- United States

- /

- Construction

- /

- NasdaqGM:BWMN

Top US Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As the major U.S. stock indexes maintain gains following a significant interest rate cut by the Federal Reserve, investors are keenly watching for further policy changes that could impact market dynamics. In this environment, growth companies with high insider ownership stand out as potentially strong investments due to their alignment of management and shareholder interests. When considering stocks in such a volatile market, it's crucial to focus on companies where insiders have substantial stakes. This often indicates confidence in the company's future prospects and can be a key factor in navigating economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We're going to check out a few of the best picks from our screener tool.

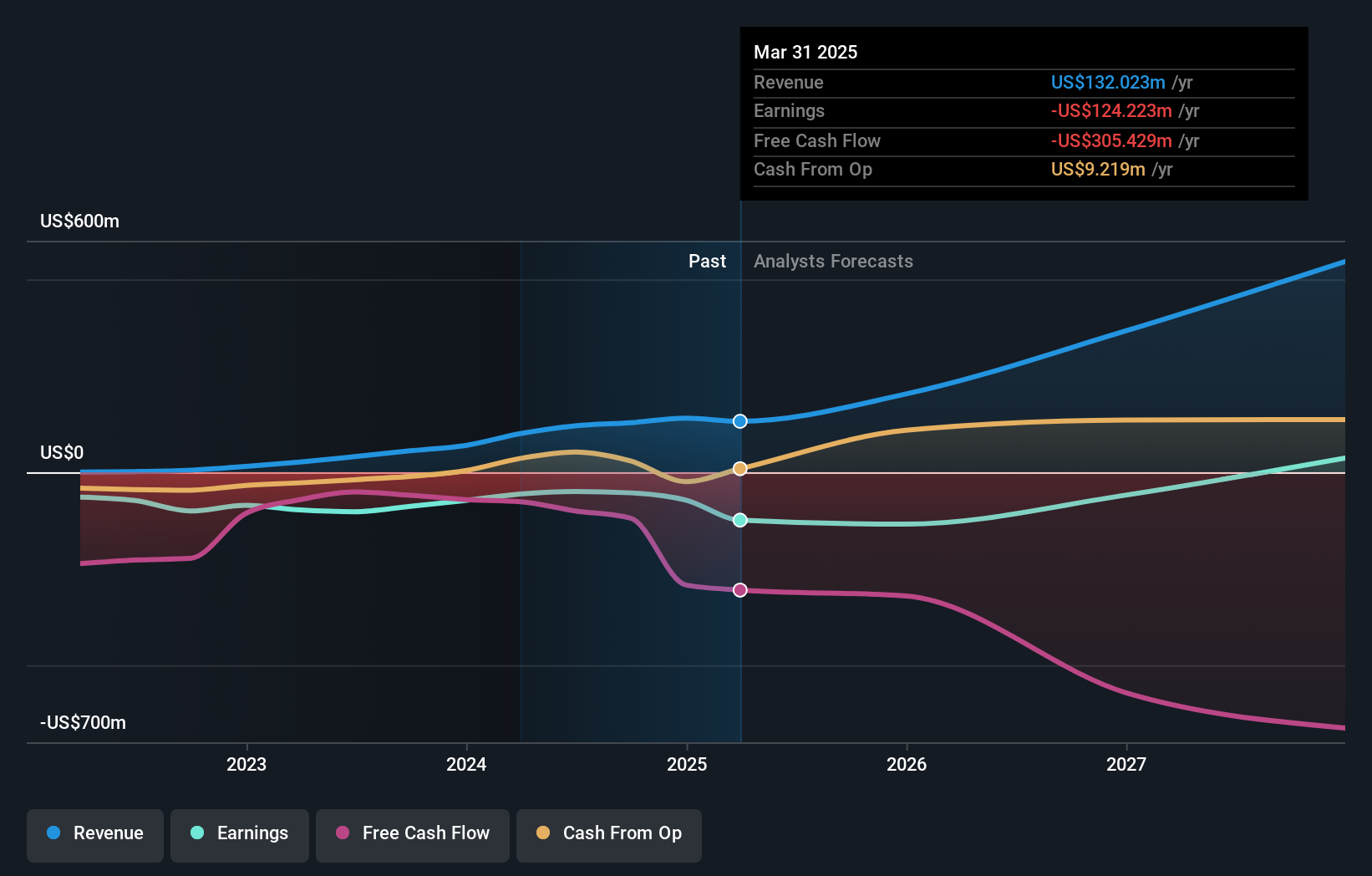

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, operates as a digital asset technology company in the United States and has a market cap of approximately $1.51 billion.

Operations: The company's revenue primarily comes from Digital Currency Mining, amounting to $120.25 million.

Insider Ownership: 14.9%

Return On Equity Forecast: N/A (2027 estimate)

TeraWulf Inc. demonstrates significant growth potential with a forecasted annual revenue increase of 53.1%, outpacing the US market's average. The company is expected to become profitable within three years, reflecting above-average market growth. Recent financial results show substantial sales growth, although net losses persist. Insider ownership remains high, indicating confidence in long-term prospects despite recent share price volatility and past shareholder dilution. The company has also eliminated all outstanding debt, enhancing financial flexibility for future expansion.

