Will JD.com’s (JD) Exclusive EV Launch Reveal a New Competitive Edge in Vertical Integration?

Reviewed by Sasha Jovanovic

- JD.com, together with GAC Group and CATL, announced earlier this week that it will exclusively sell a co-developed electric vehicle, the "National Good Car," during the 11.11 shopping festival, with the model emphasizing safety, charging efficiency, and affordability based on user insights.

- This collaboration highlights JD.com's move to expand its ecosystem by integrating retail with automotive services without directly manufacturing vehicles, introducing a new sales channel as analysts anticipate strong seasonal promotional synergy.

- We’ll explore how this exclusive electric vehicle launch could reshape JD.com’s investment narrative, especially its approach to vertical integration and consumer engagement.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

JD.com Investment Narrative Recap

To be a JD.com shareholder right now, you need to see value in the company’s drive for retail innovation and vertical integration, even as it contends with slowing revenue growth and uncertainty from investments in food delivery and new retail initiatives. The launch of its exclusive electric vehicle during 11.11 is a headline-grabbing move, but for now, its impact on the core near-term catalyst, accelerating user growth and engagement, appears minor, while the biggest risk remains persistent operating losses in new ventures.

The recent forecast from Daiwa Capital Markets, expecting JD.com to scale back investment in food delivery and gain greater order volume, stands out as most relevant. Compared to the EV initiative, this move directly addresses the company’s short-term pressures on profitability and may speak more to managing risks from rapid business diversification than any single product collaboration.

Yet, despite headline partnerships, the real risk investors should watch is if expansion into crowded sectors keeps widening group-level losses over...

Read the full narrative on JD.com (it's free!)

JD.com's narrative projects CN¥1,517.4 billion revenue and CN¥45.1 billion earnings by 2028. This requires 6.2% yearly revenue growth and a CN¥6.4 billion earnings increase from the current earnings of CN¥38.7 billion.

Uncover how JD.com's forecasts yield a $44.99 fair value, a 36% upside to its current price.

Exploring Other Perspectives

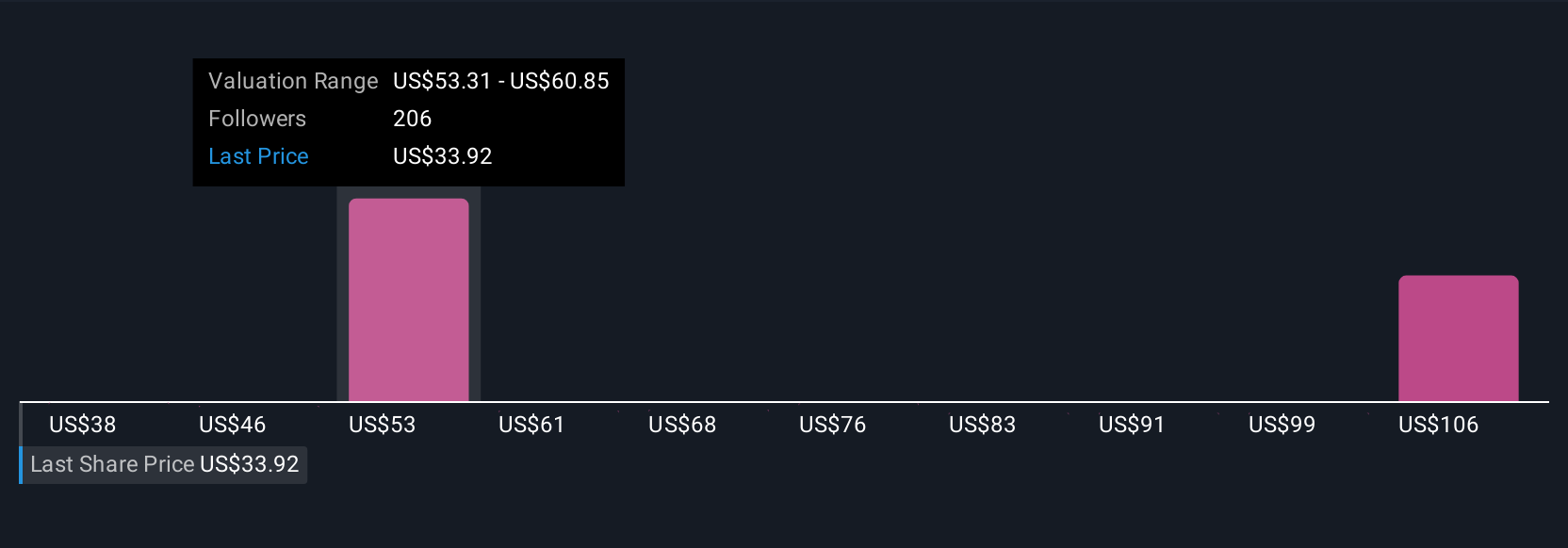

Simply Wall St Community members provided 29 fair value estimates for JD.com ranging from US$28.36 to US$123.23, showing widely differing valuations. As you consider these views, keep in mind that persistent operating losses in new businesses continue to challenge the company’s potential for sustainable earnings growth.

Explore 29 other fair value estimates on JD.com - why the stock might be worth 14% less than the current price!

Build Your Own JD.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JD.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JD.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JD.com's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives