JD.com (NasdaqGS:JD) Becomes UEFA Champion League's Official E-Commerce Innovation Partner

Reviewed by Simply Wall St

JD.com (NasdaqGS:JD) recently became the official e-commerce innovation partner for the UEFA Champions League, a high-profile collaboration that enhances its European market engagement through its brand, ochama. This development, coupled with strong financial results, might have contributed to the company's share price increase of 6.89% over the last quarter. JD.com reported a substantial rise in earnings and net income for the year ending December 31, 2024, signaling robust performance. The announcement of a cash dividend also adds to the attractiveness of its shareholding. Despite market volatility and the tech sector's decline, including a notable sell-off in tech-heavy indexes like the Nasdaq, JD.com demonstrated resilience. While the broader market faced a 1.7% decline over the past week and challenges from trade policy uncertainties, JD.com's strategic partnerships and solid financial performance might have positioned it favorably, countering broader market pressures.

Unlock comprehensive insights into our analysis of JD.com stock here.

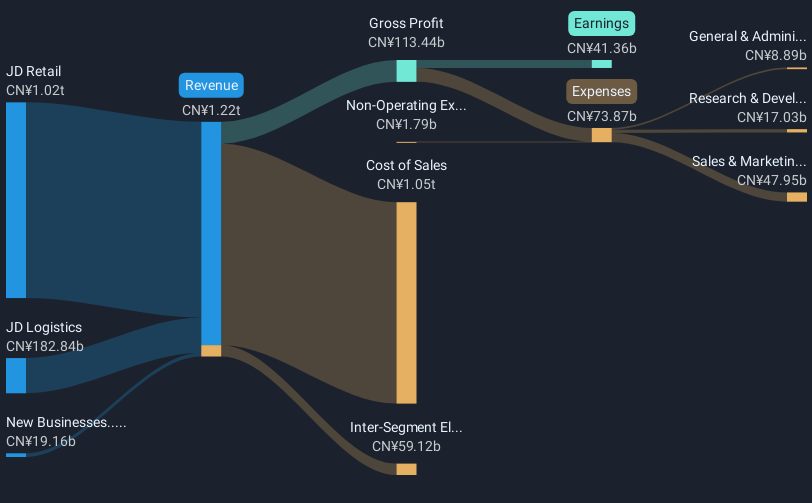

Over the last year, JD.com achieved a total return of 66.74%, outpacing both the US market and the Multiline Retail industry, which returned 12.1% and 21.5% respectively. The company's impressive growth trajectory was underscored by earnings announcements revealing a surge in net income from CNY 24.17 billion in 2023 to CNY 41.36 billion in 2024. This was complemented by revenue growth, reaching CNY 1,158.82 billion, signaling strong operational performance.

JD.com's decision to initiate a share repurchase program worth up to $5 billion in 2024 stood out as a significant move, offering value to shareholders. Additionally, the announcement of a cash dividend of US$0.5 per share provided further investor appeal. The renewal of its partnership with ATRenew Inc. and its new collaboration with the UEFA Champions League further cemented JD.com's market positioning and potential for future growth.

- Analyze JD.com's fair value against its market price in our detailed valuation report—access it here.

- Uncover the uncertainties that could impact JD.com's future growth—read our risk evaluation here.

- Invested in JD.com? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with solid track record.