- United States

- /

- Pharma

- /

- NasdaqGM:LGND

3 Stocks Estimated To Be Undervalued By Up To 49.1%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it has risen by 12% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying undervalued stocks that have not yet caught up with overall market performance can offer potential opportunities for investors looking to capitalize on growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $108.75 | $210.66 | 48.4% |

| Roku (ROKU) | $88.63 | $173.44 | 48.9% |

| Robert Half (RHI) | $42.90 | $83.14 | 48.4% |

| Lyft (LYFT) | $15.66 | $31.20 | 49.8% |

| Ligand Pharmaceuticals (LGND) | $122.40 | $240.64 | 49.1% |

| Insteel Industries (IIIN) | $38.89 | $77.46 | 49.8% |

| Hess Midstream (HESM) | $37.91 | $73.22 | 48.2% |

| e.l.f. Beauty (ELF) | $117.66 | $230.73 | 49% |

| Carter Bankshares (CARE) | $18.11 | $35.50 | 49% |

| Atlantic Union Bankshares (AUB) | $33.24 | $65.54 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Ligand Pharmaceuticals (LGND)

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company that develops and licenses biopharmaceutical assets globally, with a market cap of approximately $2.22 billion.

Operations: The company's revenue is primarily derived from the development and licensing of biopharmaceutical assets, amounting to $181.49 million.

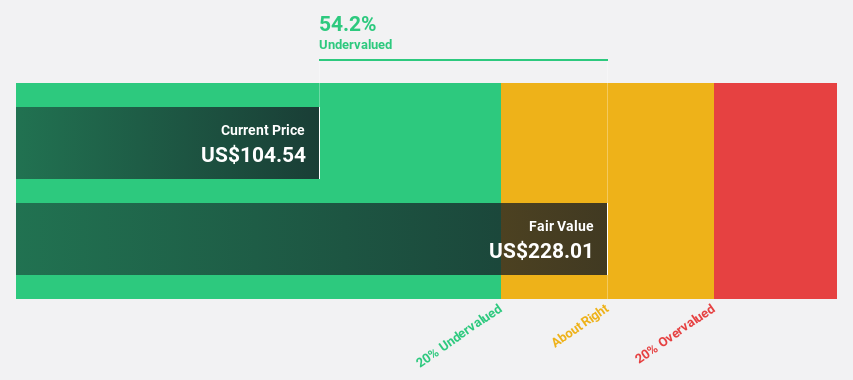

Estimated Discount To Fair Value: 49.1%

Ligand Pharmaceuticals is trading at US$122.4, significantly below its estimated fair value of US$240.64, making it highly undervalued based on cash flows. Despite a recent net loss of US$42.45 million for Q1 2025, revenue increased to US$45.33 million from the previous year, and the company expects total revenue between US$180 million and $200 million for 2025. Its addition to multiple Russell indexes highlights its growth potential amidst expected profitability within three years.

- Our expertly prepared growth report on Ligand Pharmaceuticals implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Ligand Pharmaceuticals' balance sheet by reading our health report here.

Global-E Online (GLBE)

Overview: Global-E Online Ltd. operates a direct-to-consumer cross-border e-commerce platform serving markets in Israel, the United Kingdom, the United States, and internationally, with a market cap of approximately $5.57 billion.

Operations: The company's revenue segment is primarily derived from Internet Information Providers, generating $796.77 million.

Estimated Discount To Fair Value: 31.3%

Global-E Online is trading at US$33.76, offering a significant discount to its estimated fair value of US$49.13, indicating it is undervalued based on cash flows. The company reported Q1 2025 sales of US$189.88 million and narrowed its net loss to US$17.86 million from the previous year. With a strategic partnership renewal with Shopify and projected revenue growth surpassing the market average, Global-E's profitability prospects appear strong over the next three years.

- The growth report we've compiled suggests that Global-E Online's future prospects could be on the up.

- Take a closer look at Global-E Online's balance sheet health here in our report.

Penguin Solutions (PENG)

Overview: Penguin Solutions, Inc. designs and develops enterprise solutions globally, with a market cap of $1.11 billion.

Operations: Penguin Solutions generates revenue from designing and developing enterprise solutions on a global scale.

