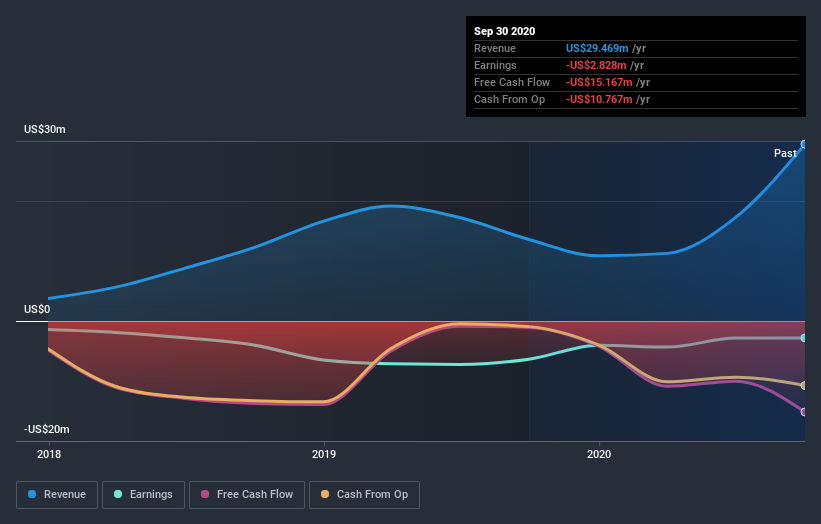

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of LMP Automotive Holdings' earnings, revenue and cash flow.

A Different Perspective

LMP Automotive Holdings boasts a total shareholder return of 386% for the last year. That's better than the more recent three month gain of 47%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with LMP Automotive Holdings (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading LMP Automotive Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade LMP Automotive Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:LMPX

LMP Automotive Holdings

Through its subsidiaries, buys, sells, rents and subscribes for, and obtains financing for automobiles online and in person in the United States.

Low with weak fundamentals.

Market Insights

Community Narratives