- Click here to discover the nuances of TeraWulf with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of TeraWulf shares in the market.

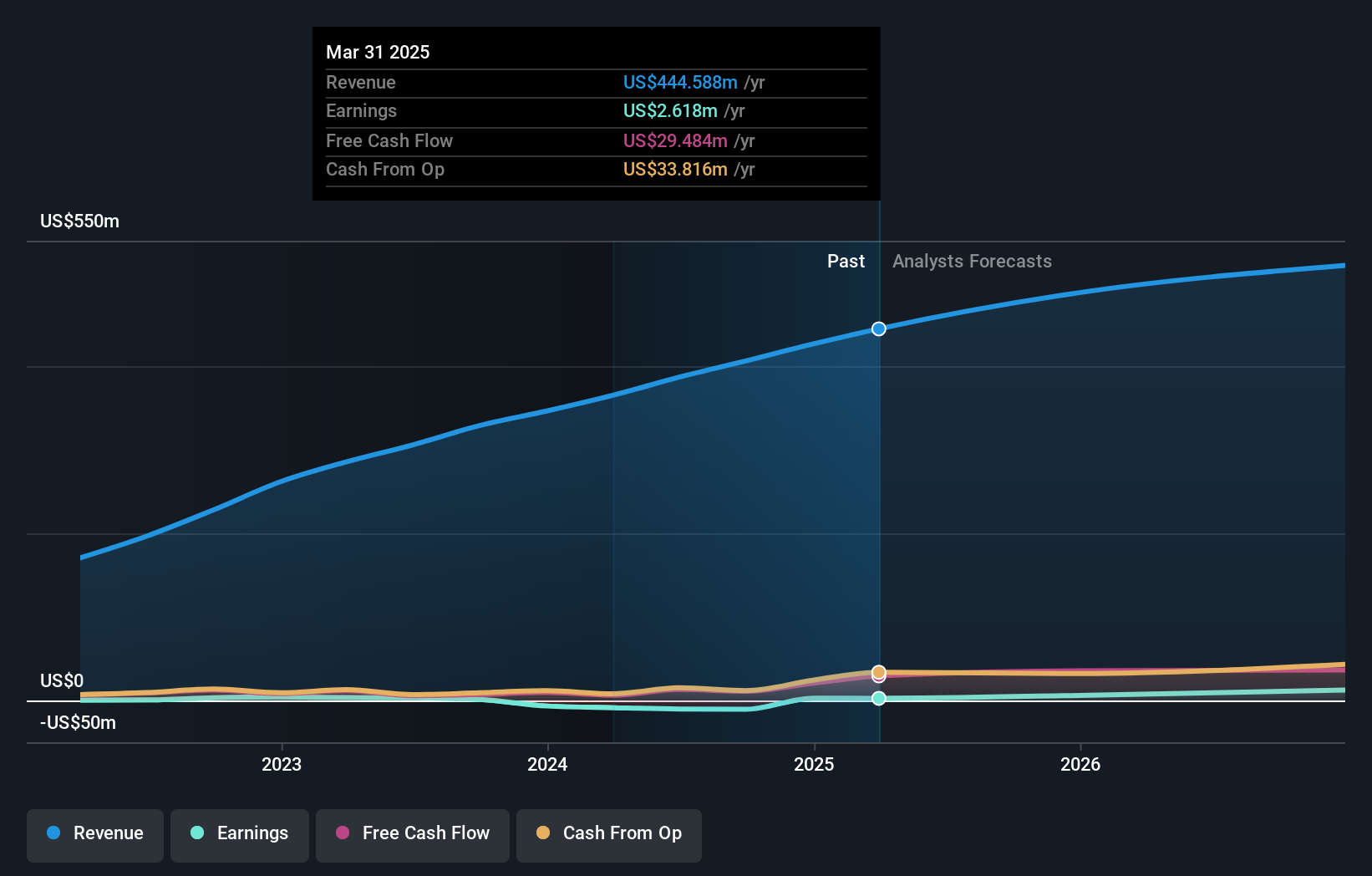

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions in the United States and has a market cap of approximately $438.74 million.

Operations: The company generates $386.81 million from providing engineering and related professional services to its customers.

Insider Ownership: 18.6%

Return On Equity Forecast: N/A (2027 estimate)

Bowman Consulting Group is forecasted to grow revenue by 13% annually, faster than the US market. Despite recent shareholder dilution, insider ownership remains high. The company is expected to become profitable within three years, with earnings projected to grow significantly. Recent contracts, such as the Taxiway V project at Charlotte Douglas International Airport and a $1.65 million contract with Oregon, bolster its growth outlook. Additionally, Bowman increased its equity buyback plan by $15 million and actively seeks acquisitions for strategic expansion.

- Unlock comprehensive insights into our analysis of Bowman Consulting Group stock in this growth report.

- Our valuation report unveils the possibility Bowman Consulting Group's shares may be trading at a discount.

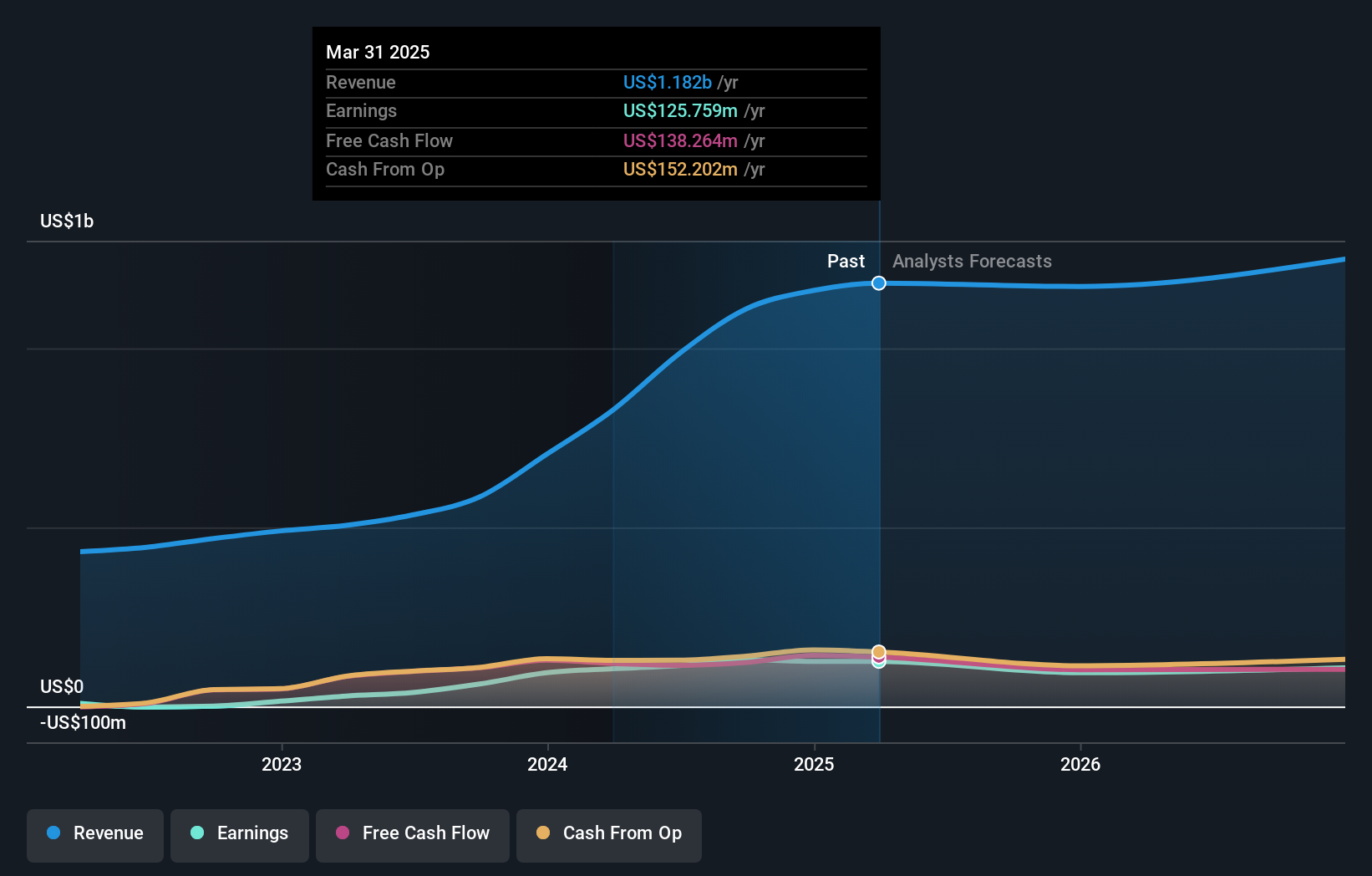

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Growth Rating: ★★★★★★

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise both in the United States and internationally, with a market cap of $668.81 million.

Operations: GigaCloud Technology generates revenue primarily from online retailers, amounting to $984.85 million.

Insider Ownership: 25.7%

Return On Equity Forecast: 30% (2027 estimate)

GigaCloud Technology Inc. demonstrates strong growth potential, with earnings forecasted to rise by 24.26% annually and revenue expected to grow at 20.2% per year, outpacing the US market. Insider ownership remains high despite some recent selling activity. The company reported significant earnings growth over the past year and announced a $46 million share repurchase program, reflecting confidence in its financial health and future prospects amidst executive changes and strategic initiatives like index inclusions.

- Get an in-depth perspective on GigaCloud Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that GigaCloud Technology is trading behind its estimated value.

Make It Happen

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 177 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bowman Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWMN

Bowman Consulting Group

Provides a range of real estate, energy, infrastructure, and environmental management solutions in the United States.

Very undervalued with excellent balance sheet.