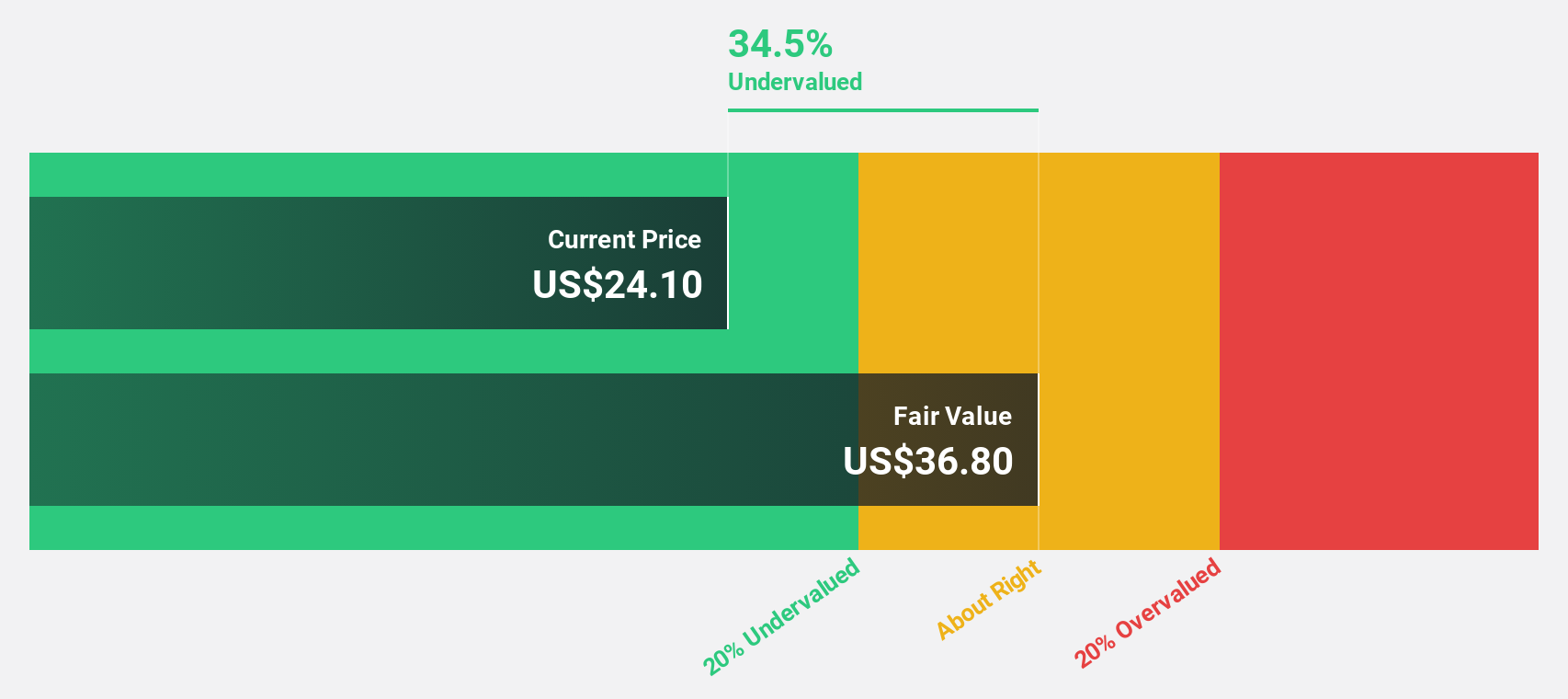

Estimated Discount To Fair Value: 36.3%

Penguin Solutions, trading at US$23.43, is significantly undervalued compared to its estimated fair value of US$36.80 based on cash flows. Despite a Q3 net income drop to US$2.66 million from US$5.62 million last year, the company projects 17% YoY revenue growth and profitability within three years, exceeding market averages. Recent refinancing reduced debt by US$200 million, enhancing financial stability amid strategic expansions in AI infrastructure and product advancements like the Stratus ztC Endurance platform.

- Our comprehensive growth report raises the possibility that Penguin Solutions is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Penguin Solutions.

Summing It All Up

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 97 more companies for you to explore.Click here to unveil our expertly curated list of 100 Undervalued US Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives